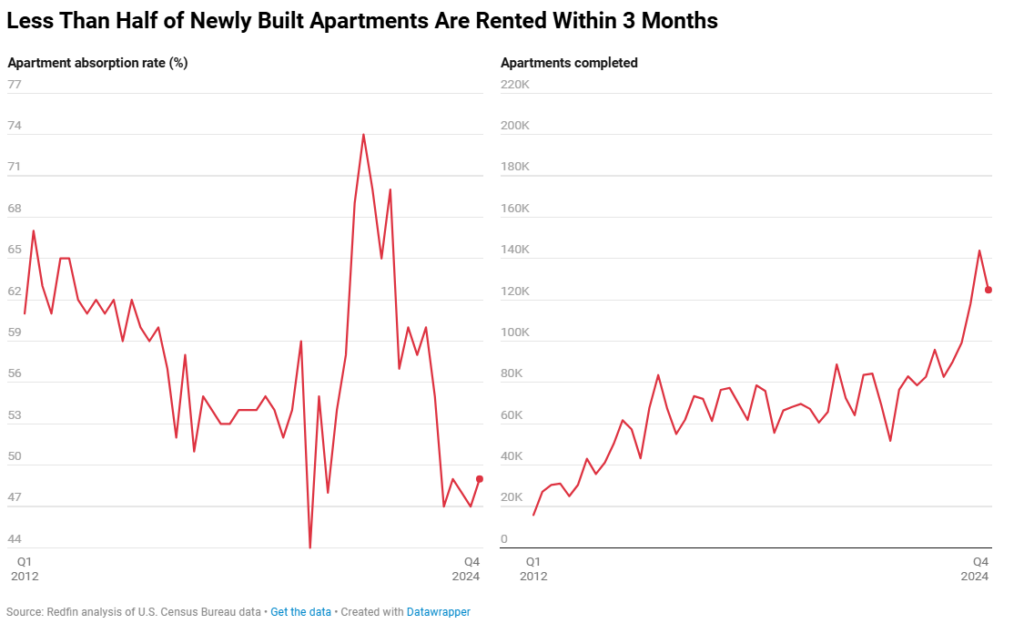

Redfin reports that 49% of newly built apartments completed in Q4 of 2024 were rented within three months, up slightly from 47% the previous quarter—marking the fifth consecutive quarter that the rental absorption rate was below 50%, a speed that continues to lag behind pre-pandemic norms.

The study found that the rental vacancy rate for buildings with five or more units was 8.2% in Q1 of 2025, tied with the previous quarter for the highest level since the start of 2021. Apartments are taking longer to rent because there are record numbers of them coming onto the market. Nearly 125,000 new apartments were completed in Q4—the second highest number on record—following the previous quarter’s all-time high (142,900).

The increase in supply has created a much healthier market for renters, with asking rents dropping slightly recently after remaining stable over the past two years.

“Renters are in a relatively rare position where they can finally benefit from market conditions rather than scramble to keep up with them,” said Redfin Senior Economist Sheharyar Bokhari. “With more apartments available, renters can afford to be a little more picky about where they want to live and are in a stronger position to negotiate for concessions like flexible lease terms, lower rents or free parking.”

Approvals for multifamily construction permits have dropped to pre-pandemic levels, however, indicating that new apartment supply will start to taper off in coming months. That is likely to eventually lead to higher absorption rates and an uptick in asking rents.

