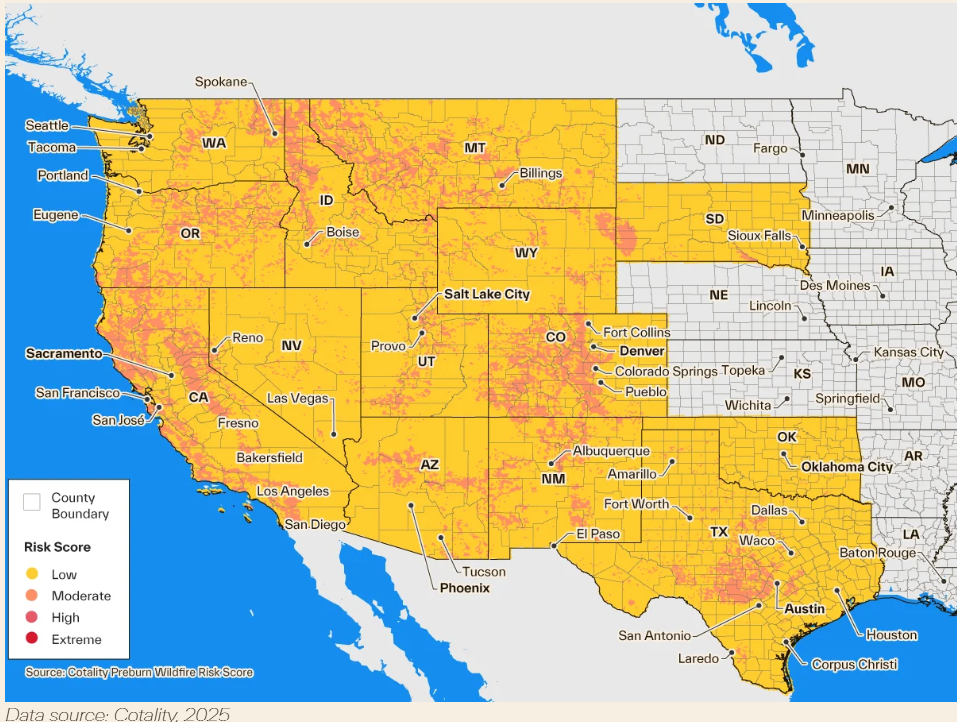

According to a new report from global property data provider Cotality, wildfires, once confined to a so-called “wildfire season,” are now an ever-present threat. The 2025 Cotality Wildfire Risk Report: Priced Out & Burned Out, reveals that more than 2.6 million homes in the Western U.S., representing a combined reconstruction cost value (RCV) of $1.3 trillion, face moderate or greater risk of wildfires, with more than one million of those homes deemed “very high risk.”

Residential Properties in the Western U.S.

