Existing-home sales fell somewhat in May, while the median sales price reached a new high, according to a new study from the National Association of REALTORS (NAR). In the four major U.S. regions, sales fell month-over-month in the South but were steady in the Northeast, Midwest and West. Sales increased in the Midwest but decreased in the Northeast, South, and West over the previous year.

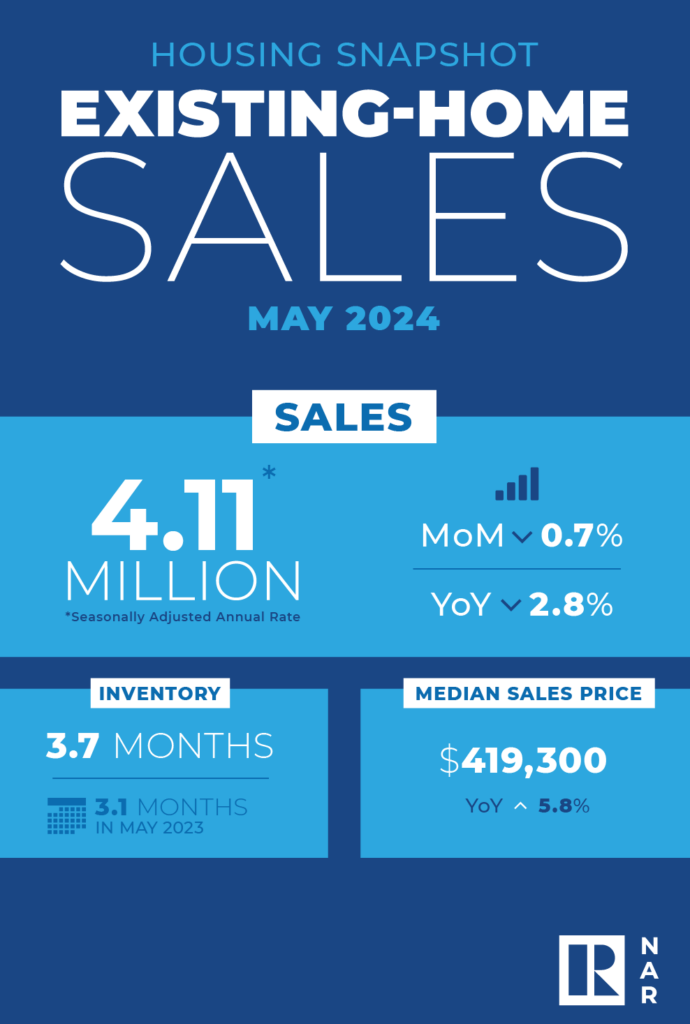

“Existing home sales dipped in May, dropping 0.7% from a month ago to a pace of 4.11 million, trailing the May 2023 seasonally adjusted annual rate of sales by 2.8%,” said Danielle Hale, Chief Economist at Realtor.com. “These closings were most directly impacted by surging mortgage rates in March and April as inflation picked up. Despite weaker sales, the median sales price rose 5.8% in May to $419,300, a new all-time high. Regionally, sales were flat in May in all regions except the South (-1.6%), while sales were lower from a year ago in all regions except the Midwest (+1.0%). Median sales prices rose in all four regions, between 3.6% and 9.2%.”

Total existing-home sales (completed deals involving single-family homes, townhomes, condominiums, and co-ops) fell 0.7% from April to a seasonally adjusted annual pace of 4.11 million in May. Year-over-year, sales fell 2.8% (from 4.23 million in May 2023).

“Eventually, more inventory will help boost home sales and tame home price gains in the upcoming months,” said NAR Chief Economist Lawrence Yun. “Increased housing supply spells good news for consumers who want to see more properties before making purchasing decisions.”

Total housing inventory at the end of May was 1.28 million units, up 6.7% from April and 18.5% from the previous year (1.08 million). At the current sales pace, unsold inventory stands at 3.7 months, up from 3.5 months in April and 3.1 months in May 2023.

