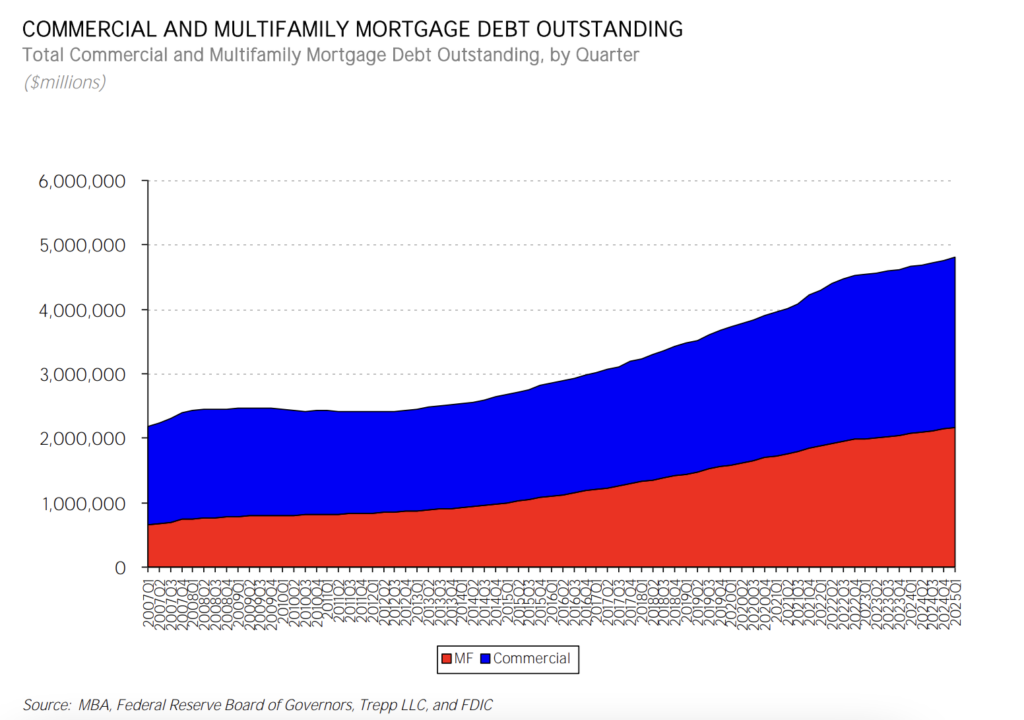

According to the most recent Commercial/Multifamily Mortgage Debt Outstanding quarterly report from the Mortgage Bankers Association (MBA), the amount of outstanding commercial/multifamily mortgage debt rose by approximately $46.8 billion (1%) in Q1 of 2025.

By the conclusion of Q1, the total amount of outstanding commercial and multifamily mortgage debt had increased to $4.81 trillion. From Q4 of 2024, multifamily mortgage debt alone climbed $19.9 billion (0.9%) to $2.16 trillion.

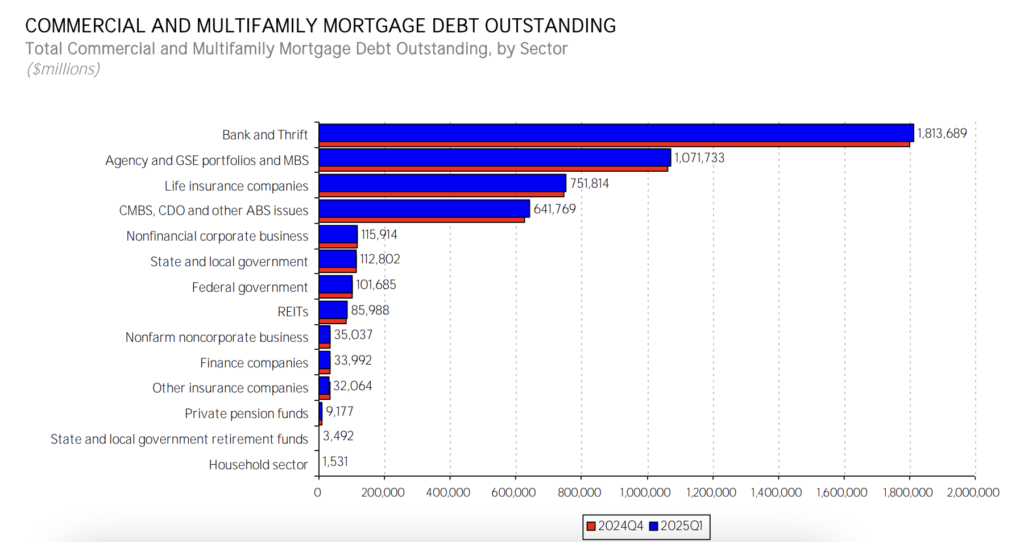

With $1.8 trillion in commercial/multifamily mortgages, commercial banks still hold the greatest stake (38%). At $1.07 trillion, agency and GSE portfolios and MBS constitute the second-largest share of commercial/multifamily mortgages (22%). An estimated $752 billion (16%) is held by life insurance firms, whereas $642 billion (13%) is held by CMBS, CDO, and other ABS issuers. CMBS, CDO, and other ABS issues are bought and held by numerous banks, life insurance companies, and the GSEs.’

