According to First American’s 2025 forecast, “The 2025 housing market is poised to make strides forward—offering progress, but still far from perfection.” This prediction turned out to be correct, according to their latest report. Mortgage rates decreased, inventories increased, affordability improved, and purchase applications surpassed those from the previous year in 2025. The market is still far from “normal,” though, experts said. Affordability issues and the rate lock-in impact have continued to limit market potential, with existing-home sales averaging roughly four million annually by far.

Recoveries require time; there are no short cuts. As the market gradually moves toward normal—progress without a breakout—the 2025 tendencies will persist into 2026. What does that actually look like? The year will be shaped by six factors: growing supply, stress areas, regional gaps, affordability, life-driven demand, and the new-home edge.

“The housing market won’t return to normal in 2026, but it should bring further progress as life events pull more buyers and sellers into action,” First American experts reported.

Prices & Salaries to Be Primary Drivers of Steady Improvement in Affordability

The labor market, inflation, and Federal Reserve policies will determine the prognosis for 2026. The Fed started reducing rates again in 2025, although the length of the cycle may be constrained by fiscal dynamics, tariff-related pressures, and sticky inflation. Mortgage rates are expected to remain in the low 6% range in our base case, but they may dip lower from current levels toward six. That would be beneficial, but it wouldn’t be sufficient to launch the market on its own.

As inventory improves and income improvements persist, the heavy lifting comes from moderate home price growth. Affordability increased year over year throughout the majority of 2025, partly due to income growth exceeding nominal increases in home prices. Our First American Data & Analytics House Price Index is currently showing appreciation at the slowest rate since 2012. Affordability should continue to rise if that trend persists into 2026, especially in locations with more active inventory where sellers are lowering prices to entice buyers.

However, both new and returning customers still have a sizable amount of pent-up desire. Existing-home sales averaged 5.4 million (SAAR) over the five years prior to the epidemic. We fall short of that criterion by over 4 million sales on average between 2022 and 2025, which is a significant number of lost customers and sellers. Fuel is added by demographics. The number of Americans in their thirties is close to 52 million (opens in a new tab/window), and many of them continue to rent. As life stages align with housing demands, this highlights the size of the pool of prospective first-time buyers.

As their homeownership rate rises over time, millennials alone will add about 10.6 million owner families over the next 25 years, followed by Gen Z. Sales activity will continue to be driven by marriages and separations, expanding families, work changes, caregiving, and downsizing even if mortgage rates remain in the low-6% area. As 2026 progresses, transactions increase because life and its events continue to occur.

Regional variations in supply still exist. In terms of both new-home and resale inventories, the Midwest and Northeast are often the most limited, which encourages a shorter time to contract and fewer concessions through 2026. The supply has increased in several Southern and Western metropolitan areas. Of the top 75 areas, 22 had more active inventory in September than their September average from 2018 to 2019. All 22 of these markets were in the South or West, with half of them located in Florida or Texas.

After seeing disproportionate price increases during the boom, cities like Austin, Texas, and Tampa, Florida, had slower immigration and higher rates, which made prices seem excessive in comparison to local wages. In certain markets, a large supply of new homes increased the adjustment by providing purchasers with greater options. Anticipate a two-speed market in the future. While some areas of the South and West continue to be soft, lean inventory in the Northeast and Midwest keeps conditions generally tight and price growth steady. Later in the year, those supply-rich markets might be strengthened by lower mortgage rates or more robust local job growth, but the difference might increase due to rising insurance and other carrying expenses, particularly along the coast.

U.S. Distress on the Horizon?

Although the national picture still appears to be normalcy rather than a catastrophe, measures of distress (opens in a new tab/window) have climbed from the pandemic floor. The weakest regions are typically found among borrowers with thinner cushions, like some FHA borrowers, and where affordability is most stretched, insurance rates have increased, or local job development has slowed.