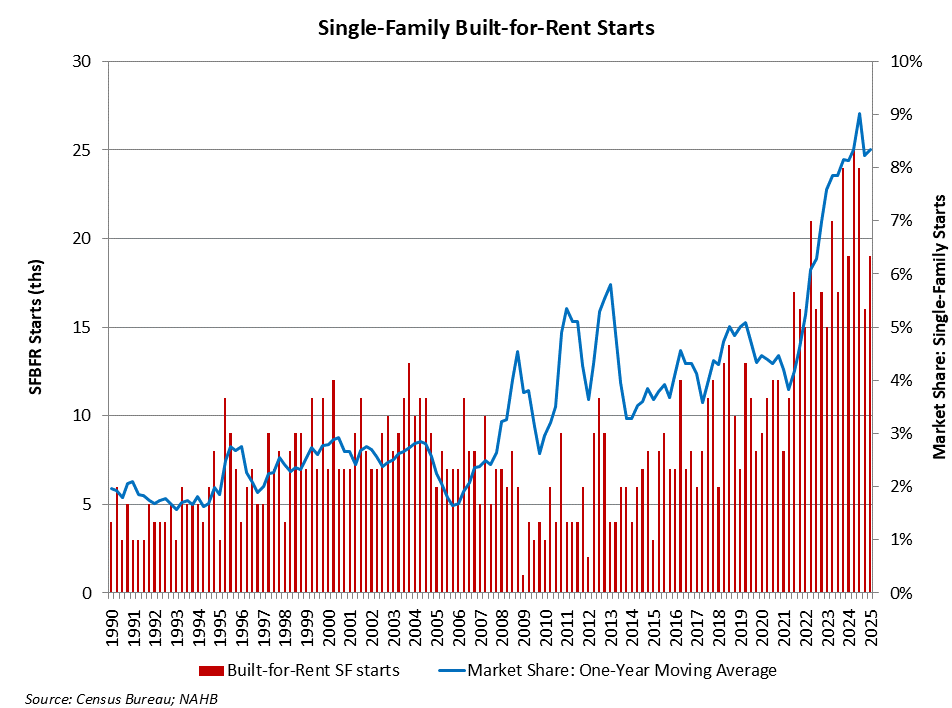

The National Association of Home Builders (NAHB) has analyzed data from the U.S. Census Bureau’s Quarterly Starts and Completions by Purpose and Design, and found there were approximately 19,000 single-family built-for-rent (SFBFR) starts during Q1 of 2025. This number was flat relative to Q1of 2024—marking a 4% increase compared to the 81,000 estimated SFBFR starts in the four quarters prior to that period.

NAHB explains that with the onset of the Great Recession and declines to the nation’s homeownership rate, the share of built-for-rent homes increased in the years after the recession. And given affordability challenges in the for-sale market for prospective buyers, the SFBFR market will maintain an elevated market share. However, in the near-term, SFBFR construction is likely to slow until the return on new deals improves.

Tariffs Weigh on Construction

NAHB further analyzed the impact of President Trump’s tariffs on the construction market, estimating that $204 billion worth of goods were used in the construction of both new multifamily and single-family housing in 2024. Of that total, $14 billion of those goods were imported from outside the U.S., meaning approximately 7% of all goods used in new residential construction originate from a foreign nation and moving forward, may have a tariff imposed on them.

“Economic uncertainty, especially around interest rates and inflation, continues to impact both builder financing costs and buyers’ ability to qualify,” said Danushka Nanayakkara-Skillington, NAHB’s Assistant VP of Forecasting and Analysis. “However, recent developments on the tariff front concerning the United Kingdom and China along with major tax legislation advancing in Congress should provide a boost to housing demand and positive momentum for the economy.”

That economic impact will fall back upon the shoulders of the consumer as tariffs on building materials will inevitably raise the cost of housing, and consumers will wind up paying for these tariffs in the form of higher home prices.

One of the biggest components to home building is softwood lumber, and Canada accounts for roughly 85% of all U.S. softwood lumber imports and represents almost one-quarter of the supply in the U.S. The Commerce Department is currently imposing 14.5% tariffs on Canadian lumber, and has indicated that it plans to more than double that rate later this year to 34.5%. Data from the most recent NAHB/Wells Fargo Housing Market Index (HMI) survey reveals that builders estimate a typical cost impact from recent tariff actions currently sit at approximately $10,900 per home tacked onto the final price, thus exacerbating affordability for the nation’s buyers.

Tracking Rental Trends

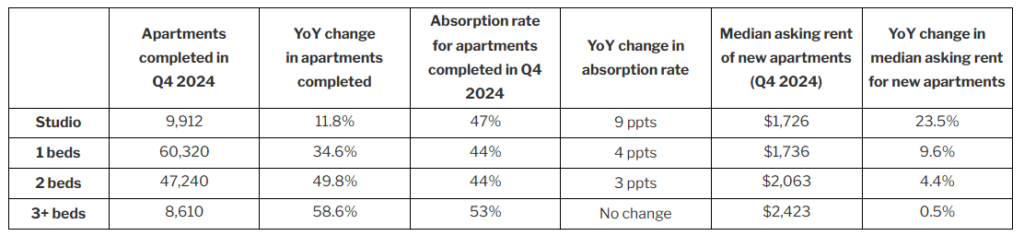

Larger three-plus bedroom apartments completed inQ4 2024 were rented at the fastest rate among different bedroom types, with 53% leased out within three months. That rate was unchanged from a year ago, even though there was a 58.6% year-over-year increase in the number of apartments completed.

The absorption rate for more common one-bedroom apartments was 44%, up from 40% a year ago. That was the same rate recorded for two-bedroom apartment types, up from 41% year-over-year.

Studio apartments recorded the biggest absorption rate increase across the different bedroom types, with 47% rented within three months, up from 38% a year ago.

Click here for more on Redfin’s analysis of U.S. rental trends.