According to a new nationwide consumer survey issued by Bright MLS, rising concerns about debt, spending, and job security might impede the housing market’s recovery in 2026 even as lower mortgage rates and increased inventory boost affordability.

The majority of Americans are concerned about their own financial circumstances, according to a Bright MLS survey conducted in December of over 3,300 persons aged 18 and older. Overall, economic fears are expressed widely across demographic and income groups.

“While home sales are projected to increase in 2026 as affordability improves, consumer confidence is moving in the opposite direction,” said Lisa Sturtevant, Chief Economist at Bright MLS. “When people feel uncertain about their jobs, their debt or their ability to cover basic expenses, they are far less likely to make big financial decisions like buying or selling a home.”

Lower-Income Households Feeling Most Pressured

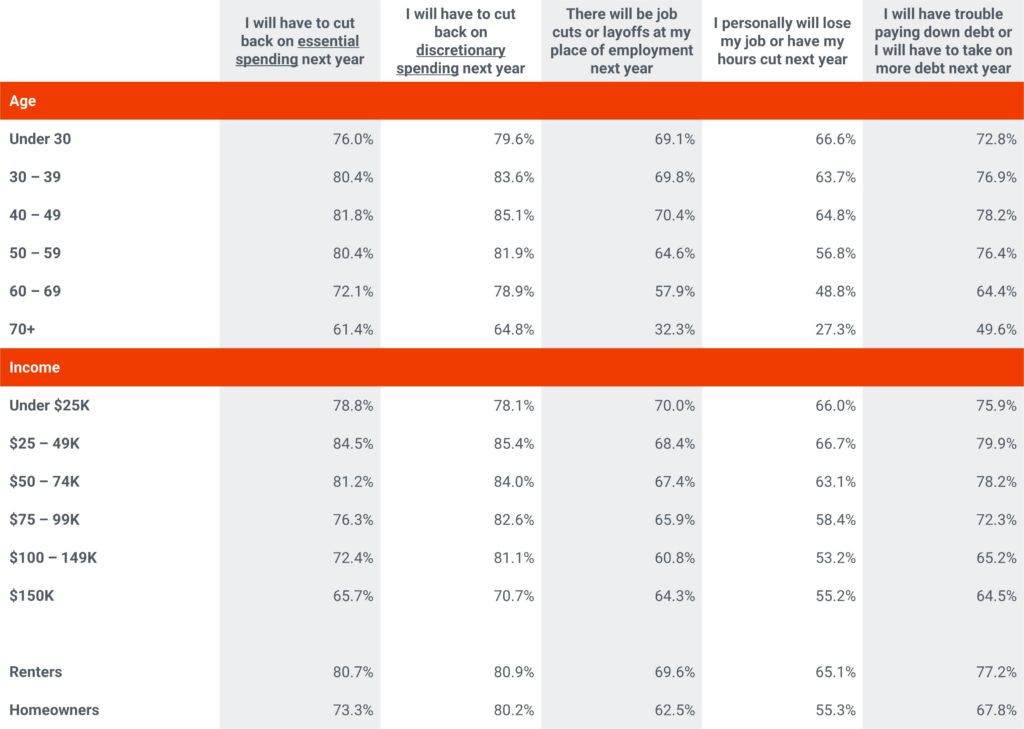

Despite the fact that economic concern is common, the study indicates that Millennials, renters, and households with lower incomes are under the most stress. Compared to 73.2% of homeowners, almost 80% of renters say they are “somewhat” or “very” concerned about having to reduce spending on necessities. Compared to 67.8% of homeowners, over three-quarters of renters (77.2%) are concerned about having to take on more debt in the coming year.

Households with lower incomes are likewise under a lot of strain. Compared to 70.0% of households earning $100,000 or more annually, about 82% of households earning less than $50,000 say they are concerned about reducing critical spending. Similarly, compared to 65.0% of households with higher incomes, some 78.0% of households with lower incomes are concerned about accruing additional debt.

