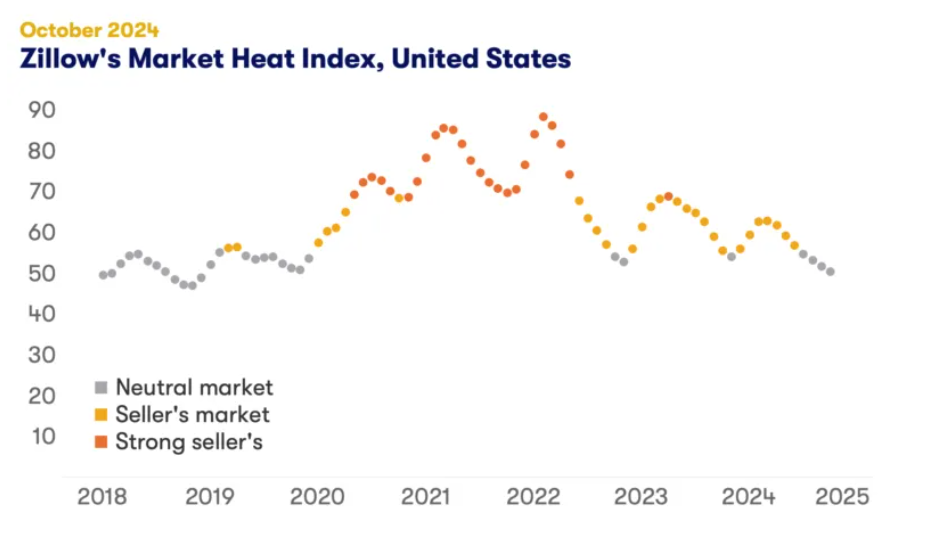

According to the latest data from Zillow, homebuyers are gaining leverage in negotiations across the nation, as competition in the housing market eased in October. Zillow’s market heat index indicates competition nationwide is creeping closer to becoming a buyers’ market, as activity begins to wind down for the winter.

“We’re seeing competition among buyers fade, with mortgage rates climbing back toward 7% as we move closer to the usual winter slowdown,” said Skylar Olsen, Zillow Chief Economist. “Inventory is still slowly building back up and price cuts are still relatively common—persistent buyers may be able to find a deal or negotiate for worthwhile concessions.”

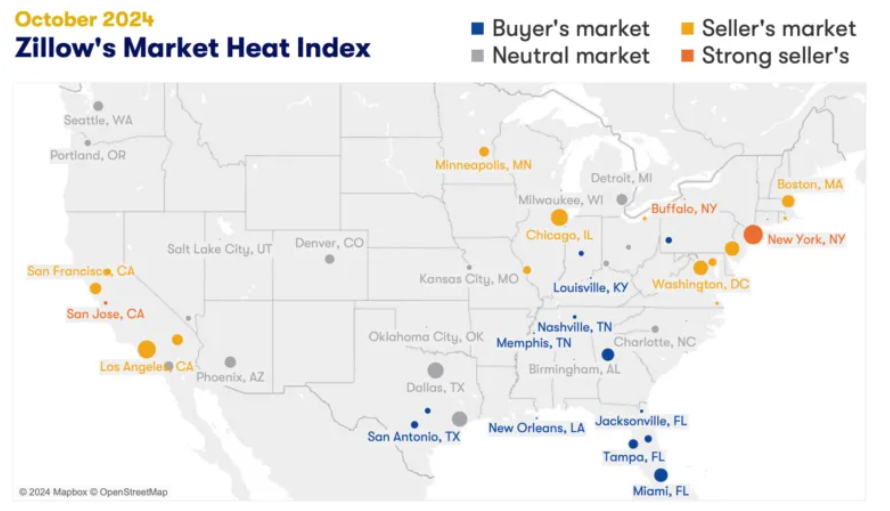

Zillow found that, unlike mortgage rates and holiday-style seasonality, two trends that have nationwide impact, seasonal inventory trends tend to be more local. The moving decisions of buyers and sellers may not be as hampered by winter weather in Southern states, for example. Even more of a differentiator is the inventory recovery from record lows during the pandemic in the South and select other areas that has helped push the scales of competition in favor of buyers—most prominently in Texas, Florida and in the New Orleans metro.

