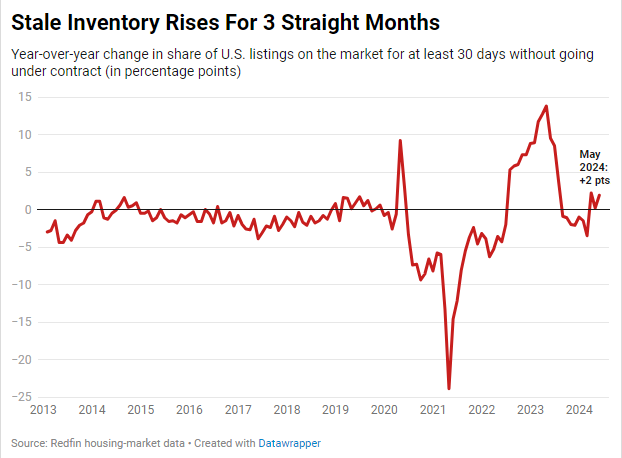

According to new Redfin research, more than three in five—an estimated 61.9%—of homes on the market in May had been listed for at least 30 days without selling. That’s up from 60% a year ago and around 50% two years ago.

Since March, when new listings increased but buyer demand remained sluggish, the share of properties on the market for at least one month has increased year-over-year, as it has since mortgage rates began climbing in 2022. More homes for sale, combined with low demand, means that less appealing listings are piling up, leaving some without a buyer.

Stubbornly high mortgage rates and record-high home prices have priced out many homebuyers, dampening demand even at a time of year when the housing market usually warms up. The average 30-year fixed mortgage rate is 6.99%, more than double the pandemic-era low and just marginally lower than the two-decade peak of 7.8% set in October 2023. The typical monthly housing payment in the U.S. is only approximately $30 less than its all-time high.

Redfin agents note that move-in ready homes in attractive communities continue to sell swiftly, while listings that do not meet that criteria are beginning to pile up in some regions of the country.

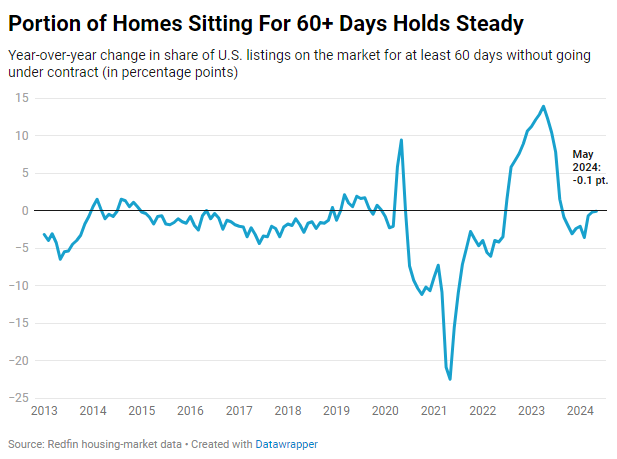

Some 40% of Listings Lingering on the Market for 60+ Days

In May, two out of every five residences on the market (40.1%) had been listed for at least two months without getting under contract. That is steady from a year ago and up from 27.8% two years ago.

In both April and May, the percentage of properties on the market for at least 60 days remained relatively stable year on year. Previously, the metric has been declining annually since September of last year. According to Redfin experts, the percentage of properties waiting for at least 60 days is anticipated to increase next month as long as mortgage rates remain high.

Metro-Level Highlights: Unsold Inventory May 2024

The top 10 U.S. metro areas with the highest share of listings sitting on the market for at least 30 days without going under contract, ranked from biggest year-over-year (YoY) increase to biggest decline (in percentage points) out of the 50 most populous U.S. metros:

1. Dallas

- Share of unsold listings sitting on the market for at least 30 days: 60.5%

- Share of unsold listings sitting on the market for at least 30 days, YoY change (in percentage points): 7.5

2. Fort Lauderdale, FL

- 75.5%

- 7.3 pts

3. Tampa, FL

- 68.7%

- 6.8 pts

4. Jacksonville, FL

- 69.2%

- 6.3 pts

5. Fort Worth, Texas

- 61.9%

- 5.0 pts

6. Orlando, FL

- 67.0%

- 4.9 pts

7. San Antonio

- 68.4%

- 4.5 pts

8. West Palm Beach, FL

- 75.6%

- 4.3 pts

9. Kansas City, MO

- 59.4%

- 2.8 pts

10. Miami

- 76.3%

- 2.7 pts

The notable Dallas metro has the largest and fastest growing share of inventory sitting on the market for 30 or more days. In May, slightly more than 60% of Dallas listings had been on the market for at least 30 days, up from 53% the previous year.

Next up are three Florida metros: Fort Lauderdale (75.5%, up from 68.2%), Tampa (68.7%, up from 61.9%), and Jacksonville (69.2%, up from 62.9%). Inventory is quickly becoming stale in Texas and Florida, owing to the fact that those states are developing considerably more homes than anyplace else in the country, contributing to rising supply, and because some homebuyers are concerned about the increasing frequency of natural catastrophes.

Conversely, the share of homes sitting on the market for at least 30 days declined the most in Seattle (41.2%, down from 50.5%), Las Vegas (55.9%, down from 63.9%) and San Jose, CA (34.4%, down from 42.2%).

To read the full report, including more data, charts, and methodology, click here.