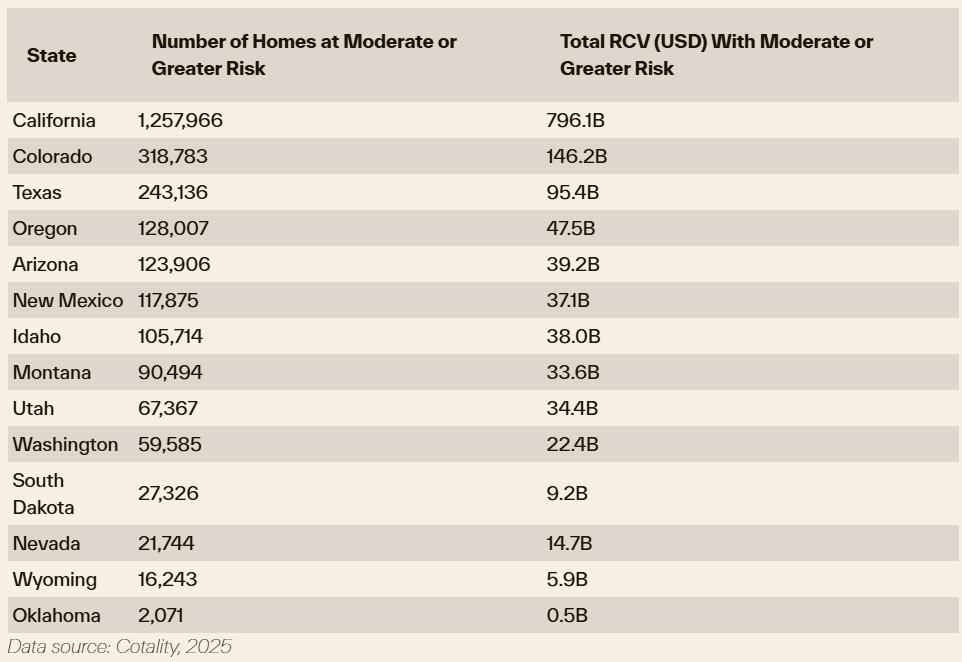

Spread across 14 states in the West, nearly half of the homes are in California (1.3 million), with Colorado (319,000), Texas (243,000), Oregon (128,000), and Arizona (124,000) rounding out the top five states with the largest number of homes at risk. These states contain a high number of homes in the Wildland-Urban Interface (WUI) where there is elevated risk due to their proximity to forested or undeveloped areas.

States With Moderate RCV

“Wildfires are complex, fast-moving, dangerous—and a growing threat to homes and communities. Understanding the level of risk will help equip homeowners and insurers to take preventative action that can save properties and lives,” said Tom Larsen, Cotality’s AVP of Product Marketing for Insurance Solutions. “There are many contributing factors to the increasing threat of wildfires, including where and how we build. Building with wildfires in mind and introducing mitigation measures for where we have already built is one of the critical conversations we need to be having right now.”

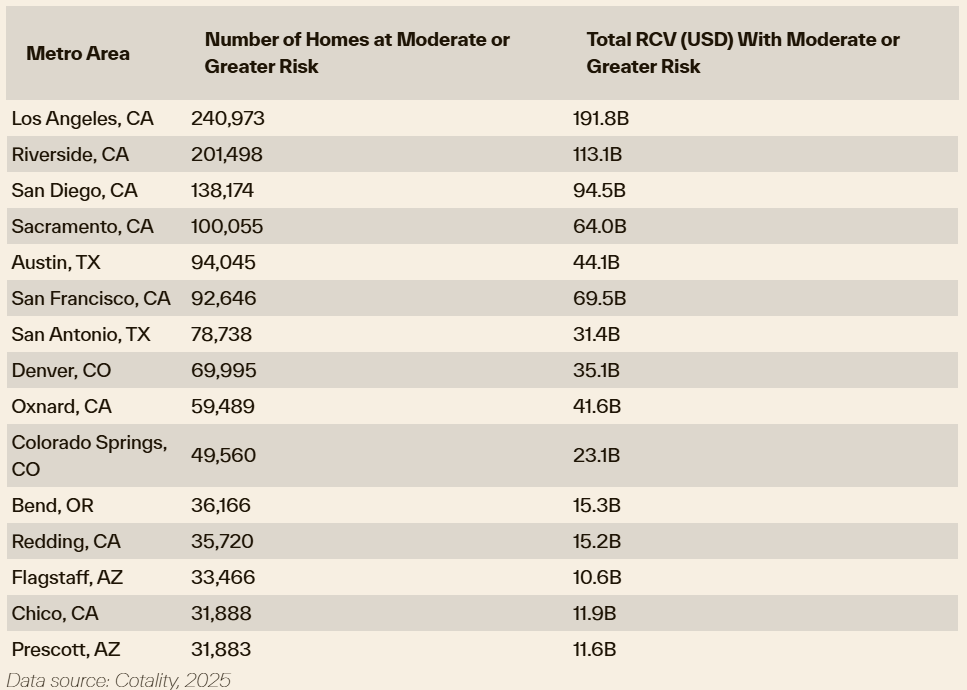

California is home to eight of the top 15 metro areas with the most homes at moderate or greater wildfire risk–but wildfire threat is not just a problem in the Golden State. Metros like Austin, Texas; Denver, Colorado; and Colorado Springs, Colorado, are also facing elevated risk. Wildfire behavior is shifting due to multiple factors, including fuel build up from decades of fire suppression, expanding development into the WUI driven by population growth, and longer, drier seasons.

