According to a new Forbes survey, first-time homebuyers are being forced to stay in the rental market by rising home prices and borrowing rates. Due to the increased demand for rentals, monthly rent rates are high, which puts strain on Americans’ finances.

Data found that some 51.9% of renters are estimated to be paying at least 30% of their household income on rent, according to Census data. Furthermore, according to a Zillow.com rental survey from April, the average renter in the U.S. currently has to earn $80,000 in order to comfortably afford a rental. It was $60,000 roughly five years prior.

Two-thirds (68%) of the 2,000 American renters surveyed by Forbes Advisor recently said they made less than $50,000 a year. In order to locate an inexpensive rental that won’t leave them penniless every month, many tenants are now having to make concessions.

Based on the survey results, the top three compromises for renters are:

- Smaller space (23%)

- Fewer amenities (22%)

- Increased budget (20%)

Of renters, 52% report total monthly renting expenses of more than $1,000, while 48% report monthly rent of less than $1,000. Rent payments of more than $1,000 per month are more common among Americans who reside in the West (69%). Among all generations, the largest percentage of Gen Zers—59%—reported paying more than $1,000 in rent. Monthly rent less than $1,000 is usually found among members of Gen X (55%), who reside in the Midwest (64%).

Annual Renter Household Income Poses Challenges

While the majority of renters in the poll earn less than $50,000 annually, 18% of renters earn between $50,000 and $75,000 annually for their family. Only 7% of renters in the survey make more than $100,000.

In the Midwest, 72% of renters reported making less than $50,000 per year for their household, and 77% of baby boomers did the same. Renters with annual household incomes over $50,000 are almost certainly from the West (38%) and belong to Gen Z (39%).

The primary reason given by respondents for continuing to rent rather than buy a home was affordability, but there are also other factors. The top five reasons renters choose to rent included:

- Can’t afford to buy a home (49%)

- Cheaper than owning (32%)

- Lower maintenance costs (24%)

- The flexibility of renting (i.e. being able to move/downsize, 17%)

- Tied: Can afford to buy a home but the selection is limited (11%) and living in current city/town only temporarily (11%)

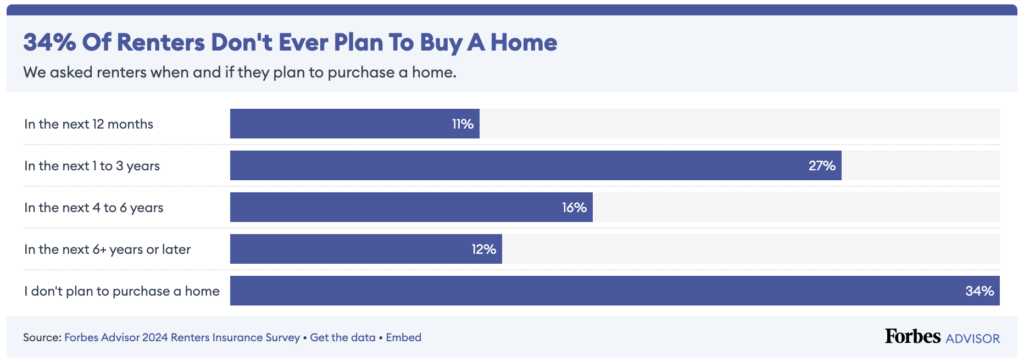

While over 33% of renters indicate they have no intention of ever owning a house, 11% of respondents say they will do so within the next 12 months, and 27% say they will do so within the next one to three years.

Because buying is too expensive, 54% of the renters in the study who identified as baby boomers and members of Gen X rent. Renters in the Northeastern U.S. were the most likely to say they had no intention of purchasing a home (40%). Millennials (34%) are more likely to intend on buying within the next one to three years, whereas Gen Z renters (16%) are more likely to plan on buying within the next 12 months.