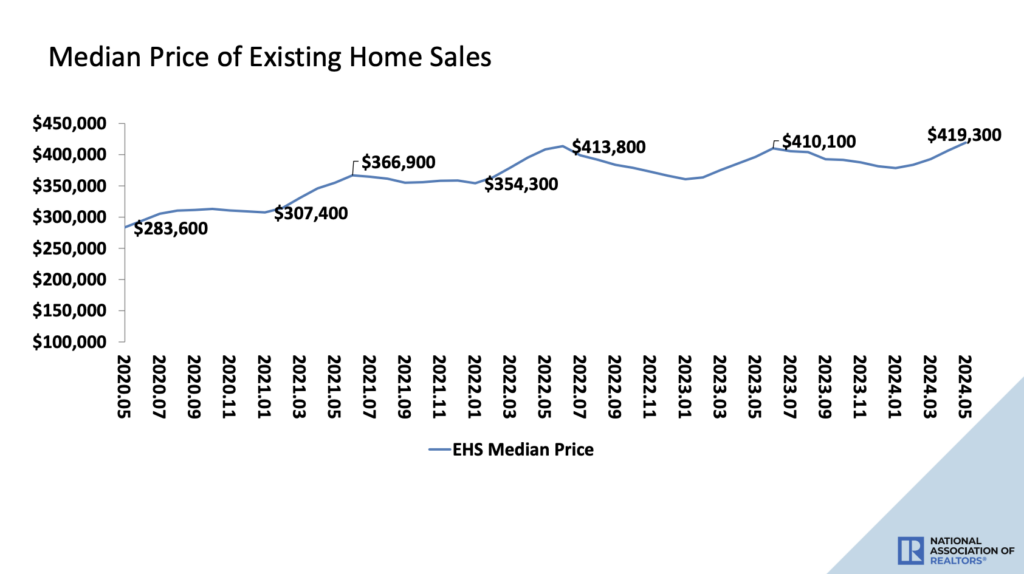

The median existing-home price for all home types in May was $419,300, the highest ever recorded and a 5.8% rise over the previous year ($396,500). All four U.S. regions saw price increases.

“Home prices reaching new highs are creating a wider divide between those owning properties and those who wish to be first-time buyers,” Yun said. “The mortgage payment for a typical home today is more than double that of homes purchased before 2020. Still, first-time buyers in the market understand the long-term benefits of owning.”

REALTORS Confidence Index Highlights

- Properties typically remained on the market for 24 days in May, down from 26 days in April but up from 18 days in May 2023.

- First-time buyers were responsible for 31% of sales in May, down from 33% in April but up from 28% in May 2023. NAR’s 2023 Profile of Home Buyers and Sellers—released in November 2023—found that the annual share of first-time buyers was 32%.

- All-cash sales accounted for 28% of transactions in May, unchanged from April and up from 25% one year ago.

- Individual investors or second-home buyers, who make up many cash sales, purchased 16% of homes in May, identical to April and up from 15% in May 2023.

- Distressed sales—foreclosures and short sales—represented 2% of sales in May, unchanged from last month and the previous year.

- According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.87% as of June 20. That’s down from 6.95% the prior week but up from 6.67% one year ago.

Single-Family and Condo/Co-Op Sales

Single-family home sales declined to a seasonally adjusted annual rate of 3.71 million in May, down 0.8% from 3.74 million in April and 2.1% from the prior year. The median existing single-family home price was $424,500 in May, up 5.7% from May 2023.

At a seasonally adjusted annual rate of 400,000 units in May, existing condominium and co-op sales were unchanged from last month and down 9.1% from one year ago (440,000 units). The median existing condo price was $371,300 in May, up 5.1% from the previous year ($353,300).

“The combination of high home prices and elevated mortgage rates has proved to be challenging for the housing market, weighing down sales activity,” Hale continued. “Despite record-high home equity, existing homeowners have largely avoided moving to hold onto their existing low mortgage rate. In fact, 87% of mortgages are locked in at less than 6%, a percentage point or more below today’s roughly 7% mortgage rate. This has kept a relative balance between supply and demand, which are both feeling interest rate effects.”

Regional U.S. Breakdown

Existing-home sales in the Northeast in May were identical to April at an annual rate of 480,000, a decline of 4% from May 2023. The median price in the Northeast was $479,200, up 9.2% from the prior year.

In the Midwest, existing-home sales were unchanged from one month ago at an annual rate of 1 million in May, up 1% from one year ago. The median price in the Midwest was $317,100, up 6.4% from May 2023.

Existing-home sales in the South fell 1.6% from April to an annual rate of 1.87 million in May, down 5.1% from the previous year. The median price in the South was $374,300, up 3.6% from last year.

In the West, existing-home sales in May were equivalent to April at an annual rate of 760,000, a drop of 1.3% from one year before. The median price in the West was $632,900, up 5.5% from May 2023.

“Looking ahead, an improvement in May inflation has brought some mortgage rate relief even though the Fed still wants to see additional evidence before easing the Fed Funds rate,” Hale said. “Additional inflation relief will likely improve mortgage rate prospects for home shoppers later this year, but it may be too little too late for some would-be first time home buyers who have likely chosen to take advantage of easing rents, a factor behind the slipping homeownership rates for younger households. In fact, according to NAR, first-time buyers purchased 31% of sales in May, down from 33% in April, but up from 28% one year ago. Home shoppers who persist could see better conditions in the second half of the year, which tends to be somewhat less competitive seasonally, and may be even more so since inventory is likely to reach 5-year highs.”

To read the full report, including more data, charts, and methodology, click here.