Buyers Slowly Taking the Reigns

Zillow found that buyers are slowly jumping into the driver’s seat, as metros such as Pittsburgh and Louisville joined 11 other major metros in October where buyers had an edge in negotiations. Those markets joining the fray comes on the heels of news that Indianapolis, Nashville, and Atlanta became buyers’ markets in September.

Competition among buyers is fueled by available inventory, and each of the 13 major markets where buyers currently have an edge are among the top 20 nationwide in terms of inventory recovery, compared to pre-pandemic levels. A dip in competition translates to softer home value appreciation, with monthly drops in home values reported in Austin, Dallas, Atlanta, Tampa, and San Antonio. The median number of days a listing remained on the market has risen the most in Southern markets as well, compared to pre-pandemic reports. Inventory nationwide remains on the road to recovery from a deficit that developed early on in the pandemic, currently at roughly 28% below pre-pandemic norms for this time of year. That’s the smallest shortfall since September 2020, and marks major progress over a 36% deficit in March, a 2024 low.

Market Uncertainty Clearing

Now that the polls have closed and Donald Trump is set for his second four-year term, Republicans have taken control of the White House and Congress, and builder sentiment has improved for the third straight month as builders expect that market conditions will continue to improve according to the National Association of Home Builders (NAHB). Builder confidence in the market for newly built single-family homes was 46 in November, up three points from October, according to the latest NAHB/Wells Fargo Housing Market Index (HMI).

As NAHB Chairman Carl Harris, a custom home builder from Wichita, Kansas explains, “With the elections now in the rearview mirror, builders are expressing increasing confidence that Republicans gaining all the levers of power in Washington will result in significant regulatory relief for the industry that will lead to the construction of more homes and apartments. This is reflected in a huge jump in builder sales expectations over the next six months.”

The Blip Knows as “Rate Relief”

The relief that home buyers felt in September from a dip in mortgage rates was brief. In mid-September, for the first time in four years, the Federal Reserve cut its benchmark interest rate by a full half-point to a range of 4.75% to 5.0%. The move by Powell is in response to the fight against inflation, after the Fed kept rates at an all-time 23-year high for more than a year.

And many anticipated mortgage rates to fall further as the Fed decided to lower the target range for the federal funds rate by 1/4 percentage point to 4.5% to 4.75% in early November, marking the lowest level since March 2023. But after a slight dip in mortgage rates, they began to tick back up in October, giving back some affordability gains. Mortgage payments on a typical home purchase rose 2.8% month-over-month in October, after falling for four consecutive months. Still, monthly mortgage payments (using a 20% down payment) are down more than $100 per month compared to the peak in May, and are $179 less than in October of last year.

Currently, Freddie Mac reports the 30-year fixed-rate mortgage (FRM) leveling off of late, currently standing at 6.78% as of November 14, 2024, down slightly week-over-week when the FRM averaged 6.79%. A year ago at this time, the 30-year FRM averaged 7.44%.

And as rates were expected to fall and provide relief to homebuyers nationwide, as Sam Khater, Freddie Mac’s Chief Economist, explained, “After a six-week climb, rates have leveled off, but overall affordability continues to be an issue for potential homebuyers. Our latest research shows that mortgage payments compared to rents on the same homes are elevated relative to most of the last three decades.”

Has Bargain Shopping Begun?

Zillow reports the typical U.S. home value hit $360,385 in October. Home values fell, on a monthly basis, in 47 major metro areas. The largest monthly drops were in Austin (-1%), Tampa (-0.7%), San Antonio (-0.7%), Dallas (-0.7%), and Atlanta (-0.7%).

On the other end of the spectrum, home values climbed month-over-month in just one of the 50 largest metro areas in October: the New York City metro area with a slight 0.1% rise. Home values remained the same in Salt Lake City and Washington, D.C., and declines were reported the smallest in Las Vegas (-0.1%) and Louisville (-0.1%).

Zillow found that home values are up from year-ago levels in 42 of the 50 largest metro areas. Annual price gains were reported the largest in San Jose (7.1%), the New York City metro area (7%), Hartford (7%), Providence (6.8%), and Cleveland (5.7%).

Home values are down from year-ago levels in seven major metro areas. The largest drops were in Austin (-3.5%), New Orleans (-3.2%), San Antonio (-2.5%), Tampa (-1.2%), and Jacksonville (-0.4%).

Click here for more on Zillow’s October monthly housing report.