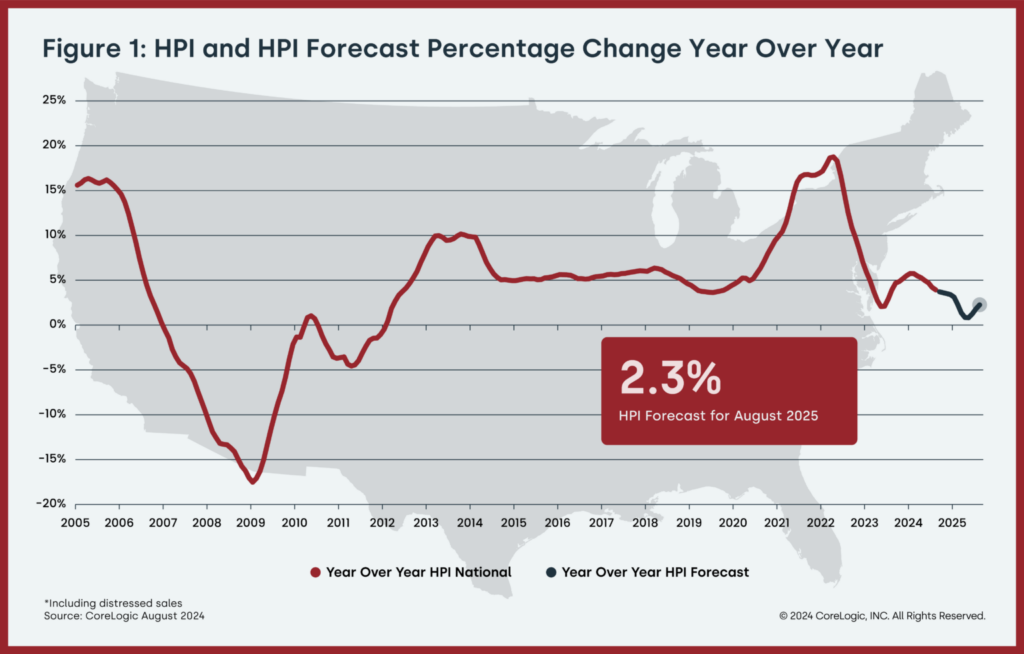

The CoreLogic Home Price Index (HPI) and HPI Forecast for August 2024 have been released by CoreLogic, revealing that although gains are expected to drop to less than 1% by next spring, home price growth picked up to about 4% year-over-year in August.

Mortgage rates fell to their lowest point in over two years during the final week of September, as reported by Freddie Mac. However, consumer expectations for price increases may be restrained due to waning confidence in the job market and uncertainties around the November election.

“Consumer confidence dropped in September to near the bottom of the narrow range that has prevailed over the past two years,” said Dana M. Peterson, Chief Economist at The Conference Board. “September’s decline was the largest since August 2021 and all five components of the Index deteriorated. Consumers’ assessments of current business conditions turned negative while views of the current labor market situation softened further. Consumers were also more pessimistic about future labor market conditions and less positive about future business conditions and future income.”

Key Findings:

- August 2024 saw a 3.9% year-over-year gain in U.S. single-family house prices (including distressed sales) over August 2023. Month-over-month, house prices fell by 1% when compared to July 2024.

- Detached properties saw an annual appreciation rate of 4.2% in August, which was 4 percentage points greater than attached houses’ (-0.2%).

- According to CoreLogic’s prediction, annual advances in U.S. home prices will slow down to 2.3% in August 2025.

- Miami experienced the largest year-over-year home price increase of the country’s 10 featured metro areas in August, at 8.9%. With a 6.8% growth, Chicago had the next-highest gain.

- In August, South Dakota had the highest annual appreciation rate (+10%) among the states, followed by New Jersey (+9.5%). The only state to have a decrease in housing prices year-over-year was Hawaii (-0.1).

Affordability Wanes in August as Rates Remain High

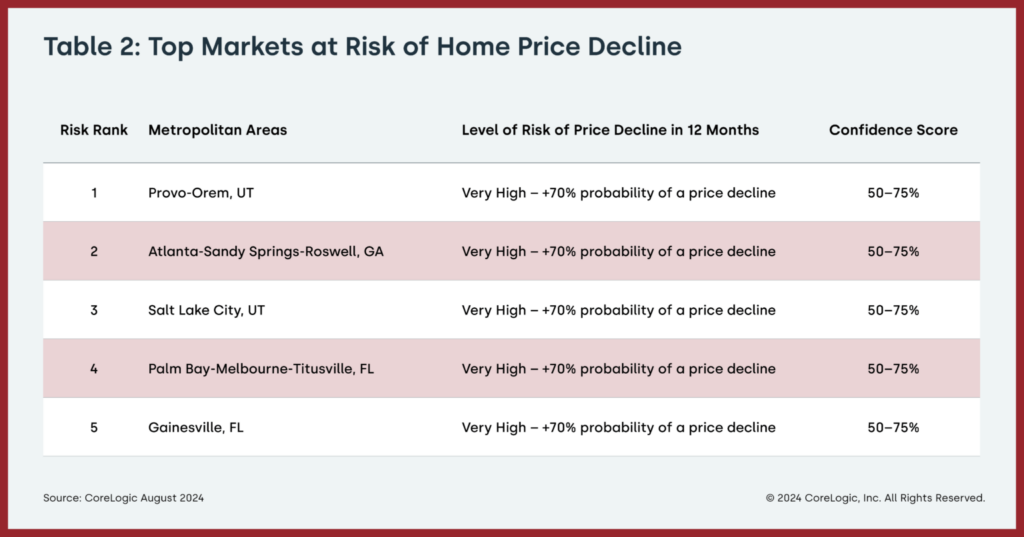

“While mortgage rates have dropped in recent weeks, August home sales were by still-high rates in July and August, which lowered affordability,” said Dr. Selma Hepp, Chief Economist for CoreLogic. “The combined impact of high prices and high mortgage rates kept a lid on price growth, with annual gains falling to the lowest level in a year and the monthly gain falling well below what is typically observed in August. Price gains in August were driven by areas in the Northeast but brought down by softening markets in Texas and Florida.“

Weekly pending home sales throughout August showed a continuous annual growth, which may carry over into the rest of the year, according to CoreLogic pending home sales data. Home price hikes may also resume their seasonal trend in the upcoming months, given that rates have dropped to their lowest points since February 2023 and demand has resumed.

Thirteen months in a row of annual appreciation began in July 2024. The CoreLogic S&P Case-Shiller Index increased by 5% year-over-year in July, down from a 6.5% gain in both February and March of this year, even as home values continued to reach new highs.

The next CoreLogic HPI press release, featuring September 2024 data, is scheduled to be issued on November 5.

To read the full report, including more data, charts, and methodology, click here.