According to the Q3 2024 Verisk Remodel Index, the cost of home repairs and remodeling in the third quarter of 2024 continued to increase, rising by 1.08% quarter-over-quarter, and just over 3.35% from the third quarter of. Costs set new highs for the past decade, rising over 69.5% from Q1 of 2013.

“Repair and remodeling costs continue to increase across the country, but the rate of increase is returning to pre-pandemic levels,” said Greg Pyne, VP, Pricing for Verisk Property Estimating Solutions for Verisk. “In the most recent quarter, those increases appear to have been driven largely by increased labor costs rather than rising material prices.”

The two categories reporting the highest quarterly increases—painting the exterior of a home, which rose 3.36%, and replacing tile flooring, which rose 2.18%—are two jobs where labor costs comprise a very high percentage of the cost of the job. Almost 55% of exterior painting costs are from labor, while almost 64% of the cost of replacing tile flooring is from labor.

Quarterly cost trends varied across the 31 categories included in the report, as prices increased in nine categories, remained the same in eight categories, and decreased in 14 categories. Some notable changes in costs included:

- Concrete and Asphalt, which accounts for about 3% of repair costs nationally, saw costs rise by 0.12%, the highest increase among all the categories

- Siding, which makes up the largest percentage of costs, rose 0.7%

- Cabinetry had the largest quarterly decrease in costs, falling by 0.11%.

Quarter-over-quarter repair and remodeling costs rose more quickly than home prices during the same period, up 1.08% compared to a 0.2% quarterly increase according to price information reported by ATTOM in its Q3 2024 Home Sales Report. Conversely, home prices rose at a brisker pace than repair and replacement costs over the past year–5.3% to 3.35%. Both home prices and repair costs outpaced the rate of inflation in Q3, when the government’s Consumer Price Index (CPI) sat at 2.1% and the Personal Consumption Expenditure Index was 2.2%.

What Regions Are Prioritizing Remodeling?

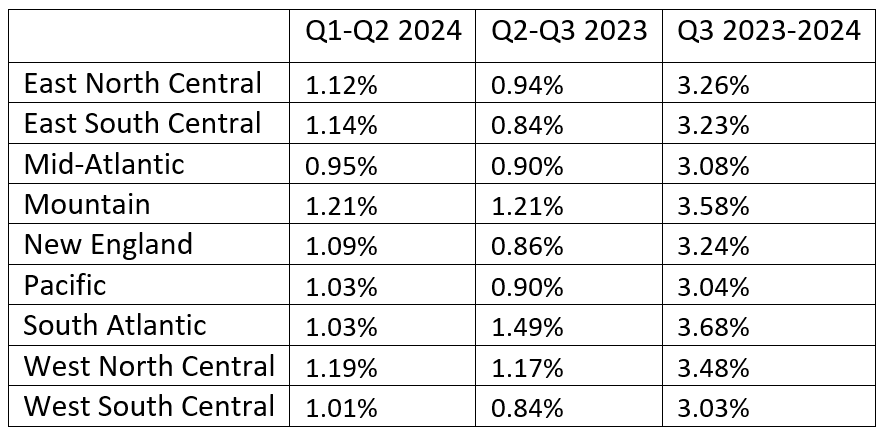

All regions again experienced cost increases both quarterly and annually. Quarterly increases ranged from a low of 0.84% in the East South Central and West South Central Regions to 1.21% in the Mountain Region. All regions experienced annual increases of over 3%, ranging from a low of 3.03% in the West South Central Region to 3.68% in the South Atlantic Region.

These numbers confirm that repair and remodel costs may be moderating, according to Pyne. “A year ago, annual increases were over five percent in every region, and over six percent in the East North Central, Mountain, and New England Regions. So it does appear that while prices continue to rise, they’re doing so at a slower pace.”

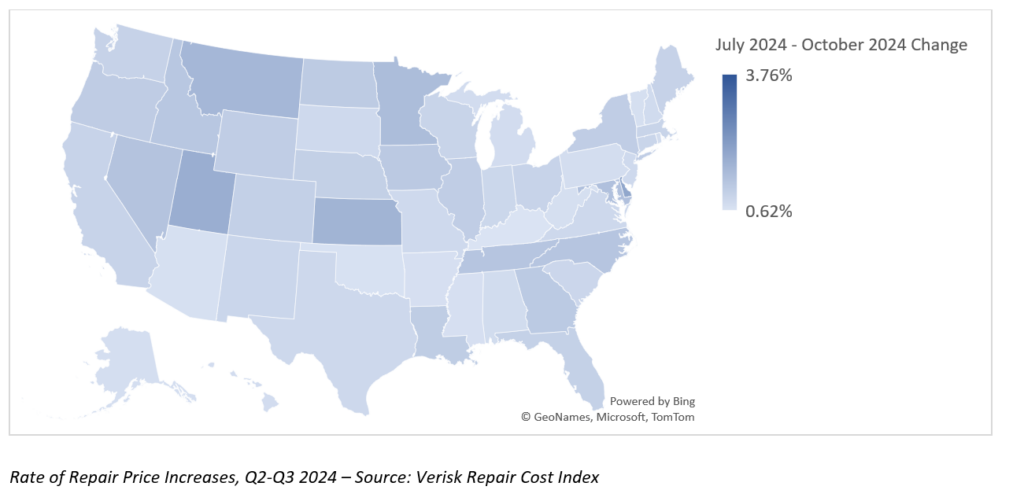

Washington, D.C. reported the highest quarterly rate of increase in the country at 3.76%, the only area to surpass a 2% increase for the reporting period. Delaware (1.95%), Utah (1.79%) and Kansas (1.66%) and Montana (1.59%) all reported increases over 1.5%.

Kentucky had the lowest rate of cost increases at 0.62%, followed by Oklahoma (0.66%), Arizona (0.68%), Arkansas (0.70%), and Mississippi (0.70%).

The Verisk Remodel Index tracks costs on 31 different categories of home repair, comprising over 10,000-line items including appliances, doors, framing, plumbing, and windows among others. Prices are compiled and updated monthly in over 430 local market areas across the country. The Index cost basis is January 2013, and the report is updated quarterly.