Cotality has released its latest National Mortgage Application Fraud Risk Index for the first quarter of 2025, showing the Index at 133, down 0.3% from the end of 2024. The year-over-year trend is up 7.3% from Q1 2024, when the index stood at 124.

The largest year-over-year increase in Q1 2025 is in the “transaction risk” category at 4.6%. Transaction risk applies to applications where elements of a home purchase transaction were not fully represented to the lender, including hidden sales concessions, non-arm’s length sales, and rapid property flipping.

“While mortgage delinquencies are currently low across the U.S., the market is ripe for an increase in fraud because of the continuing high interest rates, slow housing market, and other increasing costs of homeownership like insurance affordability,” said Matt Seguin, Cotality’s Senior Principal, Fraud Solutions. “If market conditions continue to challenge sellers, risks like misrepresented down payments, inflated prices, and straw buyers could increase dramatically.”

Overall mortgage applications remained steady from Q4 2024. Purchase share remains high at 67% of transactions. As was the case last quarter, the share of government-backed loans increased again, from 24% to 26% of applications.

For its National Mortgage Application Fraud Risk Index, Cotality analyzed the indicators that predict elevated fraud activity. There were moderate increases from December to March in the following trends:

- Income: High income relative to time on the job and/or for the geographic area.

- Transaction: Alerts on purchase transactions with multiple high-risk elements are trending up, such as inconsistent property value relative to the borrower’s age or depreciating markets.

- Occupancy: Increased alerts that a primary or secondary home will not be occupied as disclosed.

- Property: Higher levels of alerts for values in the higher ranges of geographic areas and properties being resold within one year of a prior transaction.

The number of owner-occupied properties listed for rent within the last 180 days increased by 50%, the largest quarter-over-quarter increase; however, other indicators point to stabilized occupancy risk.

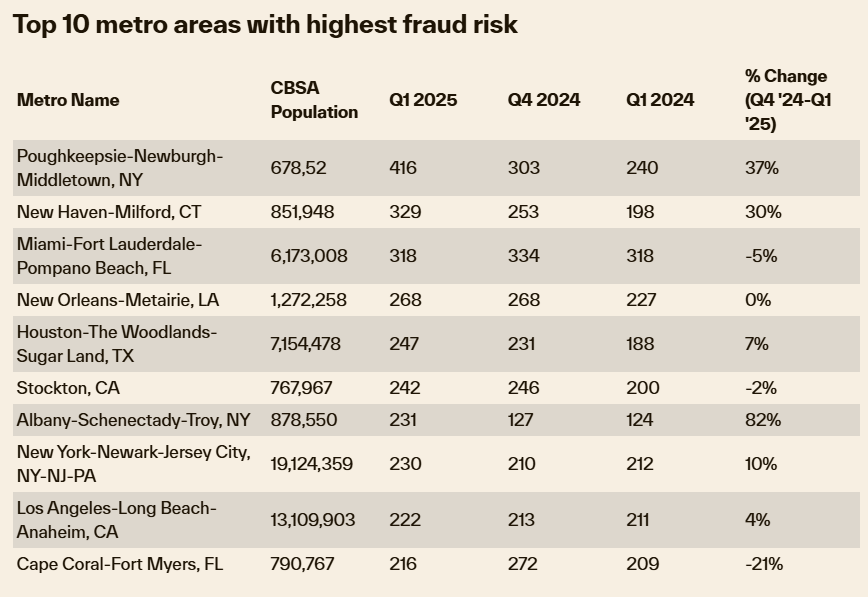

Regionally, two New York metros, Albany and Poughkeepsie, reported the highest quarter-over-quarter increase in mortgage fraud risk.

Government Stepping Up to Stamp Out Fraud

Fannie Mae recently announced a partnership with artificial intelligence (AI) platform Palantir to launch a Crime Detection Unit in an effort to enhance the GSE’s fraud detection capabilities. Palantir designs and deploys AI and machine learning (ML) technology used by government agencies and commercial clients. The company’s offerings provides expansive monitoring for anomalous transactions, activities, and behaviors to help companies detect suspicious activity and trigger investigative action.

“By integrating this leading AI technology, we will look across millions of datasets to detect patterns that were previously undetectable,” said Priscilla Almodovar, Fannie Mae’s President and CEO. “This new partnership will combat mortgage fraud, helping to safeguard the U.S. mortgage market for lenders, homebuyers, and taxpayers.”

In a letter sent to Consumer Financial Protection Bureau (CFPB) staffers from Bureau Chief Legal Officer Mark Paoletta, the agency outlined how it will channel its focus on “tangible harm to consumers” by reallocating resources from enforcement and supervision activities that can be done by states.

“The Bureau will focus its enforcement and supervision resources on pressing threats to consumers, particularly service members and their families, and veterans,” said Paoletta in the memo. “To focus on tangible harms to consumers, the Bureau will shift resources away from enforcement and supervision that can be done by states. All prior enforcement and supervision priority documents are hereby rescinded.”

The memo from Paoletta continued that the Bureau will turn its attention to mortgage fraud its “highest priority,” followed by Fair Credit Reporting Act (FCRA)/Regulation V data furnishing violations; Fair Debt Collection Practices Act (FDCPA)/Regulation F violations relating to consumer contracts/debts; various fraudulent overcharges, fees, etc.; and the protection of consumer info resulting in actual loss to consumers.