It’s the month with the worst weather in many parts of the country, but January is the best time to buy a home, according to a new LendingTree study.

The report shows that homebuyers who purchased in January could save an average of $23,00 on a 1,500-square-foot home, compared to those who buy in May — the worst time to make such a purchase.

The findings aren’t surprising, said Doug Perry, Strategic Financing Advisor at Real Estate Bees, an online platform for real estate professionals.

“The winter months bring seasonal obligations and inclement weather, resulting in the typical home seller not wanting to have their home on the market, ready for a showing at any time,” Perry said. “They just don’t need the added stress of selling a home unless it is absolutely necessary, it’s easy to kick that decision down the road. Homebuyers feel the same way so it isn’t any secret the winter months are slow for home sales.”

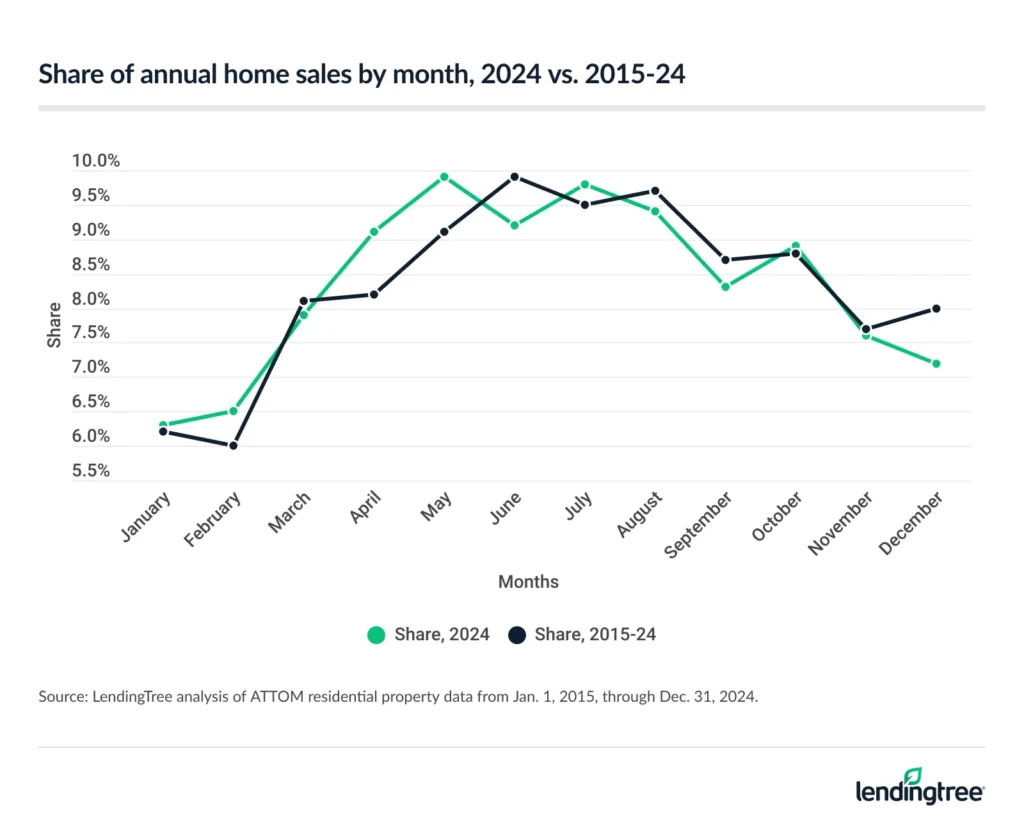

Indeed, LendingTree found that only 6.3% of homes were sold in January.

Finding the Motivated Sellers

Perry added that homebuyers who are looking for a deal have fewer homes on the market during this timeframe but the homes that are on the market are motivated sellers, and this isn’t the case during other times, so a low-ball offer will get more attention. If a buyer is willing to add homebuying to their holiday wish list, they are more likely to get a deal.

