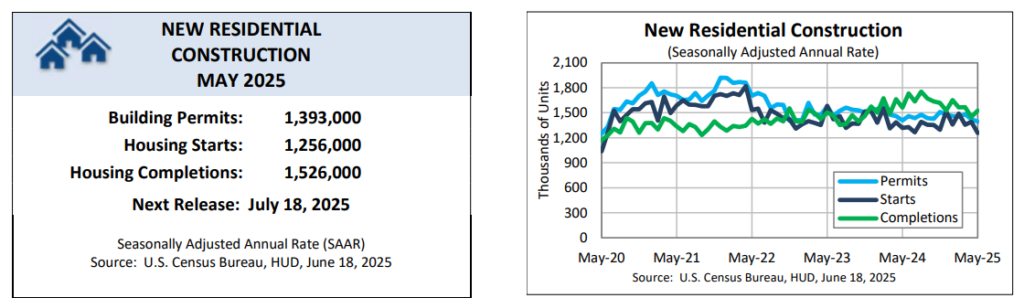

The U.S. Census Bureau and the U.S. Department of Housing & Urban Development (HUD) have announced that in May 2025, privately-owned housing starts in May were at a seasonally adjusted annual rate of 1,256,000—9.8% below the revised April estimate of 1,392,000, and 4.6% below the May 2024 rate of 1,316,000. Single-family housing starts in May were at a rate of 924,000, which was 0.4% above the revised April figure of 920,000. The May rate for units in buildings with five units or more was 316,000.

“New residential construction activity continued to fall in May with both permits and starts dropping to five-year lows,” said Realtor.com Chief Economist Danielle Hale. “This underscores the effects of the current trade war on homebuilding, augmented by worsening labor shortages and growing concern from builders about housing demand.”

The Census Bureau and HUD reported that in May 2025, privately-owned housing units authorized by building permits were at a seasonally adjusted annual rate of 1,393,000—2% below the revised April rate of 1,422,000, and 1% below the May 2024 rate of 1,407,000. Single-family authorizations in May were at a rate of 898,000—2.7% below the revised April figure of 923,000. Authorizations of units in buildings with five units or more were at a rate of 444,000 in May 2025.

HUD and the Census Bureau also reported that privately-owned housing completions in May 2025 were at a seasonally adjusted annual rate of 1,526,000, 5.4% above the revised April estimate of 1,448,000, but 2.2% below the May 2024 rate of 1,561,000. Single-family housing completions in May were at a rate of 1,027,000—8.1% above the revised April 2025 rate of 950,000. The May rate for units in buildings with five units or more was 487,000.

Builders Sentiment Drops

“Homebuilders are feeling increasingly pessimistic as the National Association of Home Builders’ builder sentiment index is at its lowest level since 2012,” said Bright MLS Chief Economist Lisa Sturtevant. “Home buyer traffic has slowed amidst economic uncertainty and persistently high mortgage rates, and more builders are cutting home prices to entice would-be buyers.”

According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI), builder confidence in the market for newly built single-family homes was 32 in June, down two points from May. NAHB’s Index has only posted a lower reading twice since 2012–in December 2022 when it hit 31 and in April 2020 at the start of the pandemic when it plunged more than 40 points to 30.

“Buyers are increasingly moving to the sidelines due to elevated mortgage rates and tariff and economic uncertainty,” said NAHB Chairman Buddy Hughes, a home builder and developer from Lexington, North Carolina. “To help address affordability concerns and bring hesitant buyers off the fence, a growing number of builders are moving to cut prices.”

NAHB also found that 37% of the nation’s home builders reported cutting prices in June, the highest percentage since NAHB began tracking this figure on a monthly basis in 2022. This compares with 34% of builders who reported cutting prices in May, and 29% in April. Meanwhile, the average price reduction was 5% in June, the same as it’s been every month since last November. The use of sales incentives was 62% in June, up one percentage point from May.

“The weak construction data contrasts sharply with strong new-home sales in April, which made up the highest share of total sales since 2005,” said First American Deputy Chief Economist Odeta Kushi. “Consider that new-home sales might offer a better deal for buyers than existing homes. Historically, new homes are priced at a premium relative to existing homes, but that gap has flipped. In April, the median price of a new home ($407,200) was actually lower than the median price of an existing home ($414,000), partly due to price cuts and builders constructing smaller, less expensive homes.”

The High Price of Skilled Labor and Tariffs

As housing affordability mounts, potential buyers, and builders as well, must content with recently imposed tariffs weighing on the price and construction of new homes.

Further exacerbating issues is a lack of skilled labor to construct new homes, and a recent report from NAHB found that skilled labor shortage’s impact on the residential construction industry is a multibillion-dollar annual challenge responsible for the lost production of thousands of newly built homes. Commissioned by the Home Builders Institute (HBI) and conducted by the University of Denver, the study’s findings were supplemented with an analysis by NAHB to provide a comprehensive view of the far-reaching implications of this critical workforce challenge.

The executive summary highlights several crucial findings:

- The study estimates an aggregate economic impact of $10.806 billion per year due to longer construction times associated with the skilled labor shortage.

- Higher carrying costs, as the direct cost impact of extended construction times amounts to $2.663 billion annually.

- The shortage has led to a reduction of approximately 19,000 single-family homes not built in 2024, representing an economic loss of $8.143 billion.

- The unweighted average increase in construction time due to the labor shortage is 1.98 months, with smaller builders experiencing an even greater delay.

“With tariffs raising materials costs and immigration policy likely worsening labor shortages, the supply side of the equation is difficult and coupled with an environment where demand for new construction homes is weakening as the number of existing homes for sale grows,” added Hale. “Builders are increasingly cutting prices (34% in May and 37% in June) and offering incentives (61% in May and 62% in June) according to the NAHB sentiment indicator. This means that shoppers in the market for a new home will still have options in many markets and are likely to be in a good place to negotiate. But builders are already adjusting their outlooks, and slowing the development pipeline which could mean that new homes are harder to come by in the next year.”

With President Trump having announced the imposition of a 10% baseline tariff on all imports to the U.S., along with additional duties imposed upon some of the nation’s biggest trading partners, these actions will hike up the price of imported products, a cost absorbed by the importer or passed on to the end consumer.

“Builders face higher financing costs, tariff uncertainty, softer demand from elevated rates, increased competition from rising existing-home inventory in key markets like Texas and Florida, and higher inventories of their own,” said Kushi. “This mix is weighing on builder sentiment and likely to slow single-family construction.”

For most goods, the cost is passed on to consumers. Any tariff on international building materials will inevitably raise the cost of housing, with consumers absorbing those costs in the form of higher home prices.

According to the NAHB, $204 billion worth of goods were used in the construction of both new multifamily and single-family housing in 2024. Of this share, $14 billion of those goods were imported from outside the U.S., with approximately 7% of all goods used in new residential construction having originated from a foreign nation.

“There is a slump in the housing market. Blame it on tariffs, high mortgage rates and overall uncertainty, but building permits and housing starts came in way below expectations in May,” said Heather Long, Chief Economist at Navy Federal Credit Union. “The overarching issue is the United States desperately needs more housing, especially for first-time buyers, and that’s not going to happen with this tepid level of new home construction. The nation needs over two million new homes a year. The current pipeline is around 1.4 million.”