Loss of income and a lack of equity are typically the two triggers required for a true foreclosure wave. The risk is still restricted because homeowners still have a sizable equity cushion and the labor market has slowed but not collapsed. The strain should be contained by 2026. Some Sun Belt and Western metro areas that saw price increases during the boom are seeing price declines, which puts recent purchasers with modest down payments at greater risk. The base assumption is gradual normalization rather than a large wave, but experts are set to continue keeping a careful eye on the labor market.

As more owners came to terms with “higher for longer,” supply increased in 2025. The long-term average is approximately 2.5%, or 250 properties per 10,000 households, according to our “inventory turnover” indicator, which measures the percentage of existing homes for sale in relation to households. We started 2025 at about 1.4%, but as the year went on, we nearly reached 1.5%. That is still much below average, but it is a step in the right direction. The improvements weren’t consistent. In the Sun Belt, particularly in Florida and Texas, where more new development and a slower market boosted supply, inventory climbed higher.

Although the rate of increase has somewhat slowed as some owners in softer markets tested the waters before delisting, the number of active listings nationwide is still larger than it was a year ago. Even though the ascent is gradual rather than abrupt, the trend is still upward in 2026. Completions provide purchasers additional options, life events encourage more owners to move, and the lock on all those current homeowners with sub-4% mortgages loosening at the margins. Lower mortgage rates also benefit the margin.

Expert Forecast — 2026

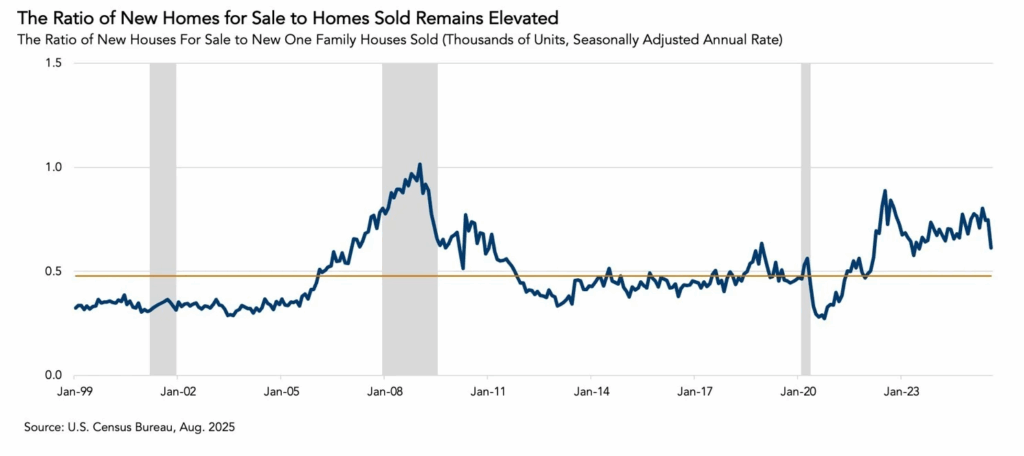

As builders weigh higher inventory against weaker demand, single-family development is moving downward. Buyers are shifting away from brand-new houses due to affordability issues and an increase in resale availability, and permit trends suggest that builders should exercise care until visibility improves. In terms of sales, single-family construction has outpaced new-home sales, which maintains the inventory-to-sales ratio high and forces builders to concentrate on turning standing inventory. A “sell what is built first” strategy has been reinforced by incentives, particularly rate buydowns, which have drawn purchasers but also reduced margins.

The move-up buyer is also influenced by new building, and before making a commitment, these buyers want assurance that their present property will sell for a fair price. Sustained demand is what really drives builders, but lower mortgage rates would be beneficial. Many current owners are still rate-locked, which restricts their options for resale and draws attention to new properties with flexible sellers and available products. For this reason, in 2026, new home sales are probably going to have an advantage over the current market. With targeted buydowns, closing-cost assistance, or price reductions, builders can make speedy adjustments.

To read more, click here.