The CoreLogic Home Price Index (HPI) and HPI Forecast for November 2024 have been made public by CoreLogic.

Gains in home prices in the U.S. have not increased since November of 2022, but 17 states have set new records, and the country as a whole is predicted to achieve a new high this April when the usually hectic homebuying season gets underway. The increase coincided with Freddie Mac’s announcement that 30-year fixed-rate mortgages increased to about 7% at the start of 2025—the highest level since July 2024. Despite the fact that mortgage rates are predicted to be high for the remainder of the year, buyer demand in more budget-friendly markets is healthy.

“Heading into the end of the year, home prices remained relatively flat though showing some marginal improvement from the weakness seen heading into the fall and following reduced homebuyer demand amid the summer mortgage rate surge,” said Selma Hepp, Chief Economist at CoreLogic.

Key Highlights:

- U.S. single-family home prices (including distressed sales) increased by 3.4% year over year in November 2024 compared with November 2023. On a month-over-month basis, home prices rose by 0.06% compared with October 2024.

- In November, the annual appreciation of detached properties (3.7%) was 2 percentage points higher than that of attached properties (1.7%).

- CoreLogic’s forecast shows annual U.S. home price gains increasing to 3.8% in November 2025.

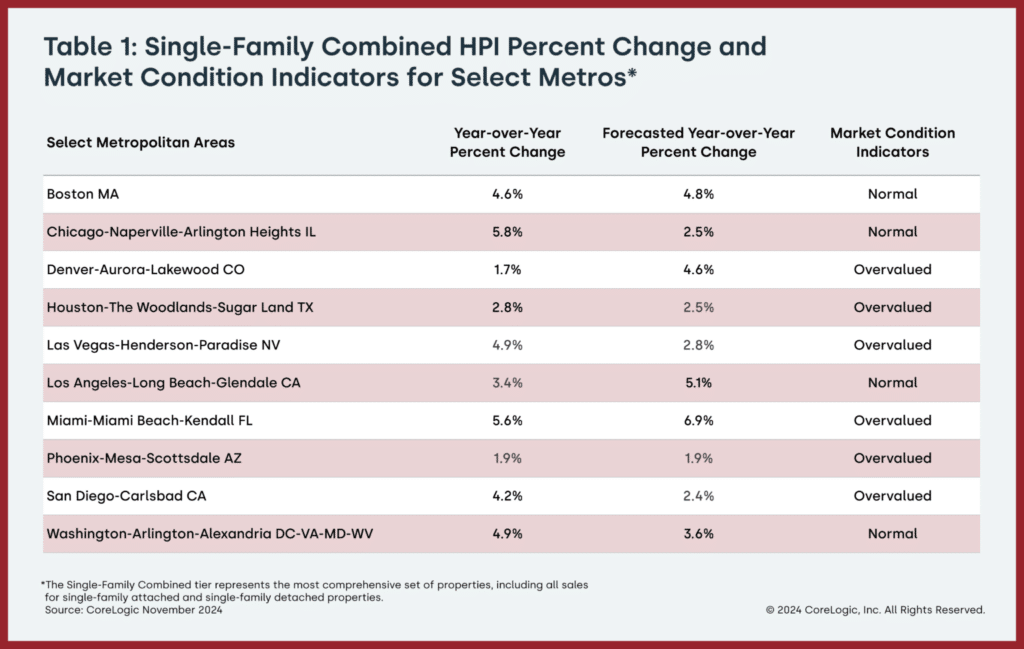

- Chicago posted the highest year-over-year home price increase of the country’s 10 tracked metro areas in November, at 5.8%. Miami saw the next-highest gain at 5.6%.

- Among states, New Jersey ranked first for annual appreciation in November (up by 7.8%), followed by Rhode Island (up by 7.3%) and New Hampshire (up by 6.9%). No state recorded a year-over-year home price loss.

“Nevertheless, the cooling home price growth trend is expected to continue well into 2025 partly due to the base effect and comparison with strong early 2023 appreciation and partly because of the expectations of higher mortgage rates over the course of 2025,” Hepp continued. “Regionally, variations persist, as some more affordable areas – including smaller metros in the Midwest – remain in high demand and continue to see upward home price pressures.”

The next CoreLogic HPI press release, featuring December 2024 data, is scheduled to be issued on February 4, 2025.

To read the full report, including more data, charts, and methodology, click here.