Homes With Moderate RCV

The 2025 Cotality Wildfire Risk Report: Priced Out & Burned Out report also explores the complexities of wildfires by analyzing the Palisades and Eaton fires that occurred in January 2025 and resulted in devastating conflagration events. Though both Los Angeles wildfires ignited as conventional wildfires, they transitioned into wildfire-induced conflagration once the fuel shifted from vegetation to the built environment of homes and businesses. The conflagration shift dramatically alters how fires spread and magnifies potential destruction that can occur. Since 2020, wildfire-induced conflagrations have destroyed more than 26,000 structures across the country.

Far Reaching Impact

In the wake of the recent wildfires in Los Angeles, Redfin examined the state of home sales in the region, reporting that they fell by double digits in the Pacific Palisades and Altadena regions in the wake of January’s wildfires.

In the Palisades (90272) region, just 12 homes sold in February, down 56% from a year earlier, and in the Altadena (91001) region, just 32 homes sold, down 43% year-over-year. Home listings fell in neighborhoods hit by the wildfires, too. Listings slowed a bit in February—but not nearly as much as sales. There were 23 new listings in the Palisades, down 12% year-over-year, and 46 new listings in Altadena, down 6%.

Sale prices did differ in the disaster-stricken regions, as prices dropped in Altadena, yet rose in the Palisades region, with the typical Altadena home selling for $1.2 million in February, down 8% year-over-year. But in the Palisades region, one of the most expensive neighborhoods in Los Angeles, homes grew even more expensive, with the typical home there selling for approximately $2.9 million, up 32% year-over-year.

Insurance Costs Mount

The nation’s homeowner’s insurance market has come under heavy pressure as the number of climate-related including wildfires grows annually.

While a national issue, California’s homeowner’s insurance market specifically is under growing financial pressure following January’s catastrophic Eaton and Palisades wildfires, which caused an estimated $52.5 billion in economic losses and affected approximately 18,000 structures, among which included 11,300 homes, (90% of which were absolutely destroyed). The fires also claimed 29 lives, making them among the costliest wildfires in U.S. history.

According to a study by Harvard’s Joint Center for Housing Studies, signs of a deteriorating private insurance market preceded the fires. According to a Federal Insurance Office (FIO) report, private homeowner’s insurance nonrenewal rates between 2018 and 2022 in fire-hit ZIP codes like Altadena (91001) and Pacific Palisades (90272) surpassed both California’s statewide average (1.3%) and the national average (1.2%), reaching 1.7% and 1.8%, respectively, in 2022.

Premiums in these high-risk areas also rose well above inflation during the same period. In Pacific Palisades, average annual homeowner’s insurance premiums climbed 33% above inflation, from $5,025 to $6,689. In Altadena, they increased 26% above inflation, from $1,485 to $1,873.

As private insurers have pulled back from riskier markets, California’s Fair Access to Insurance Requirements (FAIR) Plan, which is the state’s insurer of last resort, has seen unprecedented growth. California’s insurance commissioner recently approved a 17% rate increase for State Farm, the largest homeowner’s insurer in the state, amid what was described as a “statewide insurance crisis.”

In Pacific Palisades and Altadena alone, FAIR Plan policies more than doubled between 2021 and 2024, growing from 1,184 to 2,388. Following the fires, the FAIR Plan received about 5,000 claims and is now facing an estimated $4 billion in total losses. To remain solvent, the plan will assess $1 billion in emergency fees on its member insurers, marking the first emergency assessment in more than 30 years. Half of those fees can be passed on to consumers (private insurers and policyholders across the state).

Click here for more on the 2025 Cotality Wildfire Risk Report: Priced Out & Burned Out.