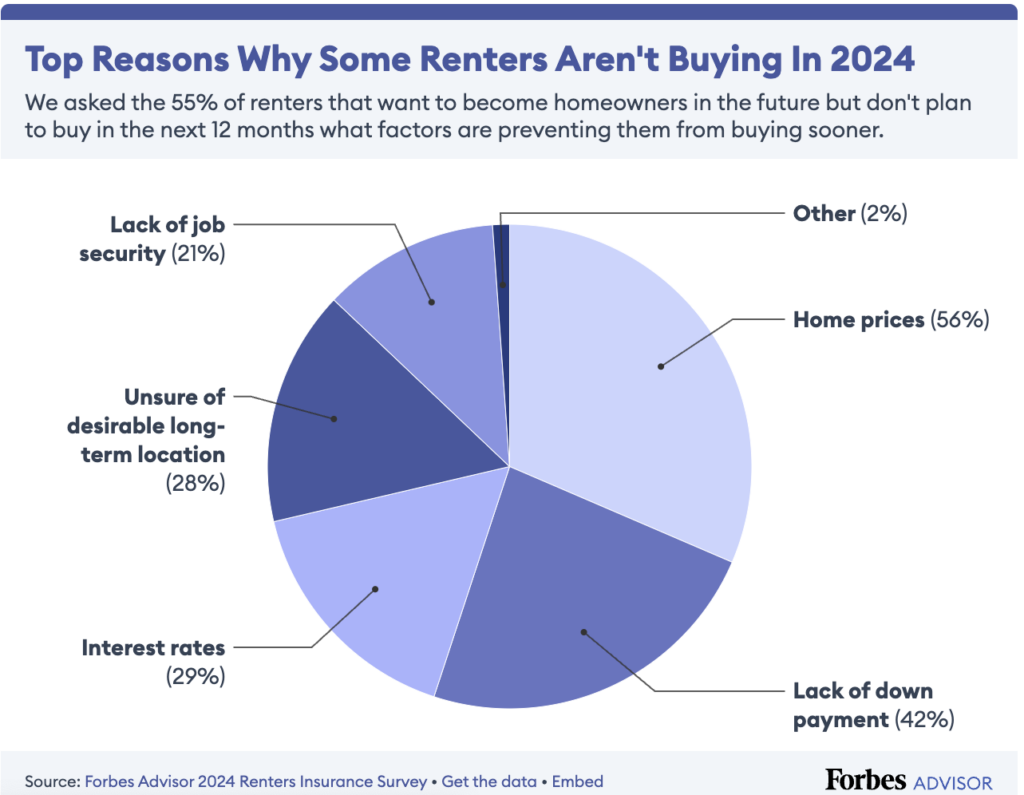

Home Costs, High Rates Preventing Renters From Buying Sooner

The renters we surveyed cited their top three reasons for not being able to buy a house sooner as:

- Home prices (56%)

- Lack of a down payment (42%)

- Interest rates (29%)

Renters in the West are most likely to blame home prices as the reason they can’t buy a home (59%), while Midwest renters (34%) point to interest rates. Generationally, home prices were most commonly reported among millennials and baby boomers (58%) as the reason why they couldn’t buy a house sooner.

Budgets (44%) and Affording Move-In Costs (39%) Among Top Challenges for Renters

For many renters, finding an affordable rental unit is only half the challenge. Saving enough money to pay for the moving costs can also be difficult. More than half of all renters surveyed (54%) reported spending more than $1,000 on move-in costs, including:

- Initial rent deposits

- Security deposit

- Application fees

- First and/or last month’s rent

Additionally, some 38% of renters reported difficulty finding a rental in the area of their choice, and 25% reported difficulty finding a rental that would be available by the date of their move-in.

Crime, Area Costs and Commute Rank Most Important Location Factors for Renters

Location is one of the most important factors when it comes to choosing a house, regardless of if you’re renting or buying. For renters, the top three most important factors when it comes to location are:

- Crime (52%)

- Cost of area (48%)

- Distance to work (28%)

The three least important factors for location are:

- Bikeability (4%)

- Highway access (8%)

- Congestion/traffic (10%)

To read the full report, including more data, charts, and methodology, click here.