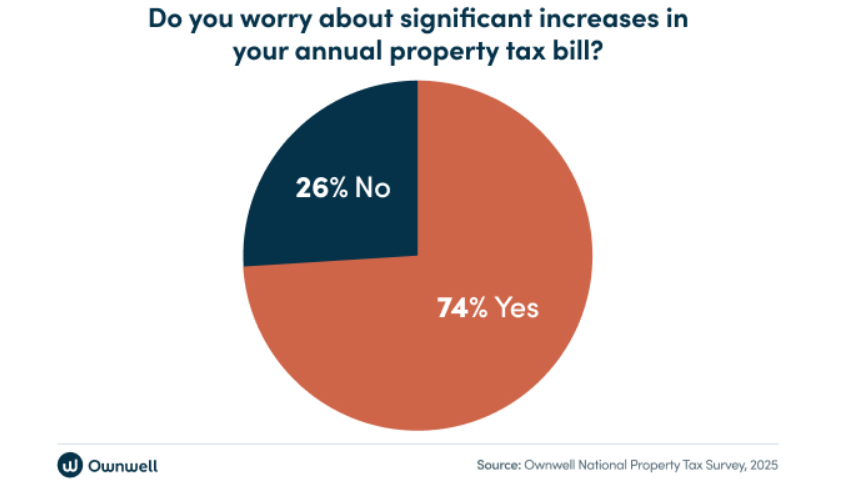

Nearly three-quarters (74%) of Americans worry about property taxes, yet few appeal those taxes, according to a recent survey by Ownwell. Many homeowners are skeptical of their home’s appraised value, and others don’t even know they can appeal their property’s appraised value. All this costs homeowners potentially thousands of dollars in tax bills—even though those homeowners would go out of their way to save $5 at the store.

Key Takeaways

- Rising property tax concerns: Almost three-quarters (74%) of respondents worry about significant increases in their annual property tax bills.

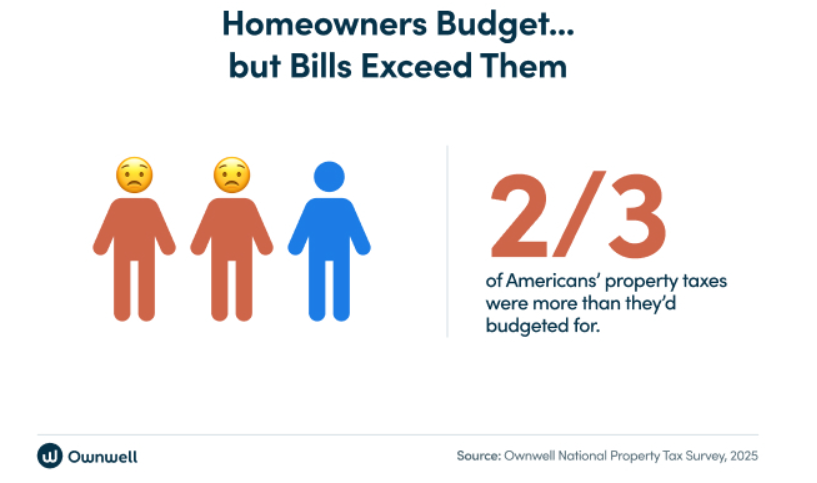

- Budgeting shortfalls: In the U.S., 82% of homeowners budgeted for property taxes, but two-thirds felt this year’s property taxes were more than they had budgeted for.

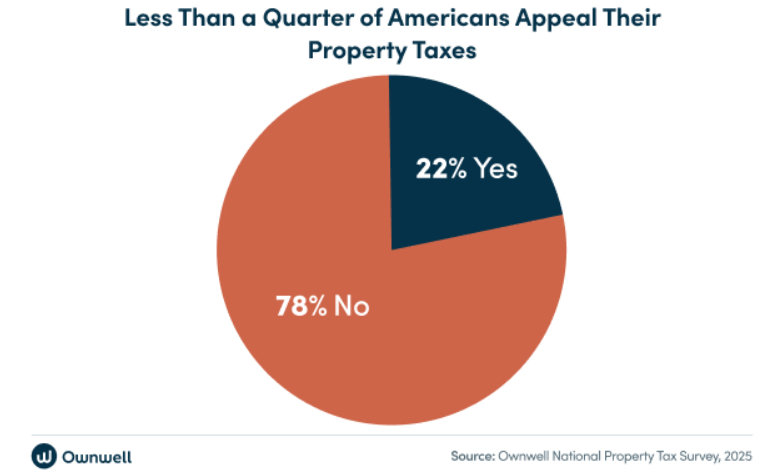

- Lack of Appeal Awareness: Nearly eight in 10 respondents have never appealed their property tax bill. Of these, 53% are unaware they have the right to do so.

