It may make sense to many that U.S. consumers are exhausted with the current housing market. In today’s climate, the majority of available homes are too expensive for the average American household. Despite annual earnings hanging just under $80,000, a median-income family cannot afford more than 75% of listings nationally, according to recent Bankrate data.

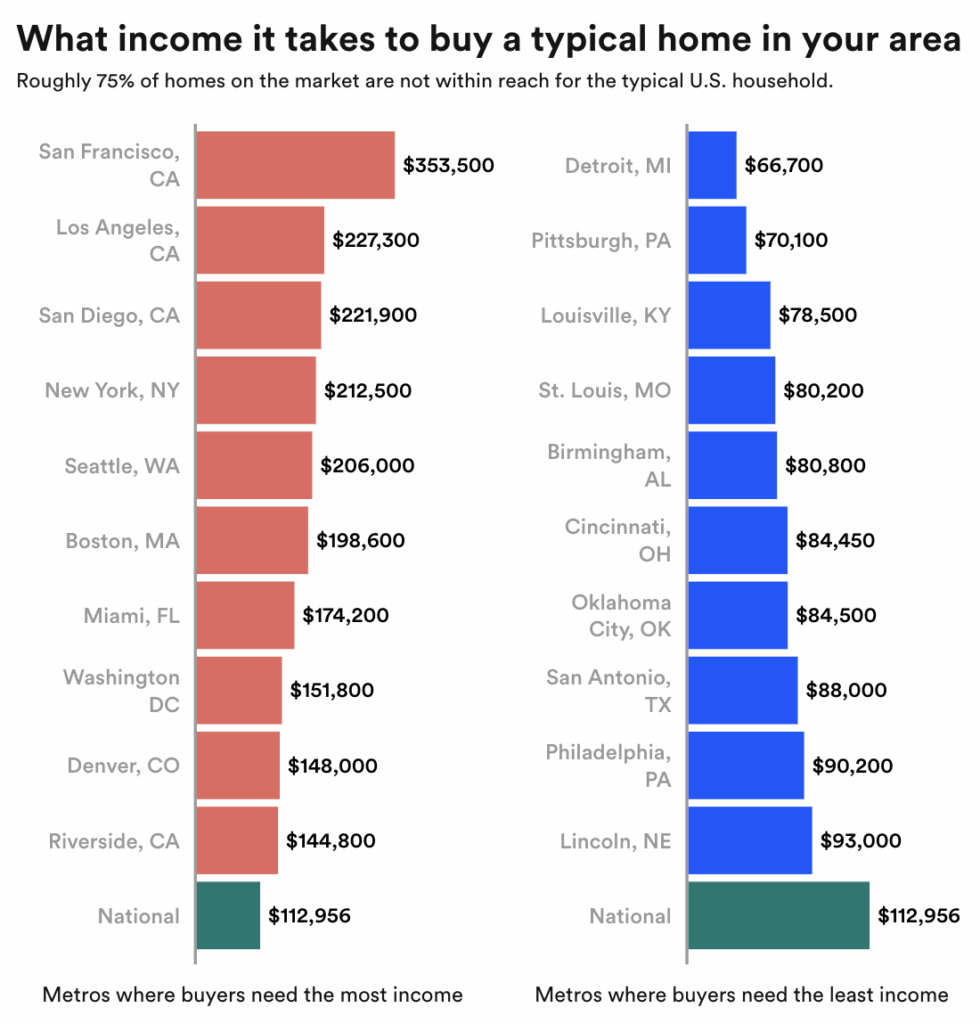

Homebuyers now need to make almost $113,000 annually in order to afford a median-priced home in 2025. This disparity is making the starter-home dream a complicated hurdle.

“The American Dream—to the extent that it involves buying a home and raising your family—has become a lot tougher,” said Chen Zhao, Head of Economics Research at Redfin. “Homeownership has become increasingly unattainable,” Zhao said. “There really is the story of the people who got in in time versus the people who did not.”

Unaffordable Homes Discouraging U.S. Homebuyers

Homeownership has become a luxury that many people cannot afford in the majority of America’s largest cities. Many consumers making the median income nationwide are being priced out of three out of every four available homes, according to Bankrate.

One major factor is that there are simply not enough homes available for purchase at the moment. Homebuilders haven’t kept up with demand since the Great Recession, and homeowners who secured extremely low mortgage rates during the crisis have been remaining on the sidelines, data revealed.

During the pandemic, property values skyrocketed, and mortgage rates rose at the fastest rate in around 20 years. Housing affordability has dropped to historically low levels in recent years as wages have struggled to keep up.

However, Americans’ desire to purchase a home hasn’t diminished, despite the fact that it seems increasingly unattainable. According to experts, prospective homebuyers frequently go above their means. If they are fortunate enough to locate one in four that is reasonably priced, they frequently witness fierce competition that drives up costs.

According to Hannah Jones, Senior Economic Research Analyst at Realtor.com, Americans have options and a route to homeownership if over 50% of the real estate in a metro region is within the average wage range.

“But when you see that the typical household can only afford 30% or 20% of the homes on the market, that’s when the market is not calibrated well to the income levels of locals,” Jones said.

