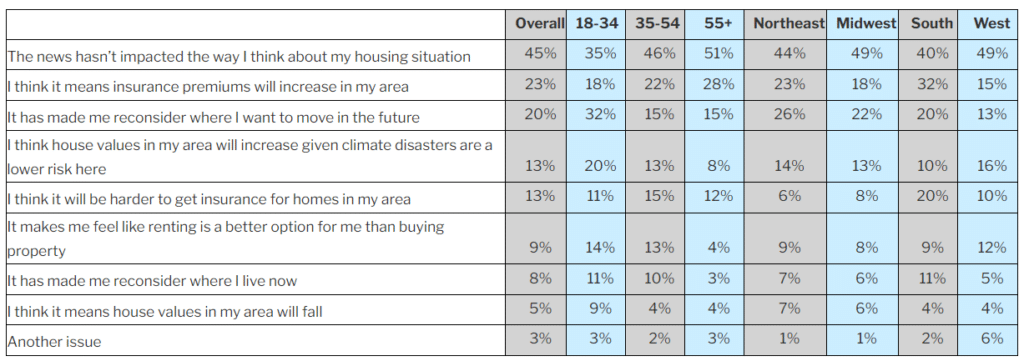

As news continues to break in the aftermath of Hurricane Helene, Redfin polled U.S. residents aged 18-34 to gauge migration patterns in the wake of the storm. The poll found that 32% of U.S. residents aged 18-34 said they would reconsider where they want to move in the future after seeing or hearing about the damage caused by Hurricane Helene. That compares to 15% of respondents aged 35 and older.

Redfin’s report is based on a commissioned survey conducted by Ipsos on Oct. 2-3, 2024. The nationally representative survey was sent to 1,005 U.S. adults. Redfin’s report focuses on responses to the following question: “Which of the following apply to you after seeing/hearing about the damage caused by Hurricane Helene?” Respondents were asked to consider nine situations.

After making landfall in Florida in late September, Hurricane Helene wreaked havoc across the Appalachia region, becoming the deadliest storm to hit mainland America in almost two decades. AP reports the death toll currently over 225 from Helene.

“Scores of Americans flocked to the Sun Belt during the pandemic because remote work allowed them to take advantage of the region’s relatively low cost of living. Some thought Appalachia was insulated from hurricane risk, not realizing that the area is prone to flooding and that hurricanes can sometimes cause flash flooding far away from the ocean,” said Redfin Chief Economist Daryl Fairweather. “Americans are beginning to realize that nowhere is truly immune to the impacts of climate change, and we’re starting to see that impact where people want to live—even people who haven’t experienced a catastrophic weather event firsthand.”

CoreLogic Hazard HQ Command Central has updated industry insured and uninsured loss estimates using newly available observed wind speed, storm surge depth, and precipitation data. The CoreLogic team estimates that Hurricane Helene caused $30.5–$47.5 billion in total wind and flood damage (including both insured and uninsured losses) across 16 states. The insurance industry, including both private companies and the National Flood Insurance Program (NFIP) will provide funds for recovery to home and business owners across the impacted states. Total insured wind and flood losses are expected to be between $10.5–$17.5 billion.

Redfin states that it’s worth noting that many people say the storm hasn’t changed their perspective on where to live, as 45% of overall respondents (and 40% of respondents in the South) said the news of Hurricane Helene hasn’t impacted how they think about their housing situation.

Of those polled, 23% of respondents expect insurance premiums in their area to increase after Hurricane Helene. The share was highest among respondents in the South (32%). Nearly one in seven (13%) respondents overall said they think it will be harder to get insurance for homes in their area after the storm. That share was also highest among respondents in the South (20%).

Many U.S. homeowners have already seen their premiums skyrocket or lost coverage as insurers grapple with skyrocketing claims due to intensifying natural disasters.

In a recent study, researchers at the Congressional Budget Office (CBO) reported that the higher a community’s median household income, the smaller the share of properties at risk of flooding, the larger the share of at-risk properties covered by an NFIP policy. Those higher-income households also received more premium discounts among properties with coverage compared to properties at risk in communities where median household income was lower, the report revealed.

As per CoreLogic, the NFIP is expected to provide approximately $4.5–$6.5 billion of insurance for to homeowners across Florida and the southeastern U.S. for recovery from Hurricane Helene. National Oceanic and Atmospheric Administration (NOAA) tidal gauges in the Tampa Bay and St. Petersburg area recorded historic tidal levels. Reports indicate extensive damage to property in the area. The Tampa/St. Petersburg area is home to a high concentration of coastal property especially commercial structures like hotels and condominiums.

Click here for more on Redfin’s migration and relocation study.