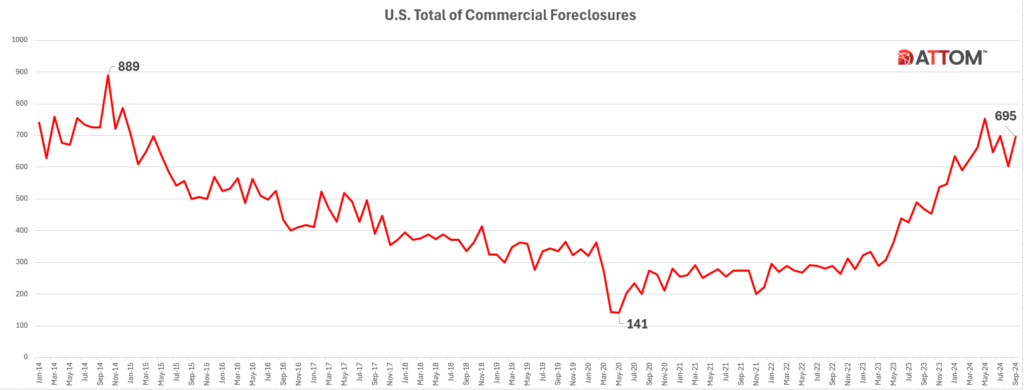

A monthly report on commercial foreclosures in the U.S. has been provided by ATTOM. According to the research, commercial foreclosure rates are still high and far higher than they were before to the epidemic. The number of foreclosures increased dramatically beginning in June 2023, reaching a peak of 752 in May 2024 before leveling off at 695 in the most current data released by ATTOM in September 2024. This current spike points to either a resurgence of financial strain or a shift in the fundamentals of commercial real estate.

The historical data on commercial foreclosure activity from January 2014 to September 2024 shows notable oscillations that were mostly influenced by the state of the economy and noteworthy occurrences such as the COVID-19 epidemic. Between 2014 and 2015, the number of business foreclosures increased steadily, reaching a high of 889 in October 2014. This early spike indicates that there was more financial turmoil in the commercial real estate market at the time.

Nonetheless, a slowdown started in 2016, and by the end of the year, monthly totals for commercial foreclosures had dropped below 500. This pattern persisted throughout the years before to the pandemic.

U.S. Historical Commercial Foreclosure Overview

The statistics for 2020 clearly shows the influence of COVID-19. Following the implementation of government interventions, moratoriums, and economic assistance initiatives, the number of commercial foreclosures fell to just 144 by April 2020. The number of business foreclosures stayed at historically low levels throughout 2020 and the first part of 2021. However, by the middle of 2021, business foreclosures had started to increase once more as economic pressures returned and pandemic-related measures were relaxed.

The number of commercial foreclosures increased continuously until reaching a peak of 752 in May 2024, following a dramatic rebound in activity by June 2023. Rising interest rates, inflation, and changes in the demand for commercial space are some of the variables that have contributed to this current spike, which most likely reflects persistent financial difficulties in the commercial real estate sector. With a total of 695 as of September 2024, there is still a significant amount of commercial foreclosure activity, but somewhat less than there was at the beginning of the year.

Measuring Commercial Foreclosure State-by-State

California led the country in September 2024 with 264 commercial foreclosures, up 12% from the month before and a startling 238% over the same period the previous year. New York came in second with 92 foreclosures, up 48% year over year and 59% month over month. There were 70 business foreclosures in Florida, which is 21% more than the previous month and 49% more than a year earlier.

Forty-five foreclosures occurred in Texas, up 15% from the previous month but down 13% from the previous year. 32 foreclosures occurred in Pennsylvania, representing a notable 129% increase month over month and a 33% increase year over year.

To read the full report, including more data, charts, and methodology, click here.