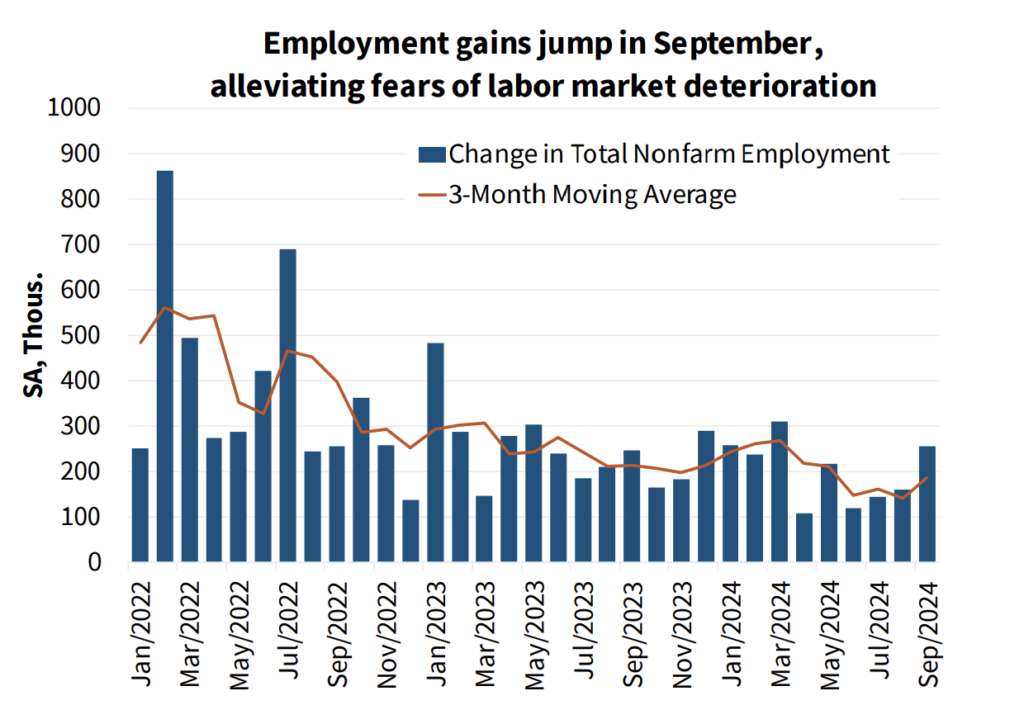

The October 2024 commentary from the Fannie Mae Economic and Strategic Research (ESR) Group revealed that the economy now looks to be on firmer footing than previously thought, following annual revisions to the national accounts and an improvement in payroll employment growth in both August and September.

The ESR Group still anticipates a slowdown in economic growth from the strong 3.2% pace seen in 2023, but it will be less severe than previously anticipated. Growth in 2024 and 2025 is now anticipated to be 2.0% and 2.3%, respectively, close to the long-run trend growth rate. The current personal income data has undergone considerable upward revisions, which is largely responsible for the improving economic outlook.