More over 80% of respondents between the ages of 30 and 49 say they are concerned about reducing spending on necessities, which is the age group with the highest levels of anxiety. 77.5% of people in this age range are concerned about having to take on extra debt or about their ability to pay it off.

“Older Millennials, who fall squarely in this age group, are facing their third major economic shock,” Sturtevant said. “They entered the workforce during the Great Recession, were hit again by the COVID-19 pandemic during key life stages, and now face renewed economic uncertainty just as many are trying to buy their first home or move up to a larger one.”

U.S. Job Security Concerns Remain a Big Factor

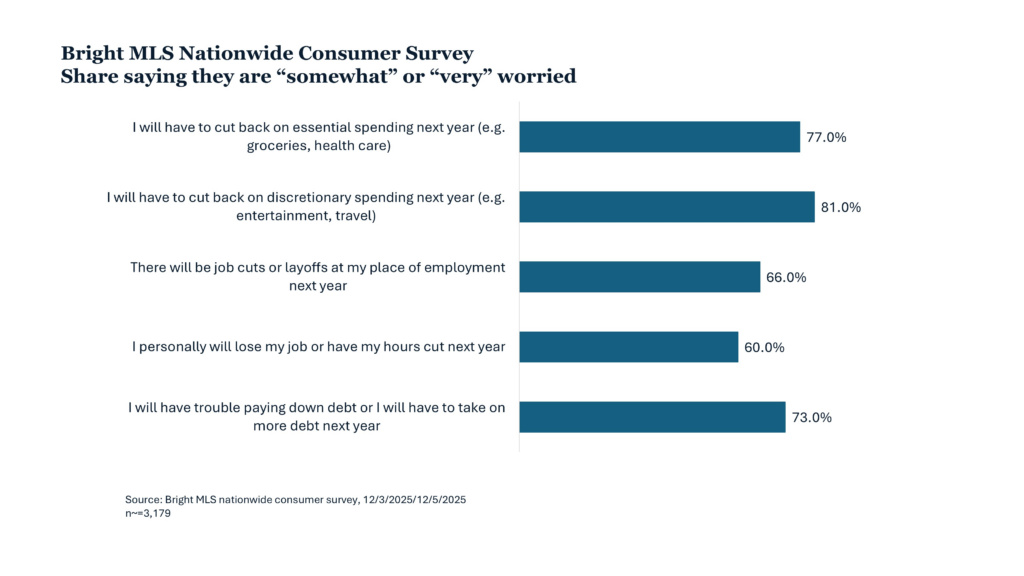

Nearly two-thirds of respondents (66.2%) say they are “somewhat” or “very” concerned that their employer may make layoffs during the next 12 months. Of those surveyed, three out of five (60.5%) say they are concerned about losing their jobs or having their hours cut.

These worries coincide with indications of a weakening labor market, such as slower job creation and a little increase in the unemployment rate in recent months. Reports of high-profile job losses at large corporations may be leading to increasing fear about job security, even though layoffs have not increased significantly overall.

Further, over 77.1% of those surveyed indicate they are “somewhat” or “very” concerned about having to reduce their expenditure on necessities in 2026. More over eight out of ten Americans (80.5%) are concerned that they will have to cut back on non-essential expenditures, indicating even greater concerns about discretionary spending. Meanwhile, 72.7% of Americans say they are “somewhat” or “very” concerned that they will struggle to pay off debt or that they would need to take on more debt in the coming year.

Since consumer spending makes up around 70% of the U.S. economy, these worries suggest that households are generally cautious about their finances as the year gets underway. These concerns imply that consumers are usually concerned about their finances as the year begins, given that consumer spending accounts for nearly 70% of the U.S. GDP.

“Lower mortgage rates and more inventory will bring some buyers back into the market,” Sturtevant said. “But for many households, economic concerns will continue to outweigh the benefits of better affordability. As a result, 2026 is likely to be a year of cautious progress rather than a full housing market rebound.”

To view the full results, click here.