Americans buy about 1.4 times more homes in the summer than in the winter, according to Lending Tree. From 2015 through 2024, the last year for which full statistics are available, 29.1% of all residential properties were sold between the beginning of June and the end of August, compared to 25.4% in March to May at 25.4%, 25.2% in the September to November period and 20.2% the rest of the year.

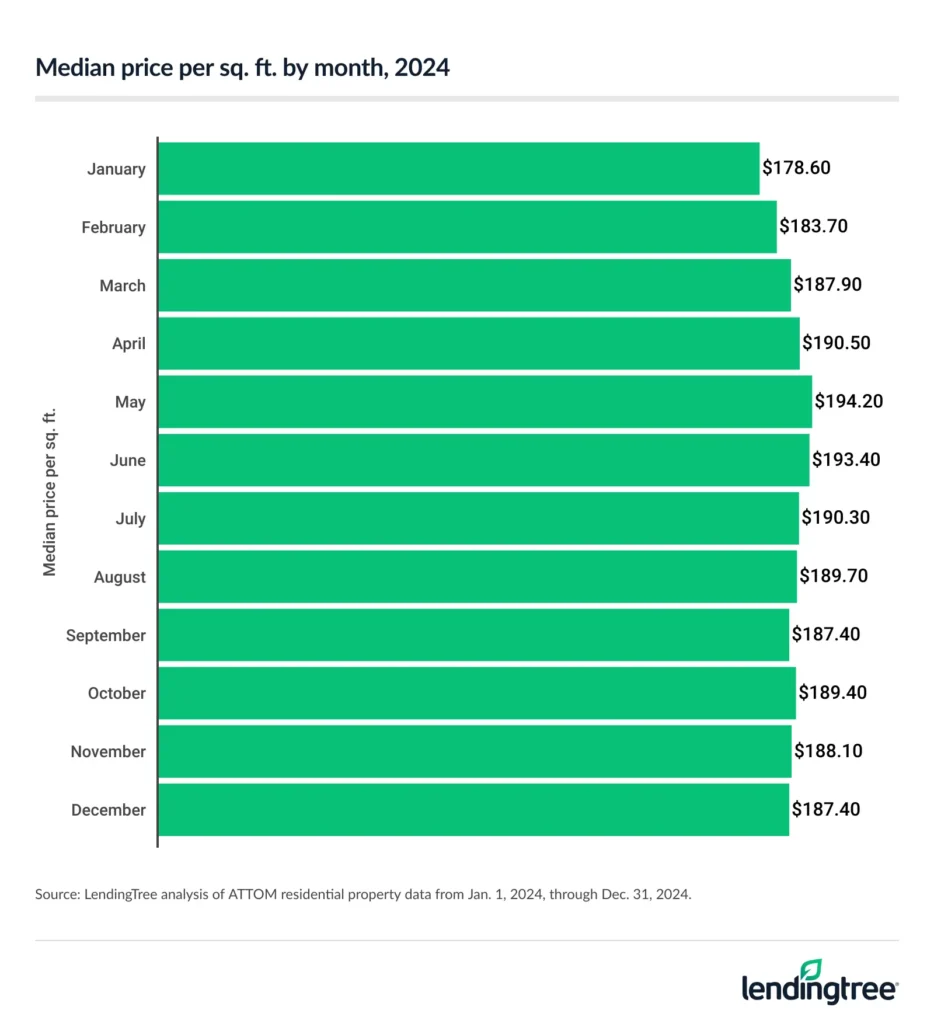

In May, which had the highest sales (6.3%) of any month, in 2024, the median home price was $194.20 per square foot, compared to $178.60 in January. Convenience is the main reason the summer moths are so popular, according to Matt Schultz, LendingTree Chief Consumer Finance Analyst: “School’s out,” he says. “Moving during the summer means parents don’t have to uproot their kids in the middle of a school year, which can be traumatic. While there may be less inventory in the winter, you may find less competition for available homes. You might also find that sellers are more eager to bargain during those off-peak times, not wanting to alienate buyers.”