Less than one in 50 properties in the most expensive property regions, such as Miami, Los Angeles, and San Diego, are affordable for the average household, according to Bankrate’s study of Realtor.com data. Given that the average cost of a property in Los Angeles and San Diego is more than $1 million, this may not be surprising to some.

However, in 2025, a number of sizable areas in the South and Rust Belt still provide some optimism and affordability. In Pittsburgh and St. Louis, Missouri, the average homebuyer can still afford one in two listings, whereas in Detroit, Cincinnati, and Birmingham, Alabama, it’s about two out of every five.

Note: Income calculations are based on a median-priced house in each market as of July, the average 30-year mortgage rate (6.8%) and a 20% down payment. It assumes spending no more than 30% of annual gross income on housing costs, including home insurance and property taxes.

Listing, Inventory Vary Across Popular U.S. Metro Regions

According to Bankrate data, roughly 12 of the 34 biggest U.S. metro areas have more than 30% of listings that are within the means of the average household. The majority, including housing markets such as Philadelphia, San Antonio, and Charlotte, North Carolina,, that have long been regarded as inexpensive, fall below that cutoff.

The results demonstrate how unbalanced the country’s housing market has grown. The average American household must earn at least $33,000 more per year to be able to purchase a median-priced home, yet more than 75% of U.S. homes on the market are out of their price range. A typical home now requires at least a six-figure income in the majority of the country’s largest metro areas.

Whether or not new homes are being constructed is frequently the cause of regional variations in affordability. New building is contributing to an increase in supply in some areas of the West and South. According to Jones, those areas have better prospects than the Northeast and Midwest, where construction has slowed, and inventory levels are still 40% to 60% below pre-pandemic levels.

“There’s this flow of wealth and talent that’s coming here that’s really changing the landscape here for buyers at all levels,” said Ana Bozovic, a market advisor for the Miami Association of Realtors. “That’s a force that isn’t going away.”

Further, in other coastal markets, similar characteristics also have made housing unaffordable. California —the “Golden State”—is home to four of the 10 least affordable metro areas, highlighting the state’s ongoing housing crisis. Boston, New York, and Seattle, Washington, are additional markets where affordability is particularly tight.

“ These places have always been expensive, but it has definitely intensified over the last five or six years as home price growth has outpaced wage growth,” Jones said.

Homebuyers Giving Up on the “American Dream”

According to housing experts—such as those quoted above— American homeownership is at its most difficult level in decades. According to a 2025 Bankrate survey, more than half of Americans say their earnings haven’t kept up with home costs, and one in five prospective homeowners think they might never save enough to buy.

According to research, typical home prices have increased by almost 50% nationwide since 2020, and salaries have not kept up with this rapid increase. Bankrate’s study of Bureau of Labor Statistics data shows that since the beginning of 2021, wages have increased by 22%.

Between 2020 and 2022, extremely low mortgage rates contributed to a purchasing frenzy, and even as rates started to rise, prices continued to grow. It wasn’t until this year that supply started to increase in several Southern and Western regions and demand eventually began to decline. However, according to a recent National Association of Realtors study, home values continued to rise in the majority of the country’s metro areas during Q3.

According to Zhao, competition for less expensive residences increases when borrowing costs are high, swiftly exhausting the limited supply of reasonably priced properties. Since rents are still much less expensive than short-term mortgage payments, many prospective buyers wind up renting for longer.

“For a lot of these places, the issue is that there just simply is not enough housing for how many people who want to live there,” Zhao said. “If you had the supply of housing that was able to address the amount of demand, then it wouldn’t be the case that a low percentage of homes are affordable to a household with median income.”

Property taxes and home insurance premiums have gone up by double digits nationwide, adding to the strain. For younger purchasers in particular, all of these pressures have made homeownership increasingly unattainable. According to the National Association of Realtors (NAR), the median age of a first-time homebuyer is currently 40 years old, representing an all-time high.

According to Zhao, individuals who chose not to make a purchase have witnessed their purchasing power decline, forcing them to accept longer commutes, settle for smaller residences, or put off making a purchase entirely.

“The people who you know are finding homeownership to be easier either have higher income or they have family members who can help,” Zhao said. “There are also those who bought a home before 2022. If you were part of that group, you got pretty lucky.”

However, some housing experts seem to concur that the home market’s affordability crisis won’t be resolved anytime soon.

“It will be like slowly easing out of this affordability situation versus anything that’s going to just flip the switch,” Jones said.

According to Realtor.com, the housing market will be more balanced in 2026, with home price growth remaining steady, a little decline in mortgage rates providing more leeway, and buyers having greater negotiating power.

Currently, buyers and sellers are engaged in a tug-of-war in the market. As a result, consumers now have fewer options, greater borrowing fees, and steeper prices.

Although housing experts don’t anticipate mortgage rates falling anywhere close to the historic lows of 2020 and 2021, a slight decline could provide some respite. Although it will take time for earnings to catch up to property prices, Jones said that more wage growth would also be beneficial.

“That’s really what we need to happen to get back to the same state of affordability that we were looking at before the pandemic,” Jones said. “ It’s a very long road.”

Experts believe that building additional homes—especially ones that are affordable for middle-class households—is the only practical solution in the long run. Homeownership will remain out of reach for millions of potential purchasers until supply and demand are properly balanced nationwide.