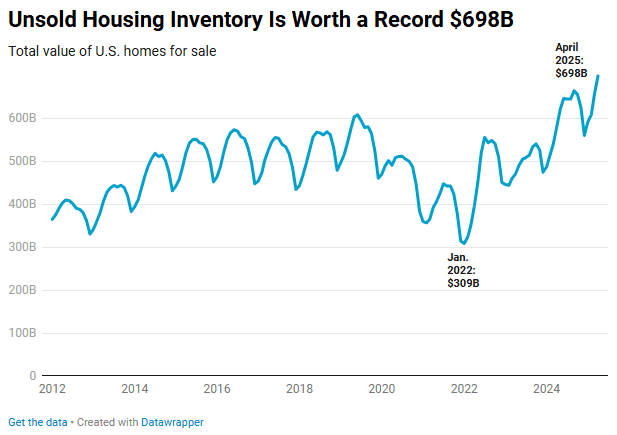

According to a recent Redfin survey, there are $698 billion worth of properties for sale in the U.S., which is the greatest dollar amount ever and up 20.3% from a year ago.

The examination of Redfin.com listings dating back to 2012 served as the basis for the report. Redfin added up the list prices of all active U.S. listings as of the last day of each month to determine the total dollar value of all inventory on the market; the most recent month for which data is available is April 2025. In the study, “value” and “list price” are synonymous; that is, when the term “total home value” is mentioned, referring to the total of all list prices.

“A huge pop of listings hit the market at the start of spring, and there weren’t enough buyers to go around,” said Matt Purdy, a Redfin Premier agent in Denver. “House hunters are only buying if they absolutely have to, and even serious buyers are backing out of contracts more than they used to. Buyers have a window to get a deal; there’s still a surplus of inventory on the market, with sellers facing reality and willing to negotiate prices down.”

Due to a combination of rising home-sale prices, slowing demand, and expanding inventory, the total value of U.S. home listings is at an all-time high:

- In the market, there are far more sellers than customers. With the mortgage-rate lock-in effect diminishing and homeowners attempting to cash out owing to economic uncertainties, the total number of properties on the market countrywide increased 16.7% year-over-year in April to reach its highest level in five years.

- The number of new listings rose 8.6% to a three-year high.

- Simply put, homes are taking longer to sell. In April, the average home sold took 40 days to enter into a contract, which is five days longer than it was a year earlier.

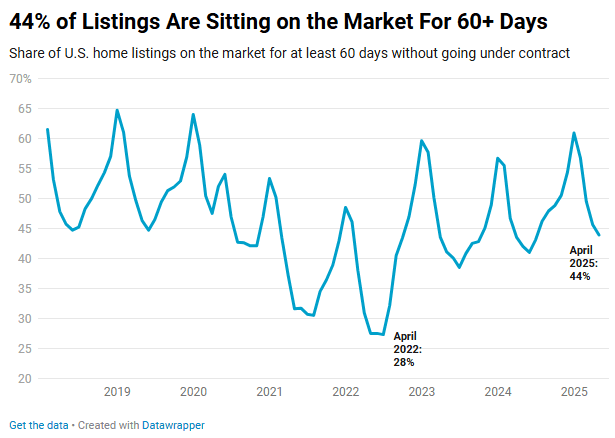

- Additionally, the percentage of inventory that has been on the market for more than two months is rising.

- Record-high monthly housing prices and general economic volatility are causing a decline in home sales, and Redfin brokers across much of the nation indicate that prospective buyers are pulling back.

- In April, the median price of a home sold in the U.S. increased 1.4% year-over-year. It should be noted that the overall value of inventory has increased by 20.3% year-over-year also, indicating that the number of listings has increased more than prices in recent years.

Inventory Remains Stale as Buyers Edge into Market

According to a different Redfin survey, the current housing market has almost 500,000 more house sellers than buyers. There are twelve figures worth of unsold inventory on the market, which may be explained by the fact that so many homes are being listed but no one is interested in buying them, as well as the fact that prices are constantly rising.

Compare today’s inventory total to the housing market during the pandemic, which was characterized by limited supply. The total listing value fell to $309 billion in January 2022, the lowest amount recorded in Redfin’s history since 2012. At the beginning of 2022, home supply was at its lowest point ever, homebuyers were “ravenous”, and mortgage rates were hovering at a historic low of 3.1%. In contrast to today’s 40-day pace, homes were being sold off the market in 24 days.

“The record-high dollar value of all homes listed for sale is one way to quantify this buyer’s market,” said Chen Zhao, Redfin’s head of economics research. “Not only are there more homes for sale than there have been in five years, but the value of those homes is higher than it has ever been. We expect rising inventory, weakened demand, and the prevalence of stale supply to push home prices down 1% by the end of this year, which should improve affordability for buyers because incomes are still going up.”

Redfin calls this “stale inventory” in its research because more than two out of five (44%) listings in April had been on the market for at least 60 days without getting under contract. This is the highest April share since 2020, when the pandemic’s beginning brought the housing market to a complete halt, and up from 42.1% a year earlier.

That stale inventory is worth $331 billion in total, which is almost half of the whole inventory’s dollar value. It’s grown 20.5% over the previous year.

To read more, click here.