According to a top mortgage industry official, the federal government is unlikely to lift mortgage giants Fannie Mae and Freddie Mac out of conservatorship this year, even though President Donald Trump has pushed to change their status, according to a Realtor.com report.

Though the specifics of the plan are yet unknown, Trump made multiple posts on Truth Social late last month expressing his desire to take Fannie and Freddie “public,” ostensibly referring to a stock offering on a major exchange.

“I am giving very serious consideration to bringing Fannie Mae and Freddie Mac public,” Trump wrote. “Fannie Mae and Freddie Mac are doing very well, throwing off a lot of CASH, and the time would seem to be right. Stay tuned!”

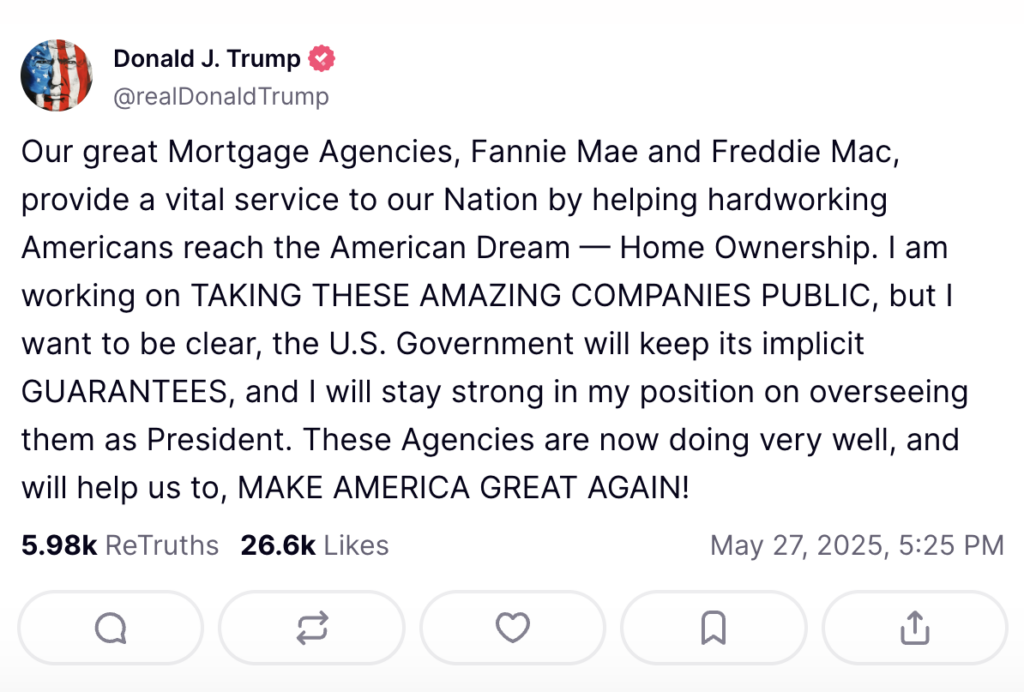

Days later, he wrote a follow-up post in which he insisted that, whatever of the new financial structure the government comes up with, the organizations would continue to have federal guarantees as a fallback.

“I am working on TAKING THESE AMAZING COMPANIES PUBLIC, but I want to be clear, the U.S. Government will keep its implicit GUARANTEES, and I will stay strong in my position on overseeing them as president,” Trump wrote.

MBA CEO Sets the Record Straight

At a HousingWire conference in Colorado Springs, Colorado, on Tuesday, June 10th, Bob Broeksmit, CEO of the Mortgage Bankers Association (MBA), offered his thoughts on the Fannie and Freddie scandal, over two weeks after Trump declared his intention to make the companies “public.”

“We do not believe that the president’s posts indicate a set course or a set timetable, and I say that based on conversations with key decision-makers in the administration, who continue to say that this is not a 2025 issue,” Broeksmit said.

The MBA CEO told Sarah Wheeler of HousingWire at “The Gathering” that the move has “been a long time coming” and will help consumers.

“It’s very complex,” Broeksmit added. “They’ve been in a conservatorship too long, but it more or less works.”

By buying whole loans from mortgage lenders and putting them into securities, Fannie and Freddie give the U.S. mortgage market security and liquidity. A ready supply of loans for homeowners is ensured by this guaranteed demand for “conforming” mortgages that satisfy the companies’ specifications.

Fannie and Freddie have been under government conservatorship since a federal bailout in 2008, meaning the Federal Housing Finance Agency has stringent monitoring and regulation over them.

The U.S. Treasury received almost all of the two companies’ revenues for years, totaling more than $300 billion and more than the government spent on the bailout.By buying entire loans from mortgage lenders and putting them into securities, Fannie and Freddie give the US mortgage market security and liquidity. A ready supply of loans for homeowners is ensured by this guaranteed demand for “conforming” mortgages that satisfy the companies’ specifications.

During the event on Tuesday, Broeksmit pointed out that Fannie and Freddie are subject to stringent capital requirements set by the FHFA and stated that they currently lack the funds necessary to meet these regulations and leave conservatorship.

“They are still nowhere near the level of capital required to release them,” he said, adding that he had spoken with administration officials who “show no interest” in relaxing the current capital standards for Fannie and Freddie.

The main concern for homeowners is how potential changes to Fannie and Freddie would affect mortgage rates, which have been ranging from 6.6% to 7% since the year started. Making sure a capital structure change doesn’t lead to higher rates was “the No. 1 concern” at MBA and in the housing sector, according to Broeksmit.

“The only way we know of to do that is to legislate an explicit guarantee that says the U.S. government stands behind the credit risk,” he said. “This would put them on an equal footing, and not only have mortgage rates not rise, but if it’s done right, they could even ease a little, because the current guarantee is not explicit.”

According to Broeksmit, it would be essential to make sure that investors maintain their level of confidence in mortgage-backed securities after conservatorship, as interest rates are a reflection of perceived risk.

To read more, click here.