Property tax bills are an ever-growing concern for homeowners across the country. Nearly three in four (74%) worry about significant increases to their annual property tax bills, especially in states like Colorado (85%), New Jersey (81%), California (80%), and New York (78%), where property tax bills are among the highest in the nation.

Property Tax Bills Are Surpassing Budgets

Even homeowners who set aside money to pay their tax bills find themselves underprepared. 82% of respondents said they budgeted for property taxes, but 59% were shocked by their last property tax bill, and 66% paid more than anticipated.

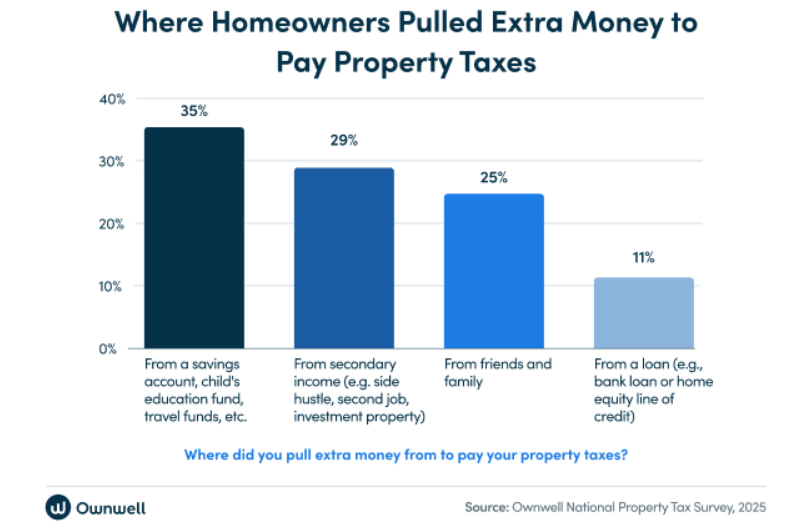

Inflation and rising home values are pushing property taxes higher, making these unexpected costs a financial strain for many. 29% of respondents have been unable to pay their property taxes on time and had to source extra funds from family, friends, or savings.

These high property taxes have pushed four in 10 Americans to consider moving to a new location. Yet most do not do the one thing that could save them money: challenge their property tax assessments, even though almost half (48%) of respondents believe their home’s assessed value is inaccurate, and 29% suspect their home is overvalued, which leads to them overpaying on property taxes.

Why? Many simply do not know they can. 78% of homeowners have never appealed their property tax bill, but 53% of them were not aware they could.

A prime example from Ownwell’s study is in Texas. While property taxes in the Lone Star State generated nearly $81.5 billion in revenue in 2023, homeowners in seven highly populated counties who did not protest could have saved themselves $2.0217 billion in taxes had they protested from 2022 to 2024, said the report.

Homeowners Will Save Money at the Store but Not on Their Property Tax Bill

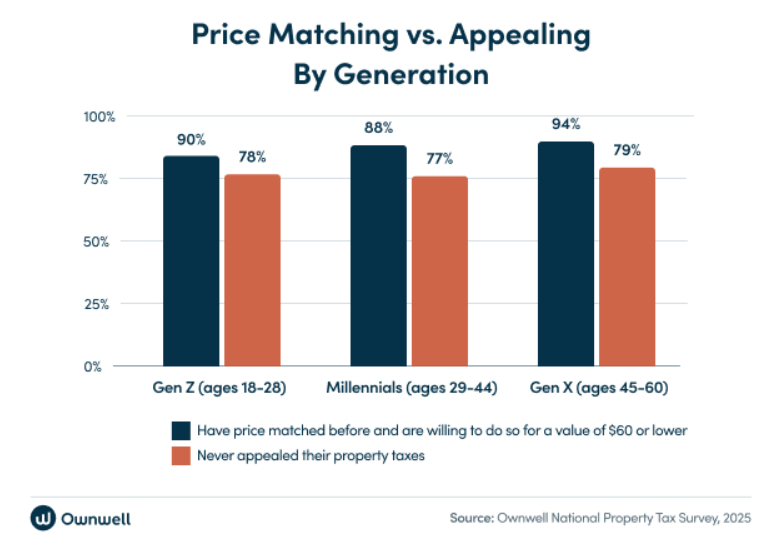

The report uncovered an interesting contradiction: most homeowners (51%) will work to save money on retail purchases through programs like price-matching (returning to a store to get reimbursed after seeing an item they had purchased go on sale for a lower price). In fact, 51% of respondents who have price-matched in the past were willing to do it again for a $5 savings.

Yet these same homeowners do not appeal their property tax bill, potentially worth thousands in savings.

As seen above, this failure to capitalize on potential savings from a successful property tax appeal runs across generations.

Click here for more on Ownwell’s property tax report.