I. Strong Demand Is Sustaining the Rental Market, Despite Economic Headwinds

This article originally appeared in the May 2025 edition of MortgagePoint magazine, online now.

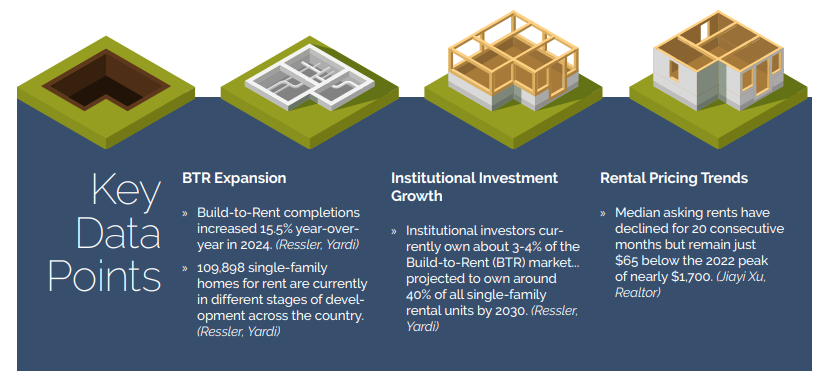

“Although rents have been falling on a year-over-year basis, demand remains strong, especially given the challenging for-sale market, where both home prices and mortgage rates remain high.”—Jiayi Xu, Economist, Realtor.com

“When potential homebuyers are priced out of the market, they often have no choice but to continue renting, but that doesn’t necessarily mean a market-shifting change in demand that will push rent prices up since these families were already renting.”—Rob Barber, CEO, ATTOM

“The rise in remote work has allowed people to live farther from their workplaces, leading to increased demand for single-family rentals in suburban and rural areas.”—Doug Ressler, Manager Business Intelligence, Yardi Matrix

II. Investment Landscape: Caution Amid Opportunity

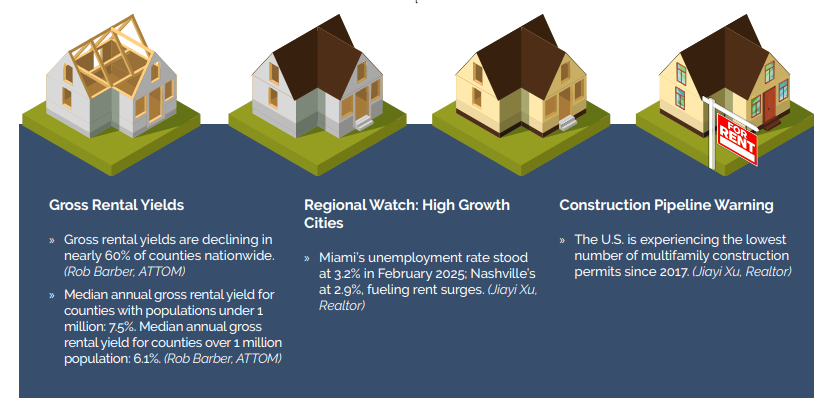

Insights from Rob Barber, ATTOM

Insights from Rob Barber, ATTOM

“Declining yields are largely being driven by rising home prices. For investors looking to enter the single-family rental market, it may be wise to wait before purchasing a property—or, if possible, focus on areas where home prices haven’t surged as much.”

“Institutional investors, who typically aren’t managing properties directly, have more flexibility to invest across a wider range of markets.”

“It’s likely that downward pressure on rental yields will continue into 2026 unless there’s a major shift in the housing market.”

III. Build-to-Rent Sector Booming and Evolving

Insights from Doug Ressler, Yardi Matrix

Insights from Doug Ressler, Yardi Matrix

“The BTR model is particularly appealing in today’s market, as it addresses both the flexibility desired by modern renters and the investment stability sought by developers and investors.”

“By 2030, institutions are expected to own around 40% of all single-family rental units, which include BTR properties.”

“Rising costs of materials and labor can make BTR projects financially challenging.”

“Navigating complex zoning laws and regulations can be difficult, especially since many areas do not have specific provisions for BTR developments.”

IV. Supply Constraints: Affordability Problems Persist

Insights from Jiayi Xu, Realtor.com

Insights from Jiayi Xu, Realtor.com

“A decline in multifamily permitting today signals fewer new rental units in the pipeline, which could result in a tighter rental supply in the coming years.”

“Higher construction costs can delay or deter new multifamily development, especially for projects operating on tight profit margins.”

“The sharp rent growth in cities like Miami and Nashville can largely be attributed to increased demand since the pandemic, fueled by the rise of remote working.”

“The decline in construction activity will reduce future rental supply, exerting upward pressure on rents.”

V. Long-Term Outlook and Strategic Responses

“The fact that rents remain elevated above pre-pandemic levels suggests that rental prices are likely to remain high in the near future.”—Jiayi Xu

“Providing high-quality amenities such as fitness centers, communal gardens, and recreational facilities helps attract and retain tenants.”—Doug Ressler

“Policies that reduce construction costs—such as tax incentives and subsidies—can encourage new development, boost rental supply, and help improve affordability.”—Jiayi Xu

“Financial sectors could create tailored financial products for multifamily developments with affordability initiatives.”—Jiayi Xu