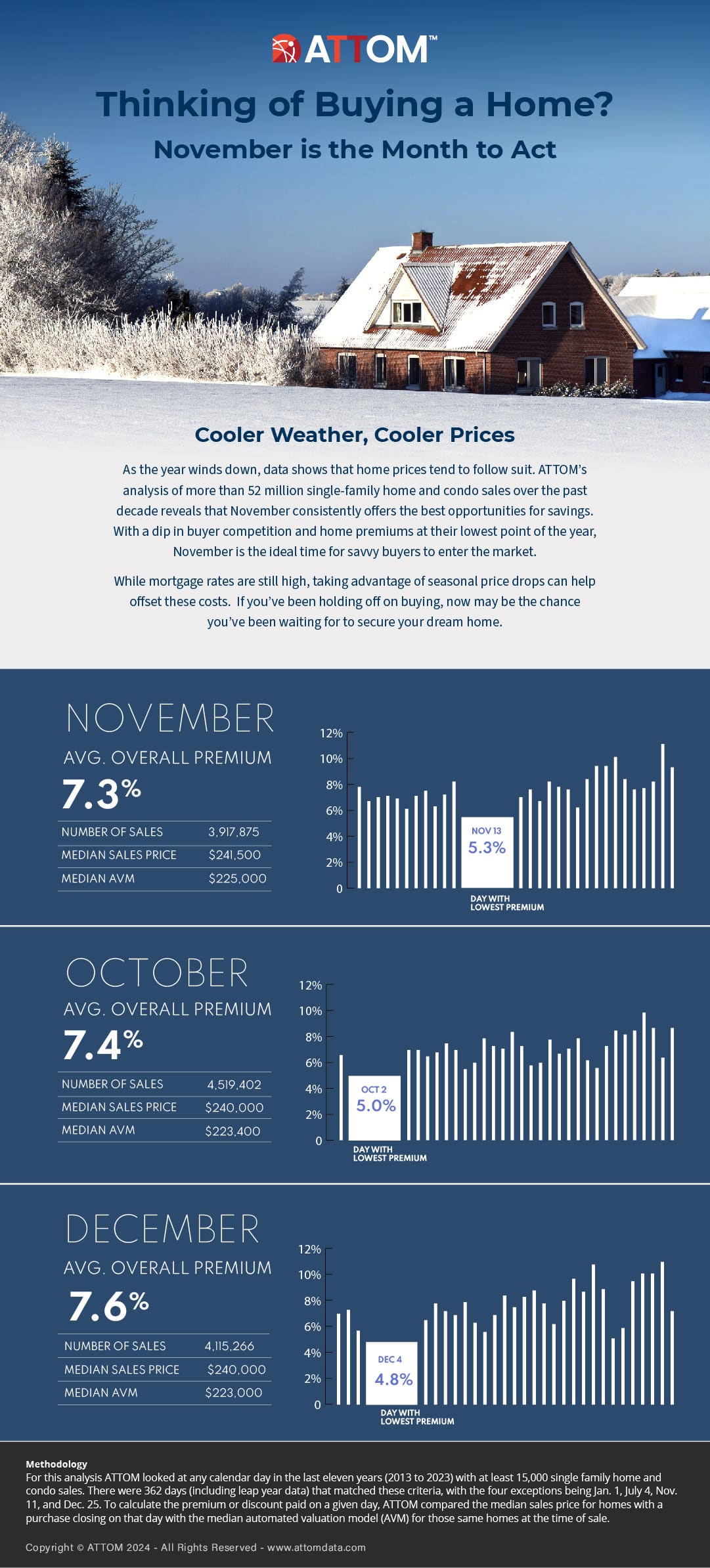

ATTOM has released its annual analysis highlighting the best days of the year to purchase a home, revealing that while November offers a 7.3% premium, it remains the lowest premium for buyers. Additionally, December 4 stands out as the single best day to buy a home.

According to ATTOM’s latest analysis of more than 52 million single-family home and condo sales over the past 11 years, buyers who close on December 4 are seeing the lowest premium above the automated valuation model (AVM). While still above market value, homebuyers are only paying a 4.8% premium, compared to the 14.6% premium buyers are seeing on May 27.

In determining the best day of the year to purchase a home, ATTOM analyzed calendar days in the last 11 years (2013-2023) with at least 15,000 single-family home and condo sales. From that determination, there were 362 days (including leap year data) that matched these criteria, with the four exceptions being January 1, July 4, November 11, and December 25. To calculate the premium or discount paid on a given day, ATTOM compared the median sales price for homes with a purchase closing on that day with the median AVM for those same homes at the time of sale.

Sync Your Calendars

ATTOM found that other days of the year offering lower premiums for homebuyers included October 2 (5% premium above market value); December 24 (5.1% premium); January 16 (5.1% premium); November 13 (5.3% premium); and October 9 (5.5% premium). ATTOM’s new analysis also examined the best months to buy at the national level and best months to buy at the state level.

Ranking the Best Months to Buy

Nationally, ATTOM found the best months to buy were:

- November (7.3% premium above market value)

- October (7.4% premium)

- December (7.6% premium)

- August (8% premium)

- September (8% premium)

Ranking the Best Months to Buy by State

According to the study, the states realizing the biggest discounts below full market value included:

- Michigan (-3.2% in December)

- Connecticut (-1.2% in January)

- Hawaii (-1.1% in June)

- Illinois (-0.9% in December)

- Minnesota (-0.9% in December)

State of the Marketplace

According to Zillow, the average U.S. home is currently valued at $359,099, a price that is up 2.6% over the past year. Freddie Mac reports that the 30-year fixed-rate mortgage (FRM) averaged 6.78% as of November 14, 2024, down slightly from last week when the FRM averaged 6.79%. A year ago at this time, the 30-year FRM averaged 7.44%.

“After a six-week climb, rates have leveled off, but overall affordability continues to be an issue for potential homebuyers,” said Sam Khater, Freddie Mac’s Chief Economist. “Our latest research shows that mortgage payments compared to rents on the same homes are elevated relative to most of the last three decades.”