The Mortgage Bankers Association’s (MBA) latest Purchase Applications Payment Index (PAPI) reveals homebuyer affordability has improved, with the national median payment applied for by purchase applicants dropping to $2,100, down $27 from $2,127 in August. MBA’s PAPI measures how new monthly mortgage payments vary across time–relative to income–using data from MBA’s Weekly Applications Survey (WAS).

“Affordability conditions have improved for four straight months, with lower mortgage rates and stronger income growth boosting prospective buyers’ purchasing power,” said Edward Seiler, MBA’s Associate VP, Housing Economics, and Executive Director, Research Institute for Housing America. “MBA is expecting that moderating home-price appreciation, coupled with lower rates, will continue to ease affordability constraints and help to boost activity in the housing market.”

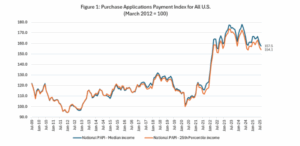

An increase in MBA’s PAPI–indicative of declining borrower affordability conditions–means that the mortgage payment to income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI–indicative of improving borrower affordability conditions–occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

The national PAPI (see chart below) decreased 1.2% to 157.5 in August from 159.4 in July. Median earnings were up 3.2% compared to one year ago, and while payments increased 2.1%, the significant earnings growth means that the PAPI is down (affordability is higher) 1.1% on an annual basis. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment decreased to $1,445 in August from $1,468 in July.

The Builders’ Purchase Application Payment Index (BPAPI) showed that the median mortgage payment for purchase mortgages from MBA’s Builder Application Survey decreased to $2,210 in August from $2,233 in July.

Key Findings

- The national median mortgage payment was $2,100 in August 2025—down $27 from July. It was up by $43 from one year ago, equal to a 2.1% increase.

- The national median mortgage payment for FHA loan applicants was $1,863 in August, down from $1, 865 in July but up from $1,817 in August 2024.

- The national median mortgage payment for conventional loan applicants was $2,112, down from $2,160 in July but up from $2,056 in August 2024.

- The top five states with the highest PAPI were: Idaho (256.5), Nevada (241.9), Arizona (214.0), Rhode Island (208.3), and Utah (205.0).

- The top five states with the lowest PAPI were: Alaska (115.1), Louisiana (115.3), D.C. (117.2), Connecticut (121.7), and New York (123.6).

- Homebuyer affordability increased for Black households, with the national PAPI decreasing from 158.9 in July to 156.9 in August.

- Homebuyer affordability increased for Hispanic households, with the national PAPI decreasing from 148.5 in July to 146.6 in August.

- Homebuyer affordability increased for White households, with the national PAPI decreasing from 160.5 in July to 158.5 in August.

Factors in Play

In early August, the 30-year fixed-rate mortgage (FRM) as reported by Freddie Mac began to drop, beginning the month at 6.72% and falling to 6.56% to close out the month, bottoming out to a 10-month low. Just last week, the 30-year FRM averaged 6.30% as September comes to a close. A year ago at this time, the 30-year FRM averaged 6.08%.

The Federal Reserve has lowered the target range for the federal funds rate by 0.25 percentage points to 4% to 4.25% at the conclusion of its Federal Open Market Committee (FOMC) meeting. This marked the first time in 2025 that the Fed has cut rates, and put an end to a streak of five consecutive meetings where the federal funds rate was held steady at 4.25%-4.50%.

Fallout from the Fed’s rate cuts caused mortgage rates to edge slightly higher, as markets were adjusted to the Federal Reserve’s outlook.

“Even with this week’s uptick, mortgage rates remain near 11-month lows, creating opportunities for both buyers and homeowners considering a refinance,” said Realtor.com Senior Economic Research Analyst Hannah Jones. “For buyers, the current rate environment is delivering a meaningful boost to affordability. At today’s levels, the monthly payment on a typical home is appreciably lower than it would have been at last year’s highs. That shift can make the difference for first-time buyers stretching their budgets, particularly in high-cost metros.”

Click here for more on the MBA’s latest Purchase Applications Payment Index (PAPI).