In June, the national median payment that purchase applicants sought for dropped from $2,211 in May to $2,172, indicating an improvement in homebuyer affordability. This is in line with the Mortgage Bankers Association’s (MBA) Purchase Applications Payment Index (PAPI), which uses information from the MBA Weekly Applications Survey (WAS) to calculate how new monthly mortgage payments change over time in relation to income.

“Affordability conditions improved in June, a positive sign for prospective homebuyers looking to take advantage of slightly lower mortgage rates and moderating home prices,” said Edward Seiler, MBA’s Associate VP, Housing Economics, and Executive Director, Research Institute for Housing America. “The median purchase application amount decreased to $324,800, and we expect that home-price growth will continue to stabilize as more inventory comes onto the market in many parts of the country.”

Additional Key Findings of MBA’s Purchase Applications Payment Index (PAPI) – June 2025

- The national median mortgage payment was $2,172 in June 2025—down $39 from May. It was up by $5 from one year ago, equal to a 0.2% increase.

- The national median mortgage payment for FHA loan applicants was $1,881 in June, down from $1,927 in May and down from $1,907 in June 2024.

- The national median mortgage payment for conventional loan applicants was $2,205, down from $2,235 in May and up from $2,180 in June 2024.

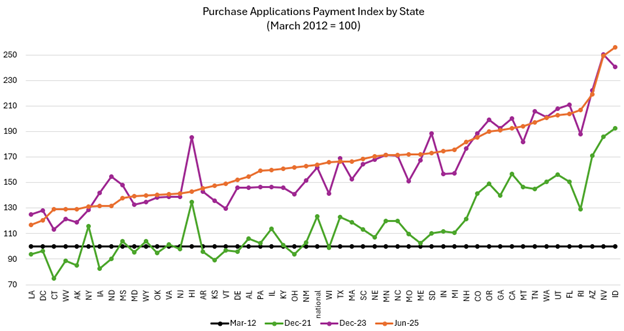

- The top five states with the highest PAPI were: Idaho (255.7), Nevada (249.5), Arizona (219.2), Rhode Island (206.9), and Utah (202.8).

- The top five states with the lowest PAPI were: Louisiana (116.9), Washington, D.C. (120.4), Connecticut (129.3), West Virginia (129.3), and Alaska (129.4).

- Homebuyer affordability increased for Black households, with the national PAPI decreasing from 166.1 in May to 163.1 in June.

- Homebuyer affordability increased for Hispanic households, with the national PAPI decreasing from 155.2 in May to 152.4 in June.

- Homebuyer affordability increased for White households, with the national PAPI decreasing from 167.8 in May to 164.8 in June.

The mortgage payment to income ratio (PIR) is larger when the MBA’s PAPI rises, which is a sign of deteriorating borrower affordability conditions. This can be caused by rising mortgage rates, growing application loan amounts, or a decline in earnings. When loan application amounts, mortgage rates, or incomes decline, the PAPI declines, which is a sign of improving borrower affordability conditions.

In June, the national PAPI (Figure 1) dropped from 166.6 in May by 1.8 percent to 163.7. The PAPI is down (affordability is higher) 4.2 percent annually as a result of the notable earnings rise, even if median earnings were up 4.6 percent from a year ago and payments increased 0.2 percent. The national mortgage payment for borrowers in the 25th percentile (those applying for lower-payment mortgages) dropped from $1,512 in May to $1,500 in June.

The median mortgage payment for purchase mortgages from MBA’s Builder Application Survey dropped from $2,328 in May to $2,273 in June, according to the Builders’ Purchase Application Payment Index (BPAPI).

To read more, click here.