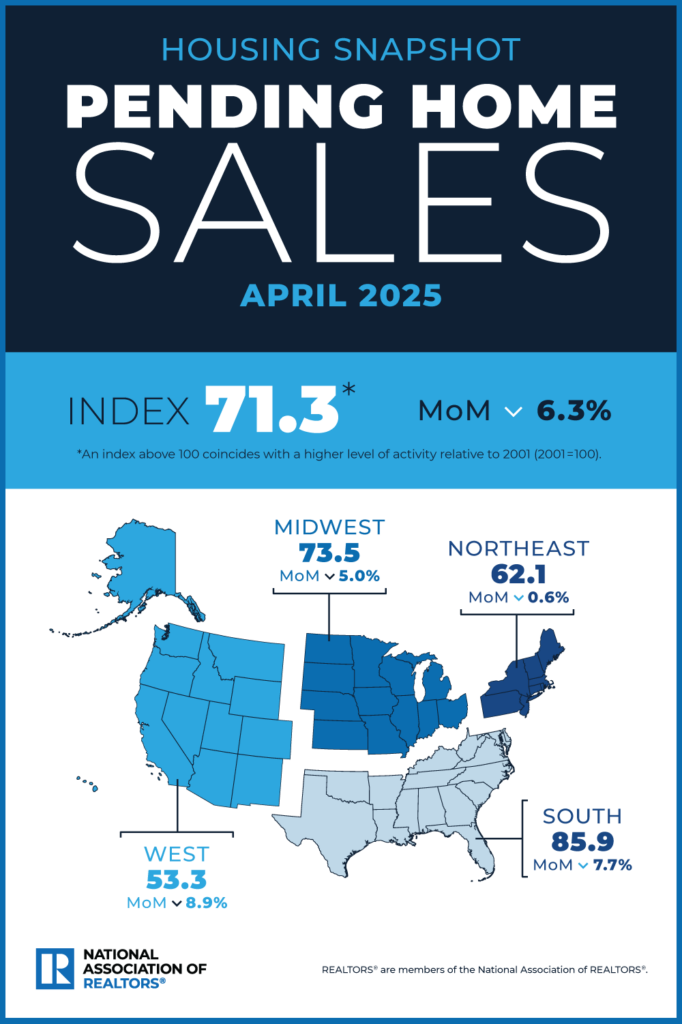

According to the National Association of Realtors (NAR), pending home sales decreased 6.3% in April 2025, with all four U.S. regions experienced month-over-month losses in transactions. Year-over-year, contract signings rose in the Midwest, but fell in the Northeast, South, and West–with the West suffering the greatest loss.

NAR’s Pending Home Sales Index (PHSI) is based on pending sales of existing homes. A sale is listed as pending when the contract has been signed, but the transaction has not closed, though the sale usually is finalized within one or two months of signing. Pending contracts are good early indicators of upcoming sales closings.

In April, NAR’s PHSI dove 6.3% to 71.3 in April. Year-over-year, pending transactions retracted by 2.5%. An index of 100 is equal to the level of contract activity in 2001.

“At this critical stage of the housing market, it is all about mortgage rates,” said NAR Chief Economist Lawrence Yun. “Despite an increase in housing inventory, we are not seeing higher home sales. Lower mortgage rates are essential to bring home buyers back into the housing market.”

According to Optimal Blue, in the month of April 2025, the nation’s average mortgage rates for a 30-year fixed-rate mortgage (FRM) hovered around the 6.75%-6.82% range.

The U.S. Department of Housing & Urban Development (HUD) reports the average U.S. sales price of a new home sold in April 2025 was $518,400—3.7% above the March 2025 price of $499,700, and 3.6% above the April 2024 price of $500,600.

“Elevated mortgage rates and economic uncertainty are headwinds for the housing market,” added First American Deputy Chief Economist Odeta Kushi. “However, rising inventory, which puts downward pressure on prices and allows incomes to catch up, serves as a tailwind.”

A Regional Breakdown

NAR reports the Northeast PHSI in April decreased 0.6% from March 2025 to 62.1, down 3.0% from April 2024. The Midwest Index condensed 5.0% to 73.5 in April, up 2.2% from the previous year. The South PHSI sank 7.7% to 85.9 in April, down 3.0% from a year ago. The West Index dipped 8.9% from March 2025 to 53.3, down 6.5% from April 2024.

“Homebuyers have a better chance to purchase homes in affordable regions such as the Midwest, where the typical home price is $313,000–25% below the national median home price,” added Yun. “Moreover, with housing inventory levels reaching five-year highs, home buyers in nearly every region of the country are in a better position to negotiate more favorable terms.”

Additional Impacts on the Market

The National Association of Home Builders (NAHB) states that tariff uncertainty continues to impact home builders nationwide, as builders prepare for potential price hikes and supply chain issues. Lumber prices remain a primary concern as prices are expected to more than double this fall due to tariff imposition.

“Consumer confidence took a hit in April as the ongoing trade war hit a fever pitch early in the month, and sweeping tariffs were announced,” said Realtor.com Senior Economic Research Analyst Hannah Jones. “Though the administration took a step back from many of the most severe measures, concerns remain about their potential impact on prices, including for newly built homes. Although inflation dipped to a multi-year low in April, the economic outlook remains uncertain. The delayed impact of recently implemented tariffs could introduce new cost pressures as they filter through the broader economy.”

According to the April NAHB/Wells Fargo Housing Market Index (HMI), on average, suppliers increased their prices by 6.3% in response to announced, enacted or expected tariffs. Builders estimate an average cost increase of $10,900 per home due to the recently imposed tariffs.

Click here for more on NAR’s April 2025 pending home sales.