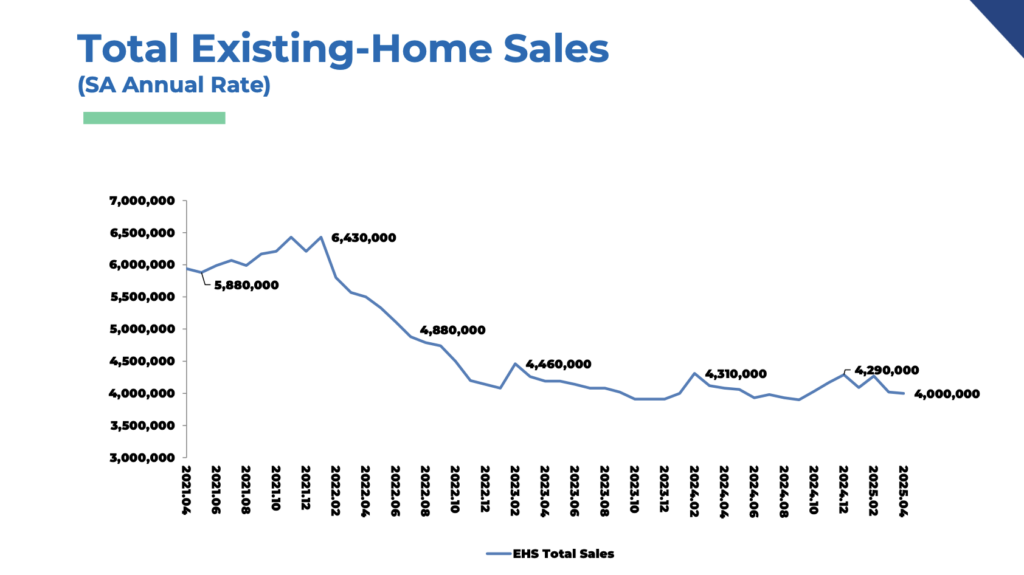

According to the National Association of REALTORS (NAR), existing-home sales decreased in April. The Midwest had growth in sales, the South saw no change, and the Northeast and West saw declines. Three regions saw a fall in sales year-over-year (YoY), while the Northeast saw no change.

“Home sales have been at 75% of normal or pre-pandemic activity for the past three years, even with seven million jobs added to the economy,” said Lawrence Yun, Chief Economist at NAR. “Pent-up housing demand continues to grow, though not realized. Any meaningful decline in mortgage rates will help release this demand.”

U.S. Highlights — Existing-Home Sales

- Completed transactions involving single-family homes, townhomes, condominiums, and cooperatives make up the total existing-home sales, which decreased by 0.5% from March to a seasonally adjusted annual rate of 4.00 million in April. Sales fell 2.0% YoY (from 4.08 million in April 2024).

- At the end of April, there were 1.45 million units in total housing inventory, increasing 9% from March and 20.8% from 1.2 million units a year earlier. The amount of unsold inventory has increased from 4.0 months in March and 3.5 months in April 2024 to 4.4 months at the current sales pace.

- All property types combined saw a median existing-home price of $414,000 in April, up 1.8% from $46,600 a year earlier. While the South and West saw price declines, the Northeast and Midwest saw price hikes.

“At the macro level, we are still in a mild seller’s market,” Yun said. “But with the highest inventory levels in nearly five years, consumers are in a better situation to negotiate for better deals.”

Danielle Hale, Chief Economist at Realtor.com, offered her expert insight on NAR’s Existing Home Sales Report.”

“Existing home sales registered a 4.00 million annual sales pace in April 2025, trailing 0.5% behind sales last month and 2.0% less than one year ago” Hale said. “Pending home sales revived in March, but remained lower than one year ago, a trend that continued in the April Realtor.com pending data. Home price growth continued, but moderated further, rising just 1.8% from a year ago. The typical asking price has remained roughly flat as the market sees a growing number of homes for-sale. Potential sellers who overreach on price may have to adjust lower in order to attract a buyer in a market where months supply rose to 4.4 months range signaling more balance, in line with our forecast predictions for 2025.”

She added: “It’s also worth noting that regional variation is more pronounced in today’s housing market. Home prices rose in the Northeast (+6.3%) and Midwest (+3.6%) even as they declined mildly in the South (-0.1%) and West (-0.2%). Research from Realtor.com has shown that the housing supply shortage is most acute in the Northeast and Midwest. These April home sales likely went under contract in March and early April, when mortgage rates held in a very narrow range between 6.6% and 6.7%. Even before the big trade announcement on April 2, consumers had reported concerns about the outlook for personal financial situations and job security, which may have undermined their confidence in making a large purchase, such as a home. In addition, fluctuating stock prices in the wake of April 2 may have reduced some homeshoppers’ downpayment and closing funds.”

Even while customers’ fears about the recession increased in Q1, the majority of respondents to a study conducted by Realtor.com shoppers stated that it would not influence their decision to purchase a property.

“Among those who reported that it would affect their home buying decision, the dominant sentiment was that a recession would be an accelerant to buyers” Hale said. “Roughly half as many said that they would be less likely to buy (15.8%) as more likely to buy a home (29.8%). Home shoppers remain optimistic amid a growing number of homes for sale, but opportunities vary by region and price point.”

Despite not being realized by many that pent-up housing demand is still rising, this demand will be released with the aid of any significant drop in mortgage rates.

“While there have been modest improvements in affordability, collaborative research from NAR and Realtor.com shows that gains have not been evenly spread across the income spectrum, with middle- and upper-middle income shoppers seeing improvement while the lowest income home shoppers see less affordability,” Hale said. “Looking ahead, mortgage rates—a key determinant of affordability—seem likely to remain in a range where they are more likely to dampen than bolster home sales in the near term.”

Note: The Existing-Home Sales data measures sales and prices of existing single-family homes for the nation overall, and gives breakdowns for the West, Midwest, South, and Northeast regions of the country. These figures include condos and co-ops, in addition to single-family homes.

To read more, click here.