According to a new report, during Q3 of 2024, there was a small increase in the delinquency rates for mortgages secured by commercial buildings. This is in line with the most recent Commercial Real Estate Finance (CREF) Loan Performance Survey from the Mortgage Bankers Association (MBA).

“Delinquency rates for commercial mortgages backed by office properties continued to increase during the third quarter but declined for loans backed by lodging, retail and industrial properties,” said Jamie Woodwell, MBA’s Head of Commercial Real Estate Research. “The commercial mortgage market is large and diverse, covering a range of property types, sizes and ages, geographic markets and submarkets, borrower types, vintages and more. Each of those differences is affecting loan performance, some to the good and some to the bad.”

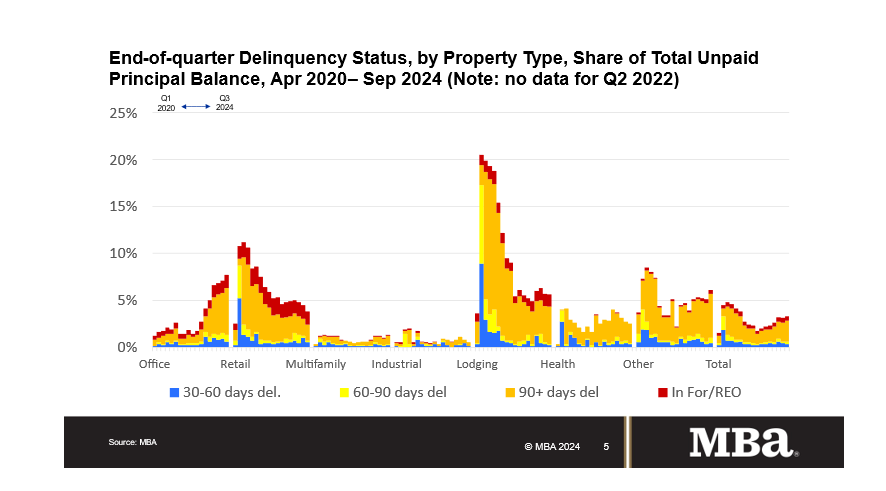

The balance of commercial mortgages that are not current increased slightly in Q3 of 2024.

Key Findings of the MBA Loan Performance Survey:

An estimated 96.8% of outstanding loan balances were current or less than 30 days late at the end of the quarter, down from 97.0% the previous quarter.

- 2.7% were 90+ days delinquent or in REO, up from 2.5% the previous quarter.

- 0.3% were 60-90 days delinquent, up from 0.2% the previous quarter.

- 0.3% were 30-60 days delinquent, down from 0.4% the previous quarter.

The share of loans that were delinquent increased for some property types, particularly office, and decreased for industrial, lodging and retail properties.

- 7.8% of the balance of office property loan balances were 30 days or more days delinquent, up from 7.1% at the end of last quarter.

- 5.6% of the balance of lodging loans were delinquent, down from 5.8% the previous quarter.

- 3.8% of retail balances were delinquent, down from 4.5%.

- 1.2% of multifamily balances were delinquent, up from 1.1%.

- 0.6% of the balance of industrial property loans were delinquent, down from 0.8%.

Among capital sources, CMBS loan delinquency rates saw the highest levels but remained flat during the quarter.

- 4.8% of CMBS loan balances were 30 days or more delinquent, unchanged from the last quarter.

- Non-current rates for other capital sources remained more moderate.

- 0.9% of FHA multifamily and health care loan balances were 30 days or more delinquent, unchanged during the quarter.

- 0.9% of life company loan balances were delinquent, down from 1.0%.

- 0.5% of GSE loan balances were delinquent, up from 0.4% the previous quarter.

Data on commercial and multifamily mortgage portfolios as of September 30, 2024, was gathered by MBA’s CREF Loan Performance survey. Since April 2020, comparable polls have been undertaken, and this quarter’s results build on those findings. In September 2024, participants reported $2.6 trillion in loans, or 56% of the $4.7 trillion in outstanding commercial and multifamily mortgage debt (MDO).

To read the full report, including more data, charts, and methodology, click here.