With many on edge financially due to the state of the nation’s economy, a new poll from Realtor.com has found that U.S. homebuyers are bracing for a potential recession, but is there a silver lining?

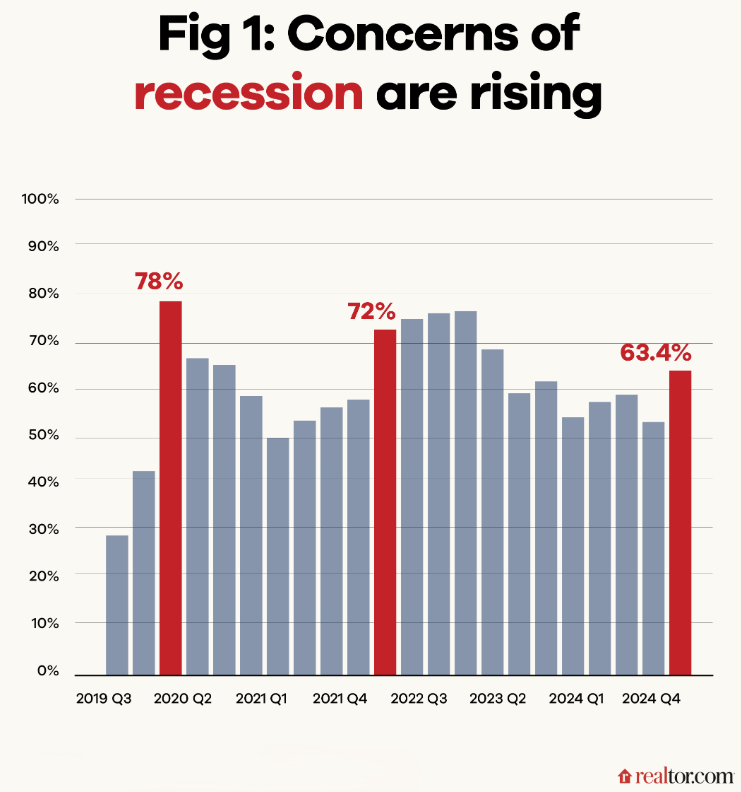

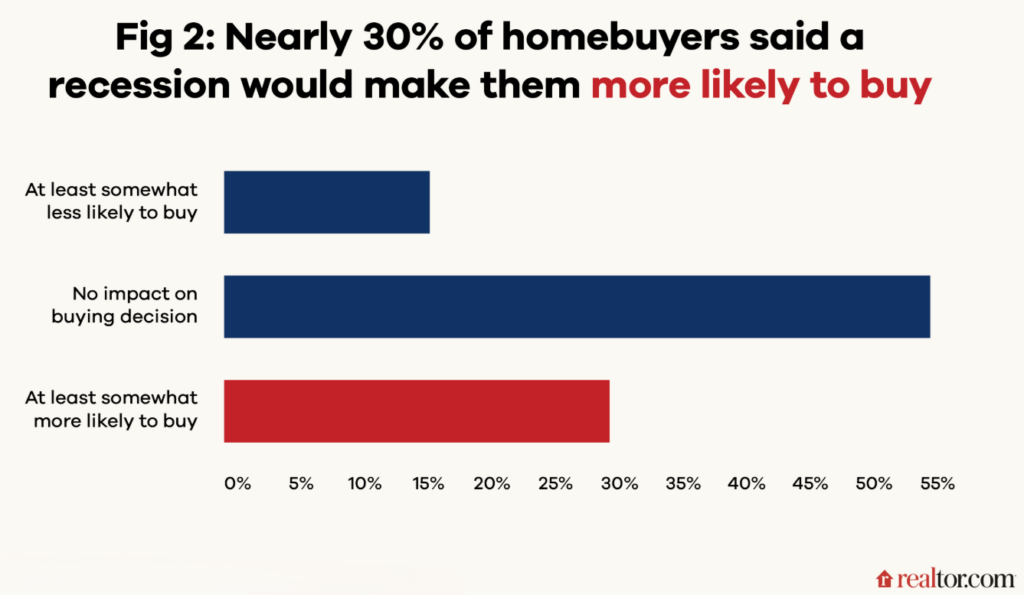

The survey found that 63.4% of those polled expect a recession within the next 12 months, marking one of the highest levels of concern since 2019, and nearly 30% indicated that a recession would make them somewhat more likely to purchase a home. This is nearly twice as large as the share who report they’d be less likely to buy a home in a recession (15.8%).

“Confidence in the economy has clearly taken a hit amid ongoing headlines around trade, tariffs, and rate uncertainty,” said Danielle Hale, Chief Economist at Realtor.com. “But while concerns are definitely present, some buyers anticipate that a downturn can bring opportunity. Well-prepared buyers who have been waiting on the sidelines are likely motivated by personal and lifestyle needs like growing families, new jobs, or retirements and these considerations can outweigh short term economic uncertainties.”

Opportunity Via Recession

And while recessionary fears have heightened, 29.8% of potential homebuyers remain motivated, and indicate they could be more likely to buy in a downturn—with the potential for lower mortgage rates and less competition amid an economic slowdown as key motivators. Of those polled, 54.4% claim a recession would have no impact on their decision to purchase a home—a sign that many will be driven more by life circumstances than macroeconomic shifts. Only 15.8% of respondents reported they would be less likely to buy in a recession, reinforcing the idea that the housing market may see continued resilience despite instability in the economic climate.

Overcoming Borrower Challenges

While there is a silver lining for many buyers, another aspect of the market brings challenges. Limited housing inventory continues to be the biggest roadblock for buyers, with 44.3% citing a lack of homes that meet their needs as a major concern. While listing activity has improved compared to last year, total active inventory remains 16.3% below historical norms, limiting choice and dampening momentum.

Household budget constraints were reported as a major issue for 36% of surveyed homebuyers, an issue that could intensify in the coming months if interest rates remain elevated, and the impact of tariffs begin to unfold. Credit-related challenges are also growing, as 13.5% of buyers cited poor credit scores as a barrier, while 8.2% struggled with poor credit scores as lenders tighten their standards and student loan changes impact credit health, the financing landscape may become more difficult for some buyers to navigate.

The bidding wars of recent years appear to be subsiding, as 7.7% of surveyed buyers identified overbidding as a top concern in Q1 of 2025, down from 10.4% a year ago. This trend aligns with increased time on the market, a moderate rise in listings, and more stable pricing; all of which point to a slower, less stressful home search experience. For buyers able to act amid the uncertainty, today’s conditions may offer more negotiating power, more choice, and less pressure than in recent years.

In analyzing the data, Realtor.com’s economics team conducted a randomized survey of site visitors to listing detail pages on the site, the Site Visitors Survey. Respondents were asked about the reasons they’re visiting the site, how they have been engaged with the housing market, and how they feel that current market conditions are affecting their behavior. The survey was first launched in Q4 of 2019, and this report focuses on results reported from shoppers in Q1 of 2025.

Click here for more on Realtor.com’s analysis of homebuyer trends.