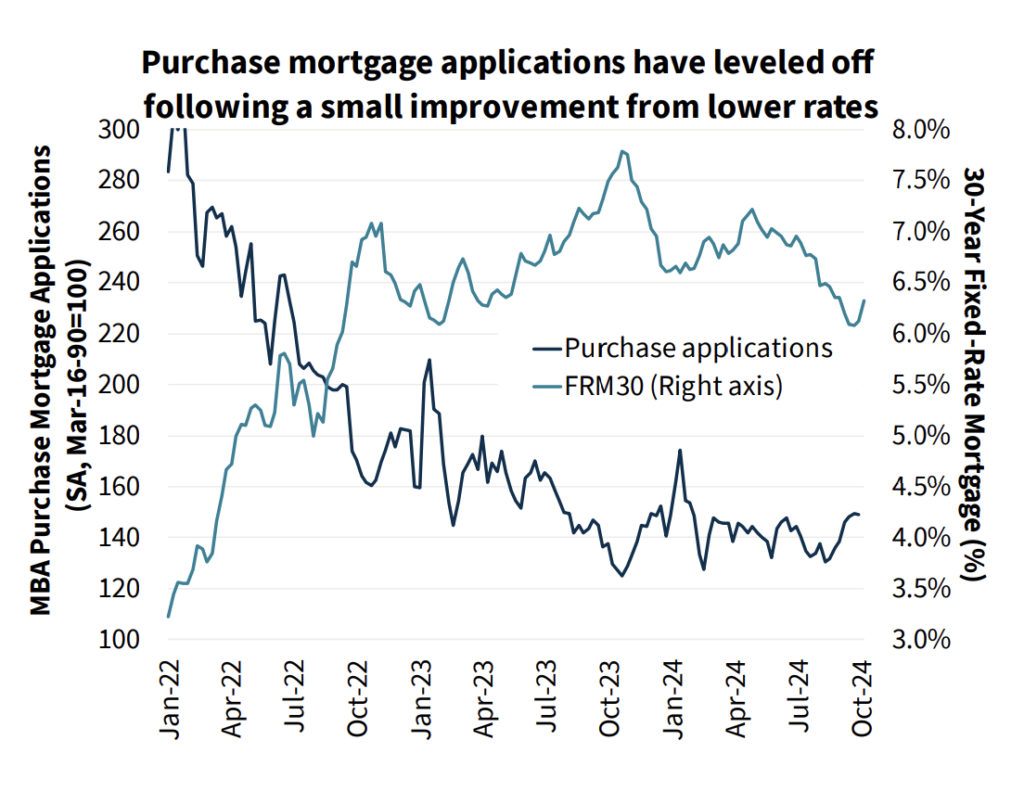

Bond market estimates for rate cuts have moved closer to the dot plot from the Federal Reserve’s most recent Summary of Economic Projections, as a result of data revisions and recent job data. The 10-year Treasury has therefore increased by more than 40 basis points since its mid-September low. This indicates an upside risk to the most recent mortgage rate forecast from the ESR Group, which currently projects that the 30-year mortgage rate will end the year at 6.0%, down from the previous month’s prediction of 6.2%, and would gradually fall to 5.7% by the end of 2025.

“While potential homebuyers have noticed the decline in mortgage rates over the last few months, they are equally aware that there has been little relief on the home price side, the other primary driver of unaffordability, particularly for first-time buyers,” said Mark Palim, Fannie Mae Senior VP and Chief Economist. “The timing of the long-expected pick-up in home sales activity, as well as a further moderation in home price appreciation, will depend in part on the willingness of current homeowners to relinquish their low mortgage rates by offering their homes for sale. Of course, continued strong homebuilding activity will also play a significant role as the shortage of national housing stock remains the primary impediment to affordability.”

The August employment report showed stronger-than-expected job increases, and significant upward revisions to personal income data suggest that the current consumer spending trend is more sustainable than it was a month ago. Fannie Mae has significantly raised its real Gross Domestic Product (GDP) forecast even though it’s still expected for economic growth to decelerate. We have revised our Q4/Q4 economic growth forecasts for 2024 and 2025. Previously, Fannie Mae had predicted 2% growth in 2024 and 2.3% growth in 2025.

Fannie Mae Economic Forecast

The Fannie Mae Home Price Index (FNM-HPI) historical adjustments indicate a little slower rate of price rise over the last year; still, their projection for the future has been revised upward. When combined and based on the FNM-HPI, Fannie Mae predicts that home prices will increase by 5.8% in 2024 (up from 6.1% in Q4/Q4) and 3.6% in 2025 (up from 3.0%).

Further, Fannie Mae upgraded predictions for overall home sales, although there is some downside risk to the estimate given the recent spike in mortgage rates. The GSE anticipates an estimated 5.24 million homes sold in 2025, up from 4.77 million in 2024.

“Despite decelerating slightly, home price growth remained robust in the third quarter, as the supply of homes for sale, particularly on the existing side, remained weak relative to historical levels,” said Mark Palim, Fannie Mae Senior VP and Chief Economist. “Even though mortgage rates fell precipitously in the third quarter, and we saw some improvements to the months’ supply of homes for sale, home purchase activity barely budged—at least on a national basis—which we view as evidence that the market remains significantly constrained by both the ‘lock-in effect’ and affordability generally, but especially elevated home prices. In fact, consumers have told us as much: In September, high home prices supplanted high mortgage rates as the top reason for our survey respondents’ overwhelming pessimism toward homebuying conditions. Overall, the strength of this latest home price reading confirms the ongoing challenges with tight supply; however, the index’s continued deceleration shows that we’re slowly moving toward a better balance between supply and demand.”

Finally, Fannie Mae completed its yearly benchmarking exercise for mortgage originations to include the most recent data from the Home Mortgage Disclosure Act (HMDA). This has resulted in a slight increase of $33 billion in the historical estimate for mortgage originations in 2023. While they predict that mortgage originations in 2025 will be $2.14 trillion, a little decrease from $2.16 trillion, the outlook for total mortgage originations in 2024 is now $1.67 trillion, basically unchanged from last month.

To read the full release, including more historical data for the economy, housing and mortgage markets, and forecasts, click here.