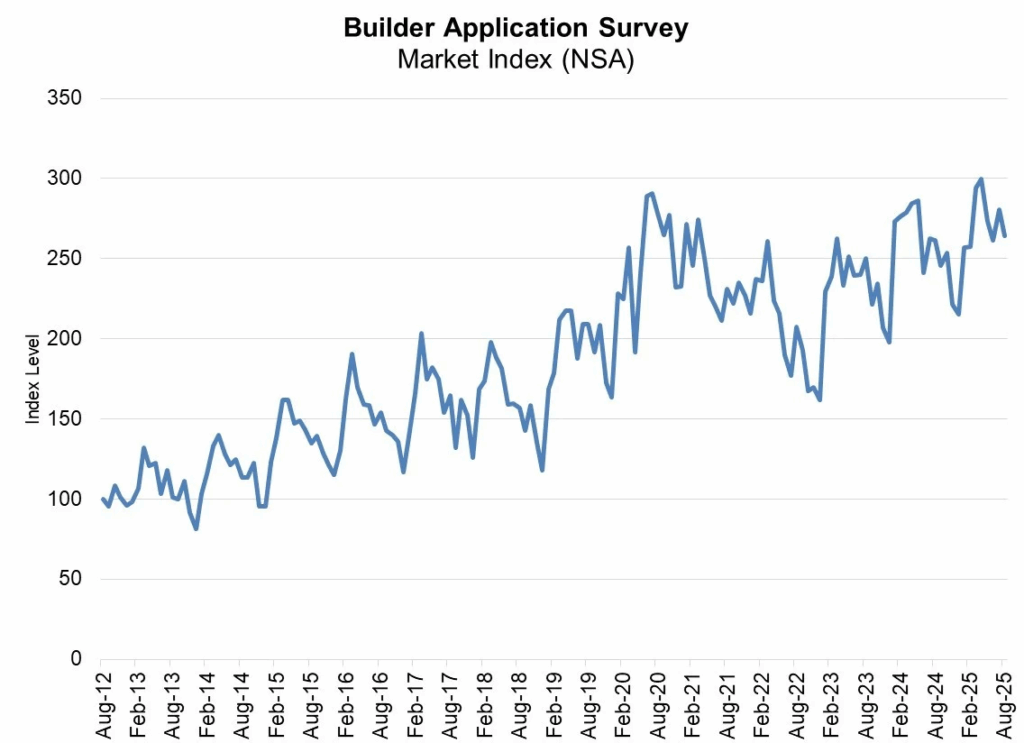

According to recent statistics from the August 2025 Builder Application Survey (BAS) of the Mortgage Bankers Association (MBA), mortgage applications for new home purchases rose by 1.0% over the previous year. The number of applications fell approximately 6% from July 2025.

Note: Typical seasonal patterns have not been adjusted for in this update.

“Applications to purchase newly constructed homes remained higher than last year, although the monthly pace of applications slowed from July,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “The bright spot in the August results was that estimated new home sales increased for the third consecutive month to its strongest sales pace in almost a year.”

New Home Purchase Mortgage Applications Tick Upward in August

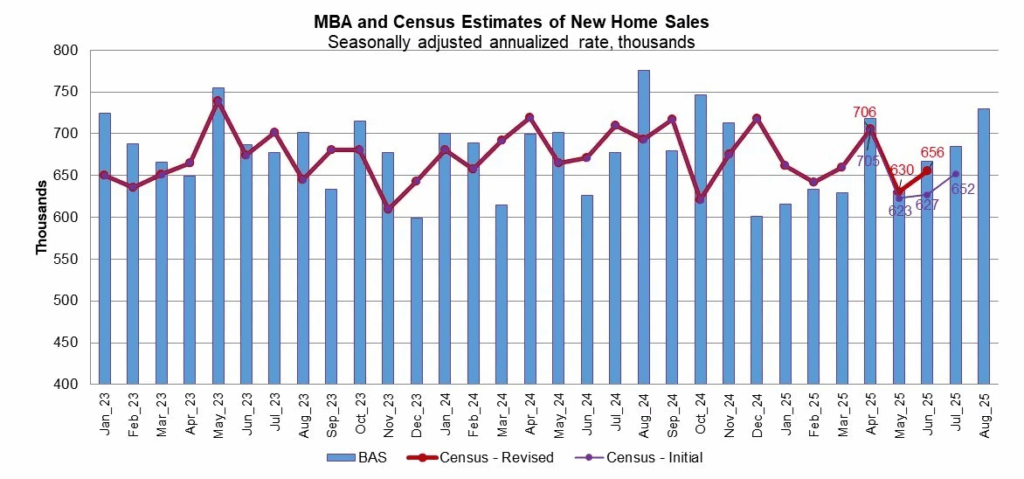

According to MBA, the number of new single-family home sales in August 2025 was 730,000 units, a seasonally adjusted annual rate that has been a leading indication of the U.S. Census Bureau’s New Residential Sales report for years. The BAS’s mortgage application data, along with assumptions about market coverage and other variables, are used to calculate the new home sales estimate.

The pace of 685,000 units in July is up 6.6% from the seasonally adjusted forecast for August. According to MBA’s unadjusted estimates, August 2025 saw 56,000 new home sales, down 3.4% from July’s 58,000 new home sales.

Conventional loans accounted for roughly 49.9% of loan applications by product type, followed by FHA loans (35.6 percent), RHS/USDA loans (1.2%), and VA loans (13.4%). In July, the average loan size for new homes was $372,745; in August, it was $374,288.

“Housing inventory levels continue to grow, which has given prospective homebuyers more buying options and continues to reduce sales price pressures,” Kan said. “The average loan size remained below $380,000 for the fifth consecutive month and was close to 2021 levels.”

To read more, click here.