In an effort to safeguard against the growing threats posed by climate change, the Federal Housing Finance Agency (FHFA) is intensifying its focus on understanding and mitigating climate-related risks within the U.S. housing finance system. Climate Scenario Analysis (CSA), a pivotal tool for evaluating exposure to climate-related risks under different future climate conditions, has emerged as a critical component of this strategy.

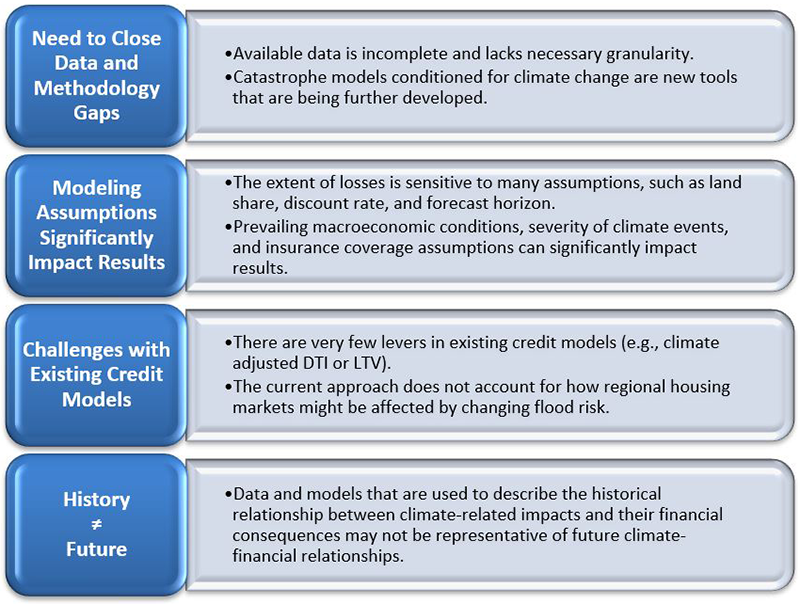

Recent analyses underscore the urgency of addressing gaps in data and methodology to bolster confidence in forecasting the impact of climate change on the housing market. These analyses also underscore the sensitivity of predictive models to various assumptions, emphasizing the need for robust, adaptable strategies.

The implications of climate change for the housing finance system are profound. Extreme weather events such as hurricanes, wildfires, floods, and rising sea levels threaten property values and increase the likelihood of mortgage defaults, delinquencies, and foreclosures. The FHFA warns that insufficient awareness and insurance coverage among borrowers exacerbate these risks, potentially leading to economic instability in affected regions.

Transition risks associated with the shift toward a low-carbon economy further complicate the landscape. While long-term benefits include reduced energy costs and enhanced environmental sustainability, short-term disruptions may strain sectors reliant on traditional energy sources and technologies.

Climate Scenario Analysis

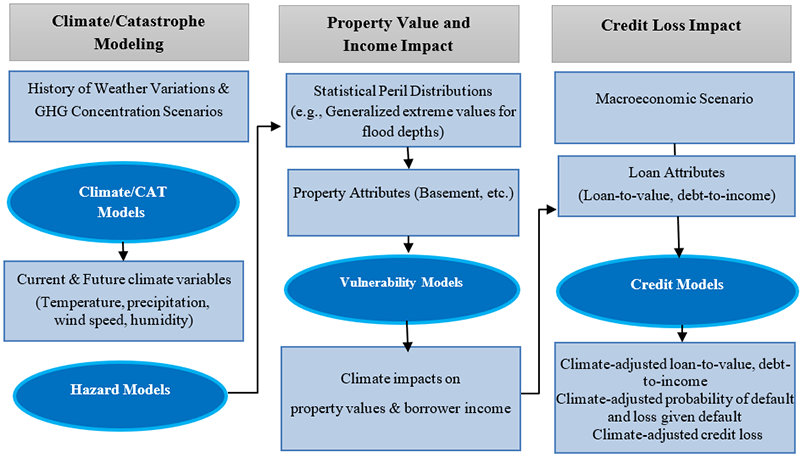

To address these challenges, FHFA is actively assessing the exposure of its regulated entities—including Fannie Mae, Freddie Mac, and all of the Federal Home Loan Banks—to climate risks through comprehensive CSA exercises. These exercises evaluate potential flood risks and other climate-related impacts using sophisticated modeling techniques that combine natural hazard catastrophe models with integrated economic assessments.

Lessons learned

Key findings from early CSA exercises highlight critical areas for improvement. Data and methodology gaps currently hinder accurate risk assessment, particularly at the local level where granularity is essential for predicting property-level losses. Moreover, existing financial models may inadequately account for the full spectrum of climate-related risks, underscoring the need for enhanced predictive capabilities.

“While progress has been made in understanding climate risks and implementing CSA frameworks,” stated a FHFA spokesperson, “ongoing efforts are crucial to fortify the housing finance system against future climate scenarios.”

Looking ahead, FHFA intends to expand its expertise in climate scenario analysis and refine its approach to assessing and mitigating climate risks. These efforts aim not only to ensure the resilience of the housing finance system but also to promote sustainable community development amidst evolving environmental challenges.

As climate change continues to reshape the global landscape, FHFA remains committed to equipping its regulated entities with the tools and insights necessary to navigate an increasingly uncertain future.