According to Zillow’s most recent market report, reduced mortgage rates and more inventory are providing house buyers with a window of opportunity at an uncommon time of year. For those looking to purchase a home, affordability has significantly increased, and rather than decreasing as is usually the case at this time of year, competition among them may continue into the fall.

“Late summer may be an opportunity for buyers who have been waiting in the wings for a monthly mortgage payment they can qualify for,” said Skylar Olsen, Zillow Chief Economist. “Buyers have more options to choose from for two reasons. For one, it’s easier to qualify for more of the homes on the market now that mortgage rates are a bit lower. Beyond that, more inventory is becoming available enough to improve buyer negotiating power. Attractive properties in hot markets are still selling quickly, but some metros—or neighborhoods within them—have flipped further in favor of buyers.”

Assuming a buyer puts 20% down payment and before taxes and insurance are taken into consideration, declining mortgage rates have made purchasing a home again roughly reasonable at the national level (meaning monthly payments typically require less than one-third of median family income). From a peak in May, the average monthly payment on a house purchase has decreased by more than $100 throughout the country. That decrease in the exorbitant San Francisco metro area is more than $300 each month.

Measuring Inventory & New Listings MoM

- New listings decreased by 1.1% month-over-month in August.

- New listings increased by 0.8% this month compared to last year.

- New listings are 21.3% lower than pre-pandemic levels.

- For-sale inventory (the number of listings active at any time during the month) in August increased by 0.2% from last month.

- There were 22.1% more for-sale listings active in August compared to last year.

- Inventory levels are -30.8% lower than pre-pandemic levels for the month.

In addition to decreased prices, some criteria are shifting in the buyers’ advantage. In July, the Zillow market heat index moved from favoring sellers to being in neutral zone. Up until October, sellers had the advantage across the country for the previous two years.

Although it is taking longer than it has in the past, homes are selling faster than it did before the pandemic. August sales took 20 days to go pending, which is two longer than July sales but roughly six days quicker than sales at same time of year prior to the epidemic. Even though the expansion of inventory has halted, there are currently more homes for sale than in any other month since September 2020—nearly 1.18 million.

Because buyers are now more likely than sellers to be enticed by lower rates, lower rates could delay or slow a typical autumn cooling. There are already indications that the housing market’s trajectory may be changing. The percentage of Zillow listings that had a price reduction decreased somewhat between July and August, bucking a trend that had seen increases each month since March. In August, price reductions were made to little under 26% of the houses listed for sale. As we’ve seen in recent months, that’s not a record, but it’s fairly high for this time of year.

More Opportunities for Homebuyers

- Lower rates mean improved affordability: Purchasing power is greater, and buying a house may now fit into buyers’ monthly budgets.

- Homes are taking longer to sell, giving buyers more time to decide and more leverage in negotiations.

- Inventory continues to slowly recover from a years-long shortfall, giving buyers more options.

New Opportunities for Home Sellers

- Well-priced and -marketed homes are still selling relatively quickly, in 20 days, almost a week faster than at this time of year before the pandemic.

- Lower mortgage rates could raise buyer competition in the fall. The share of homes with a price cut dropped in August.

- One-third of homes that sold in July—the most recent data available—went for more than asking price.

- Some 70% of sellers turn around and buy—the benefits to buyers given above apply to their next home.

U.S. Home Values Climb MoM in 9 of the 50 Largest Metros

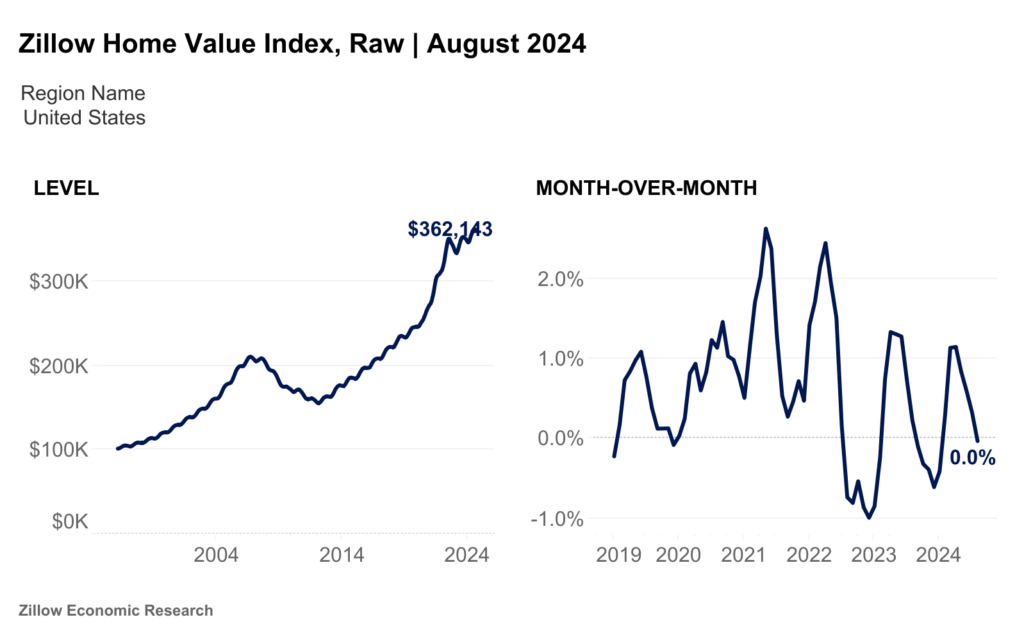

The average U.S. home this month was listed at $362,143. Assuming a 20% down payment, the average monthly mortgage payment was $1,827. From July to August, monthly mortgage expenditures decreased by 3.4% due to lower mortgage rates.

August saw increases in home values month over month in nine of the fifty largest metro areas. Buffalo (0.7%), New York (0.6%), Providence (0.4%), Hartford, CT (0.3%), and Philadelphia (0.3%) saw the largest gains. In 37 significant metro regions, the monthly value of homes decreased. San Francisco (-1.3%), San Jose, CA (-1.1%), Austin, Texas (-1%), Denver (-0.7%), and New Orleans (-0.6%) had the biggest monthly declines.

In five significant metro regions, home values are lower than they were a year ago. New Orleans (-4.6%), Austin, Texas (-4.6%), San Antonio (-2.9%), Birmingham, AL (-0.9%), and Dallas (-0.4%) saw the biggest declines. The average mortgage payment has climbed by 103.8% since before the epidemic and is 2.9% less than it was a year ago.

Conversely, U.S. asking rents increased by 0.2% month-over-month in August. The pre-pandemic average for this time of year is 0.4%. Rents are now up 3.4% from last year. Rents fell on a monthly basis in 2 major metro areas: Austin, Texas (-0.4%) and Boston (-0.1%). Overall, rents are up from year-ago levels in 49 of the 50 largest metro areas. Annual rent increases are highest in Hartford, CT (7.7%), Cleveland (7.2%), Louisville, KY (7.1%), Richmond, VA (6.8%), and Virginia Beach, VA (6.6%).

To read the full report, including more data, charts, and methodology, click here.