A new Redfin report revealed that in May, the median price of a home in the U.S. increased by 0.7% year-over-year (YoY), reflecting the smallest growth since June 2023. The median sale price of $440,997 last month, however, was the highest May price since 2012.

According to a recent Redfin prediction, by the end of 2025, home values will begin to decline annually. Eleven of the 50 most populated U.S. metropolitan areas have already experienced that, with the worst declines in May occurring in Oakland, CA (-6.7%), Jacksonville, FL (-5.2%), and Dallas (-4.6%). Due to unacceptably high homebuying expenses and economic uncertainty, there are currently far more home sellers than purchasers in the market, which is limiting the growth of home prices in the U.S.

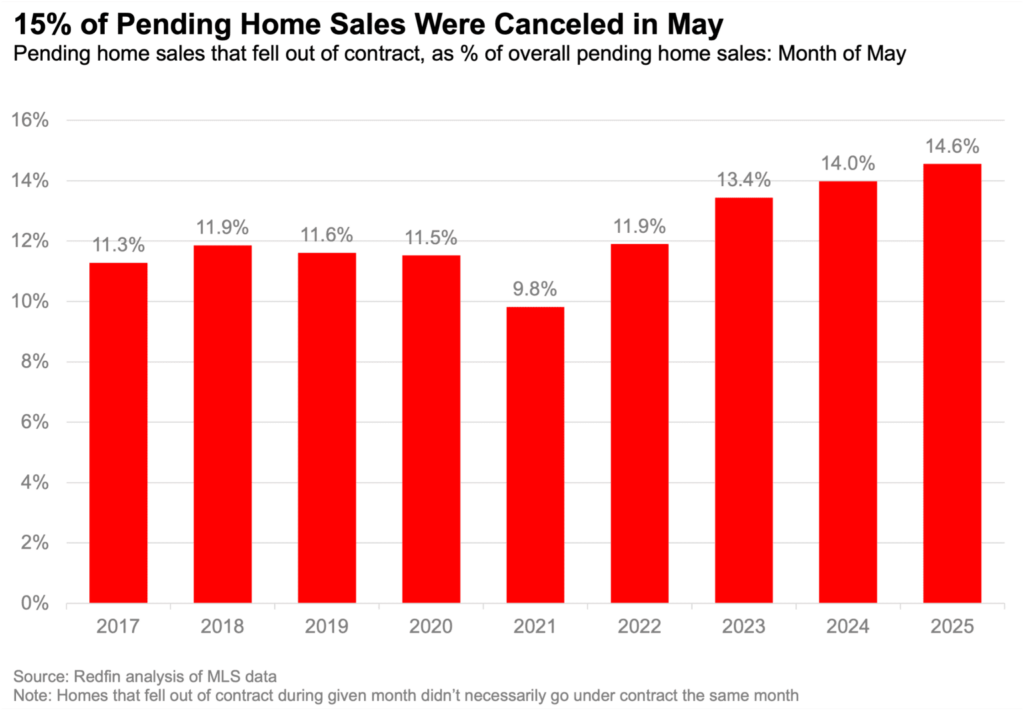

With mortgage rates still high at over 7%, existing-home sales in May reached their lowest level since October at a seasonally adjusted annual rate of 4.21 million. Both a month and a year ago, there was minimal change in existing-home sales, total home sales, and pending sales. Also in May, over 59,000 home-purchase agreements were canceled, which represents 14.6% of all homes under contract during that month. That is up from 14% a year ago and the highest May percentage in data going back to 2017.

The greatest cancellation rates among the major metro areas Redfin examined were in Florida and Texas, whose home markets have slowed significantly in recent months. First place went to San Antonio (21.3%), then Orlando, FL (20%), and Jacksonville, FL (19.7%).

“The market has been shifting in buyers’ favor, but it doesn’t feel that way to many Americans because homebuying costs remain near record highs,” said Asad Khan, Senior Economist at Redfin. “Buyers may gain more negotiating power in the coming months as more sellers face a tough reality: Sellers no longer hold all the cards.”

Key Highlights — National

- The Midwest saw the highest growth in pending sales: Cincinnati (8.2%), Indianapolis (6.7%) and Milwaukee (6.6%) saw the biggest increases. The Midwest, which has drawn purchasers due to its relative affordability, is home to six of the ten metro areas where pending sales increased the fastest.

- Florida experienced the largest losses in pending sales: Miami (-19.6%), Fort Lauderdale, FL (-16.9%), and Las Vegas (-12.8%) witnessed the worst drops. Four of the 10 metro areas with the fastest declines in pending sales are in Florida. Closed home sales also declined the furthest in the “Sunshine State.”

- The Northeast witnessed the highest share of price increases: Philadelphia (10.9%), New Brunswick, NJ (8.4%), and Providence (7.7%). Price increases in the Northeast can be fueled by a relative shortage of inventories.

- Dallas (-4.6%), Jacksonville, FL (-5.2%), and Oakland, CA (-6.7%), saw the biggest price drops. Of the 11 metro areas where prices dropped, two are in Florida, three are in California, and four are in Texas. Extreme weather occurrences, increased insurance prices, and a rush in homebuilding have caused the housing markets in Florida and Texas to swiftly cool.

Seller’s Market: New Listings Stall as Price Growth Moderates

The number of active listings, or properties for sale, increased 16.2% YoY and 0.7% month over month on a seasonally adjusted basis, reaching its highest level since March 2020. In addition to properties taking longer to sell, which results in a buildup of stale inventory, active listings are increasing as a result of the mortgage rate lock-in effect abating. The average May home that went under contract took 38 days, which is the slowest May rate since 2020 and nearly a week longer than a year ago. Prior to the pandemic, homes took about this long to sell.

The fact that less than one-third (31.2%) of May sales of homes sold for more than their asking price is the lowest May percentage in five years, indicating that buyers have some negotiating leverage already.

Although there was an increase in active listings in May, new listings experienced the slowest annual growth since November, falling 2.9% month-over-month on a seasonally adjusted basis and up 2.9% YoY.

“We’ve hit a plateau with home prices. A lot of homeowners are considering renting their homes out instead of selling,” said Rob Wittman, a Redfin Premier real estate agent in the Washington, D.C. area. “The buyers who come through on tour these days have little urgency. They’re often browsing instead of buying because they’re hoping mortgage rates will come down, even though that’s unlikely to happen soon.”

New listings fell most in:

- San Jose, CA (-16.7%)

- Orlando, FL (-10.7%)

- Jacksonville, FL (-9.2%)

Florida is home to six of the 10 metro areas with the fastest declines in new listings. Parts of Florida are seeing a decline in new listings following a recent spike.

Additionally, the largest increase in days on market occurred in Florida. Out of all the metros Redfin examined, Orlando saw the largest rise, with the average home going under contract in 51 days, up 19 days from the previous year. Miami (+14 days) and Fort Lauderdale (+18 days) followed.

In the “Sunshine State,” homes also had the lowest chance of selling for more than their asking price. The lowest percentages of residences selling above list were in West Palm Beach, FL (6%), Miami (7.7%), and Fort Lauderdale, FL (9.3%). Six of the 10 metro areas where homes were least likely to sell on the above list are in Florida.

According to Redfin, mortgage rates will stay close to 7% for the remainder of the year.

To read more, click here.