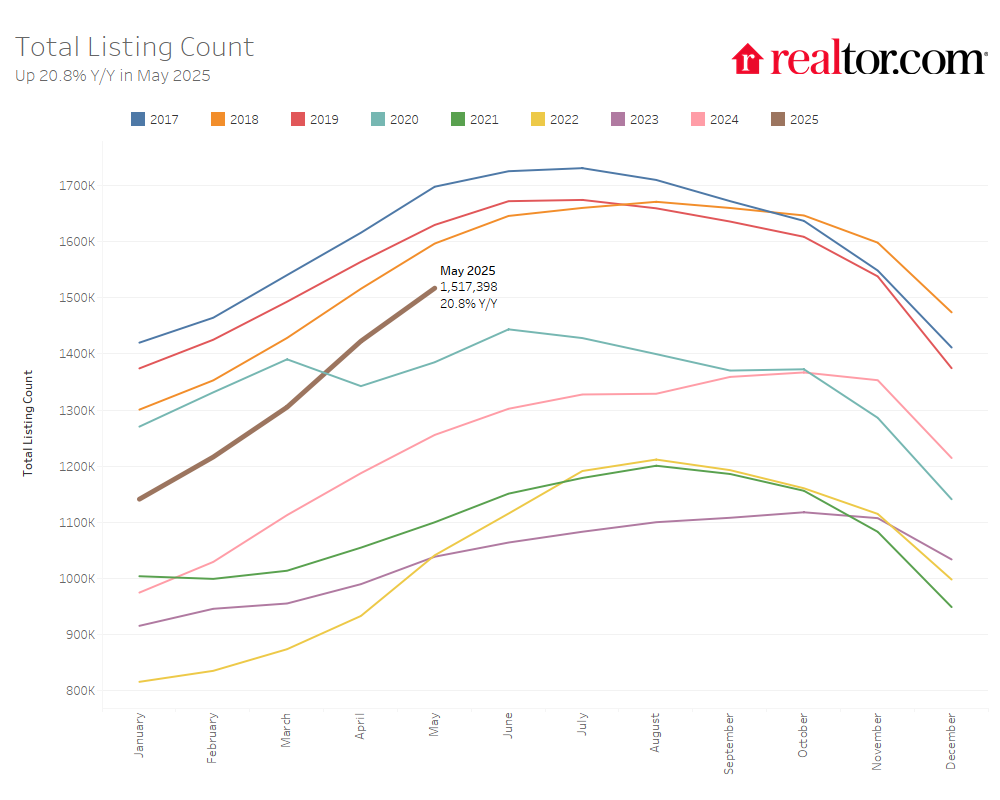

The May Monthly home Trends Report from Realtor.com indicates that the U.S. home market is making a resurgence, although the recovery is highly fragmented. Only metro areas in the South or West have entirely recovered to pre-pandemic inventory levels, while the Northeast and Midwest are still experiencing a shortage of available homes. The number of homes for sale in the U.S. surpassed one million for the first time since winter 2019, according to recent data.

Inventory increased in all four major U.S. regions in May:

- West: +40.7%

- South: +32.9%

- Midwest: +22.9%

- Northeast: +19.0%

So, what does this mean for potential buyers still looking to attain the American Dream?

“The number of homes for sale is growing, and even hit a key milestone in May, with more than a million active listings. But not every housing market is equally well-supplied,” said Danielle Hale, Chief Economist at Realtor.com. “Recent construction trends explain a lot of the variation in recovery that we see across markets. Many markets that built aggressively during and after the pandemic are now seeing more listings, longer time on market, and even some modest price softening. In contrast, markets that didn’t build as many homes are still facing an acute shortage, which continues to prop up prices and limit buyer options.”

May 2025 Housing Metrics – National

| Metric | May 2025 | Change overApr. 2025 (MoM) | Change overMay 2024 (YoY) | Change over May 2019 |

| Median listing price | $440,000 | +2.0 % | +0.1 % | +37.5 % |

| Active listings | 1,036,101 | +8.0 % | +31.5 % | -12.3 % |

| New listings | 465,096 | -1.4 % | +7.2 % | -20.4 % |

| Median days on market | 51 | +1 day | +6 days | -1 day |

| Share of active listings with price reductions | 19.1 % | +1.1 percentage points | +2.4 percentage points | +3.7 percentage points |

