S&P Dow Jones Indices (S&P DJI) released the May 2024 results for the S&P CoreLogic Case-Shiller Indices, revealing a continued deceleration in the upward trend of U.S. home prices. The indices, a leading measure of U.S. home prices with over 27 years of historical data, show varied performance across different regions.

Annual gains decelerate

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, which covers all nine U.S. census divisions, reported a 5.9% annual gain in May, a decrease from the 6.4% gain in April. The 10-City Composite saw an annual increase of 7.7%, down from 8.1% the previous month. Similarly, the 20-City Composite posted a 6.8% year-over-year increase, a drop from the 7.3% increase in April.

Among the 20 cities tracked, New York led with a 9.4% annual gain, followed by San Diego at 9.1% and Las Vegas at 8.6%. Portland recorded the smallest annual growth at 1.0%.

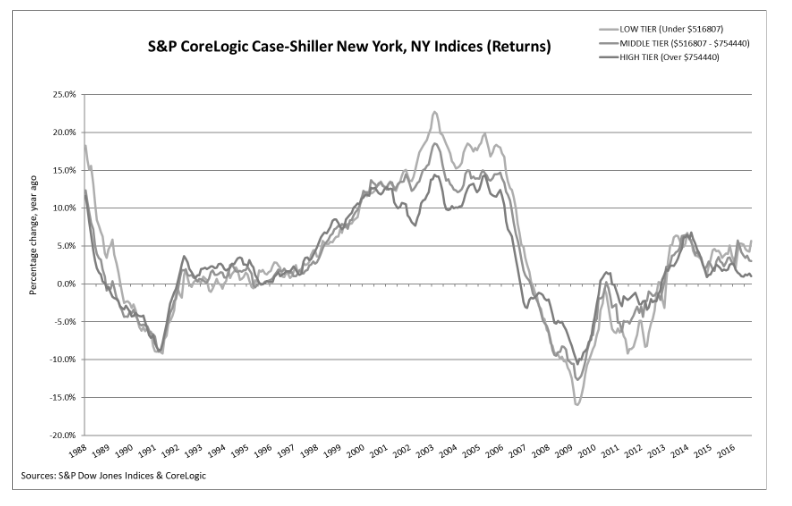

The chart below compares year-over-year returns for different housing price ranges (tiers) in New York.

Month-over-month changes

Month-over-month, the upward trend continued to decelerate. The U.S. National Index, the 20-City Composite, and the 10-City Composite each posted pre-seasonal adjustment increases of 0.9%, 1.0%, and 1.0%, respectively. After seasonal adjustment, the U.S. National Index maintained the same month-over-month change of 0.3% as April, while the 20-City and 10-City Composites reported monthly changes of 0.3% and 0.4%, respectively.

Expert analysis from S&P DJI

Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P DJI, provided insights into the recent trends. “While annual gains have decelerated recently, this may have more to do with 2023 than 2024, as recent performance remains encouraging,” Luke said. He highlighted that the home price index has appreciated 4.1% year-to-date, marking the fastest start in two years.

The national index has risen over the past four months, reversing the stall experienced late last year. All 20 markets tracked by the indices have shown annual gains for the past six months, a streak not seen since the COVID housing boom. However, this rally is shorter and less intense, with above-trend growth averaging 6.2%.

Market Dynamics and Regional Comparisons

New York reclaimed the top position with a 9.4% annual return, surpassing San Diego and Las Vegas. Luke noted that both red and blue states are experiencing similar annual gains, averaging 5.9% as the 2024 presidential election approaches.

“The waiting game for the possibility of favorable changes in lending rates continues to be costly for potential buyers as home prices march forward,” Luke added, emphasizing the ongoing challenge for potential homebuyers in the current market.

Additional insights from Realtor.com Senior Economist Ralph McLaughlin

“The latest S&P CoreLogic Case-Shiller Index showed home sales prices continued to climb higher through May, but the pace of growth slowed,” McLaughlin said. “The national composite rose 5.9% from a year ago in May after rising 6.4% in April, while the 10- and 20-city indexes rose by 7.7% and 6.8%, respectively, with the former down 0.4 percentage points from than the prior month’s annual pace and the latter down 0.5 percentage points.”

“This month’s index covers home sales in March, April, and May, so the deceleration is occurring in what typically is a seasonal ramp-up period for the housing market. During this time period, an inflation-driven surge in mortgage rates from 6.6% to 7.2% occurred, which zapped the borrowing power of homebuyers and helped dampen the rate of price growth.”

“Regionally, home prices are showing more differentiated performance, New York takes the top spot of the fastest growth market, where prices were up 9.4% from a year ago. San Diego (+9.1%) and Las Vegas (+8.6%) were close behind, with high single-digit price growth,” McLaughlin continued. “Markets seeing slower home price growth were in the West, with Portland (+1.0%), Denver (+2.1%), and Minneapolis (+2.4%) seeing the most moderate gains among the 20 markets reviewed. This mirrors recent trends in Realtor.com data, where markets in the Northeast and Midwest are seeing bigger upticks, reflecting local economics and broader supply and demand dynamics.”

“We should expect the rate of home price growth to continue to slow over the next several months as the effects of high spring mortgage rates manifest themselves into prices. After that, the trajectory of price growth is going to largely be determined by how deep and frequent the Fed cuts rates as well as how desperate sellers will become.”

“Current expectations are that there will be a quarter point cut in September and December, and then once a quarter after that until the long-term equilibrium rate of 4% is reached, suggesting that capitalization of these cuts into prices will be slow and steady, McLaughlin concluded. “What’s more, the Fed appears to be flying the economy to a soft landing, which would mean sellers may not become desperate and will thus be ill-inclined to cut prices to the extent that it would lower aggregate price growth. The result of this scenario would be an extended period of stable price growth throughout most of next year.”

For full access to the data series and more detailed information, visit the S&P Dow Jones Indices website.