U.S. Highlights — Multifamily Mortgage Debt Outstanding (Q1 2025)

- In Q1 of 2025—narrowing it down to multifamily mortgages—agency and GSE portfolios and MBS made up half of all outstanding multifamily debt ($1.07 billion)

- Banks and thrifts came in second with $639 billion (30%)

- Life insurance companies followed with $242 billion (11%)

- Next, state and local government totaled $94 billion (4%)

- CMBS, CDO, and other ABS issues rounded out the list with $62 billion (3%)

“Despite lower origination volumes, the overall level of commercial and multifamily mortgage debt rose in the first quarter of 2025,” said Reggie Booker, MBA’s Associate VP of Commercial Real Estate Research. “This increase reflects the extended duration of outstanding loans and the continued appetite for real estate investment across key investor groups.”

Revolving Trends: Commercial/Multifamily Mortgage Debt Outstanding

The biggest dollar gains in Q1 were made by CMBS, CDO, and other ABS issues in their commercial/multifamily mortgage loan holdings, which increased by $16.2 billion (2.6%). Their holdings grew by $13.1 billion (0.7%) for banks and thrifts, $7.5 billion (0.7%) for agency and GSE portfolios and MBS, and $6.1 billion (0.8%) for life insurance firms.

Further, the biggest percentage gain in commercial/multifamily mortgage holdings was 4% for REITs. On the other hand, assets held by private pension funds fell by 10.6%.

A quarterly gain of 0.9% is represented by the $19.9 billion rise in multifamily mortgage debt outstanding from Q4 of 2024. With a gain of $10.0 billion (1.6%) in dollars, banks and thrifts had the biggest increase in their multifamily mortgage debt holdings. MBS and agency and GSE portfolios saw a $7.5 billion (0.7%) gain in holdings, while life insurance firms saw a $1.9 billion (0.8%) increase.

With an increase of 10.9%, REITS had the biggest growth in their multifamily mortgage debt holdings. At 12.7%, private pension funds experienced the biggest drop in their multifamily mortgage loan holdings.

Note: MBA’s analysis summarizes the holdings of loans or, if the loans are securitized, the form of the security. For example, many life insurance companies invest both in whole loans for which they hold the mortgage note (and which appear in this data under Life Insurance Companies) and in CMBS, CDOs and other ABS for which the security issuers and trustees hold the note (and which appear here under CMBS, CDO and other ABS issues).

Quarterly Commercial & Multifamily Mortgage Debt Outstanding — by Sector

| Debt by Sector | Number of millions (Q1 2025) | % of total (Q1 2025) | Number of millions (Q4 2024) | % of total (Q4 2024) | Change in millions | Sector share of $ change |

| Bank and thrift | $1,813,689 | 37.7% | $1,800,564 | 37.8% | 13,125 | 28.1% |

| Agency & GSE portfolios & MBS | $1,071,733 | 22.3% | $1,064,242 | 22.3% | 7,491 | 16.0% |

| Life insurance companies | $751,814 | 15.6% | $745,707 | 15.7% | 6,107 | 13.1% |

| CMBS, CDO & other ABS issues | $641,769 | 13.3% | $625,523 | 13.1% | 16,246 | 34.7% |

| Nonfinancial corporate business | $115,914 | 2.4% | $115,861 | 2.4% | 53 | 0.1% |

| State and local government | $112,802 | 2.3% | $112,163 | 2.4% | 639 | 1.4% |

| Federal government | $101,685 | 2.1% | $100,331 | 2.1% | 1,354 | 2.9% |

| REITs | $85,988 | 1.8% | $82,710 | 1.7% | 3,278 | 7.0% |

| Non-farm non-corporate business | $35,037 | 0.7% | $34,820 | 0.7% | 217 | 0.5% |

| Finance companies | $33,992 | 0.7% | $34,348 | 0.7% | -356 | -0.8% |

| Other insurance companies | $32,064 | 0.7% | $32,440 | 0.7% | -376 | -0.8% |

| Private pension funds | $9,177 | 0.2% | $10,268 | 0.2% | -1,091 | -2.3% |

| State & local government funds | $3,492 | 0.1% | $3,398 | 0.1% | 94 | 0.2% |

| Household sector | $1,531 | 0.0% | $1,529 | 0.0% | 2 | 0.0% |

| Total | $4,810,687 | $4,763,904 | 46,783 |

Source: MBA, Federal Reserve Board of Governors, Trepp LLC, and FDIC

Note: Beginning with the Q2 2014 release, MBA’s analysis of mortgage debt outstanding modifies the data from the Federal Reserve’s Financial Accounts of the United States with respect to loans held in commercial mortgage-backed securities (CMBS) and by real estate investment trusts (REITs). The corrections create differences with previous releases and with the Federal Reserve data.

To read more, click here.