| Median list price per sq. ft. | $234 | +0.5 % | +0.6 % | +53.3 % |

U.S. Supply Recovering Faster in Western & Southern Regions

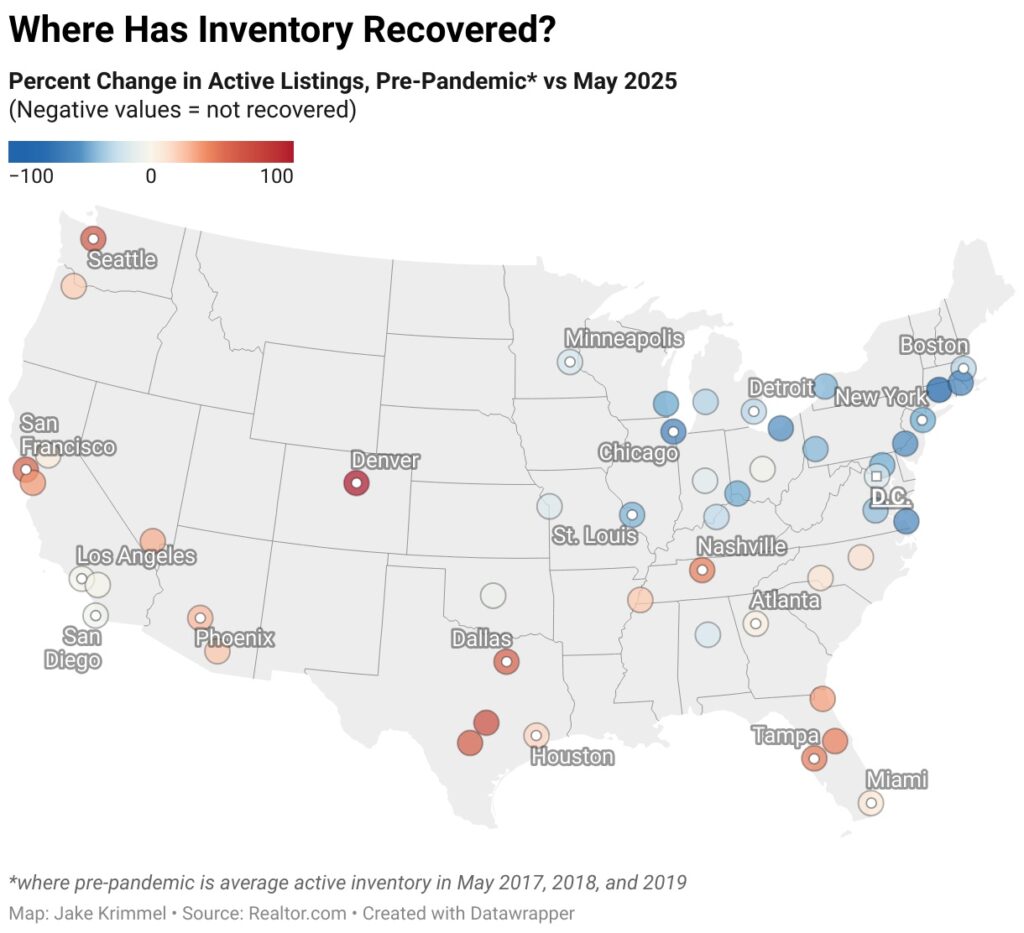

In May 2025, annual inventory growth were reported in all 50 of the main U.S. metro areas. However, just 22 have entirely recovered to their inventory norms from 2017 to 2019, and all of them are in the South or West. Due in large part to a post-2020 construction boom, cities like Denver (+100.0% vs. pre-pandemic), Austin, Texas (+69.0%), and Seattle, WA, (+60.9%) lead the way in terms of active inventory. Conversely, metro areas that have recovered the least include Hartford, CT (-77.7%), Chicago (-59.3%), and Virginia Beach, VA (-56.7%).

For the first time since winter 2019, the number of active listings nationwide exceeded one million, and the number of newly listed residences increased by 7.2% annually. However, a hot spring shopping season has not resulted from these gains. For the sixth consecutive month, price reductions increased, and the typical time to sell a home was 51 days, some six days longer than the previous year.

The largest percentage of listings with reduced prices since at least 2016 was 19.1% in May 2025. Metros in the West and South, such as Phoenix (31.3%), Tampa, FL (29.9%), and Denver (29.4%), had the largest price reductions.

“More homes on the market means buyers finally have options and leverage they haven’t had in years,” said Gary Ashton, Founder of The Ashton Real Estate Group of RE/MAX Advantage in Nashville. “But the strategy for buyers and their agents this spring largely depends on where you live. In Southern locales, like Nashville, the average sales price has increased by 3% as homes remain on the market for longer and local supply increases. We can expect to see sellers get creative with offering concessions to buyers and start to consider more price reductions.”

Every one of the 50 biggest markets saw an increase in inventories year-over-year at the metro level. The biggest increases were in:

- Washington, D.C. (+75.6%)

- Las Vegas (+66.8%)

- San Diego (+66.4%)

In regions of the Midwest and the Northeast, inventory levels are still low. The New York metro is 44.0% below pre-pandemic levels, and the Washington, DC metro is still 15.9% below its 2017–2019 norms, despite year-over-year improvements.

The three metros that have recovered the least are:

- Hartford, CT (-77.7%)

- Chicago (-59.3%)

- Virginia Beach, VA (-56.7%)

Despite strong annual inventory growth, 28 of the 50 largest metro areas still have inventory levels below those of the pre-pandemic period. However, 22 markets—up from 20 last month and 18 in March—have now surpassed their 2017–2019 averages.

Regional differences in inventory recovery are pronounced. All 22 metro areas that have more inventory than they did before the outbreak are in the South or West. In fact, in every major Southern metro save Birmingham, AL, the current active inventory is higher than pre-pandemic levels. Los Angeles, San Diego, and Riverside—the three largest markets in Southern California—are the only ones on the west coast that have not reached their inventory levels from 2017 to 2019.

In comparison to their pre-pandemic levels, the marketplaces with the highest inventory are:

- Denver (+100.0%)

- Austin (+69.0%)

- Seattle (+60.9%)

Building activity during the pandemic and current inventory conditions are clearly related, according to Realtor.com research. In general, metro areas like Austin, Texas, Nashville, TN, and Denver that increased house construction have seen their inventory levels recover to that of before 2020. New York, Boston, and Buffalo, NY, which have less recent construction, have not.

The findings of a new Realtor.com Housing Supply Gap report, which found a nearly 4 million home shortage nationwide, are reflected in this uneven recovery. Without significant changes to zoning, permitting, and construction incentives, supply-constrained regions—particularly in the Northeast and Midwest—run the risk of slipping even further behind.

To read more, click here.