The S&P CoreLogic Case-Shiller Indices results for November 2024 have been published by S&P Dow Jones Indices (S&P DJI) in a new report. In November 2024, the leading indicator of U.S. home prices had an annual gain of 3.8%, which was marginally higher than the increases in 2024.

“With the exception of pockets of above-trend performance, national home prices are trending below historical averages,” said Brian D. Luke, CFA, Head of Commodities, Real & Digital Assets at S&P Global. “Markets in New York, Washington, D.C., and Chicago are well above norms, with New York leading the way. Unsurprisingly, the Northeast was the fastest-growing region, averaging a 6.1% annual gain. However, markets out west and in once red-hot Florida are trending well below average growth. Tampa’s decline is the first annual drop for any market in over a year. Returns for the Tampa market and entire Southern region rank in the bottom quartile of historical annual gains, with data going back to 1988.”

Hannah Jones, Senior Economic Research Analyst for Realtor.com, also commented on the annual spike seen from the indices, saying, “The S&P CoreLogic Case-Shiller Index notched 3.8% higher annually in November, accelerating slightly from October’s growth. The 10- and 20-city indexes saw annual increases of 4.9% and 4.3%, respectively. All three indices showed sustained or accelerating price growth compared to the previous month, bucking the recent trend. This month’s release covers home sales in September, October, and November, a period in which buyers saw the most for-sale home options in nearly five years. “Mortgage rates hit a recent low of 6.08% in late September, before climbing to 6.8% in November.”

Jones continued: “Eager buyers took advantage of the brief reprieve in rates, which resulted in a 6.1% bump in existing home sales in November. Mortgage rates have climbed since November, even surpassing 7% once again in January. The recent climb in rates could stifle buyer demand once again, making for a bumpy start to 2025.”

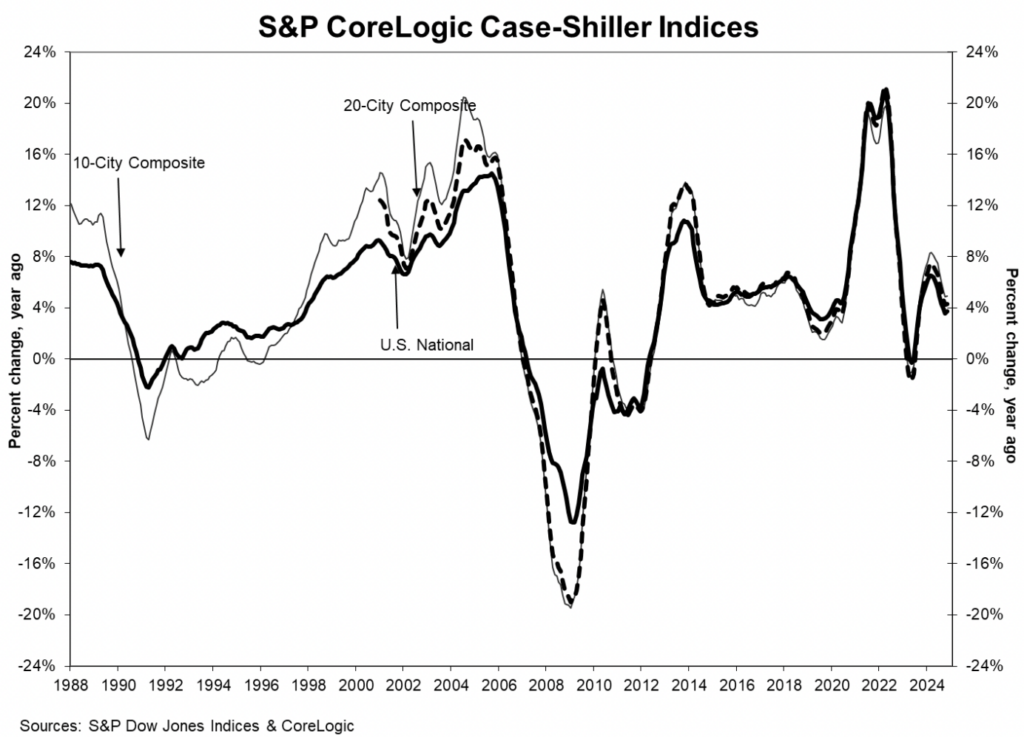

The U.S. National, 10-City Composite, and 20-City Composite Home Price Indices’ yearly returns are shown in the chart below. In November 2024, the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, which accounts for all nine U.S. census divisions, had an annual gain of 3.8%. Year-over-year (YoY) growth of 4.9% and 4.3% were reported by the 10-City and 20-City Composites, respectively.

U.S. Single-Family Home Values Climb YoY

Following a 3.6% annual rise the month before, the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, which includes all nine U.S. census divisions, recorded a 3.8% annual return for November. Similar to the previous month, the 10-City Composite experienced an annual gain of 4.9%. After rising 4.2% the month before, the 20-City Composite reported a 4.3% year-over-year increase.

“Regional variation in the housing market means that buyers across the country face vastly different market conditions,” Jones added. “Markets in the Midwest and Northeast continued to see substantial demand, resulting in sustained price growth in November, while the South and West continued to soften. New York once again saw the highest annual gain among the cities with a 7.3% increase, followed by Chicago (6.2%) and Washington (5.9%). The Florida market continued to soften, and Tampa notched the lowest growth among the cities with a 0.4% decline.”

With a 7.3% increase in November, New York—once again—had the largest annual gain out of the 20 cities. Chicago and Washington came in second and third, with annual gains of 6.2% and 5.9%, respectively. With a 0.4% decline, Tampa, FL, had the lowest return.

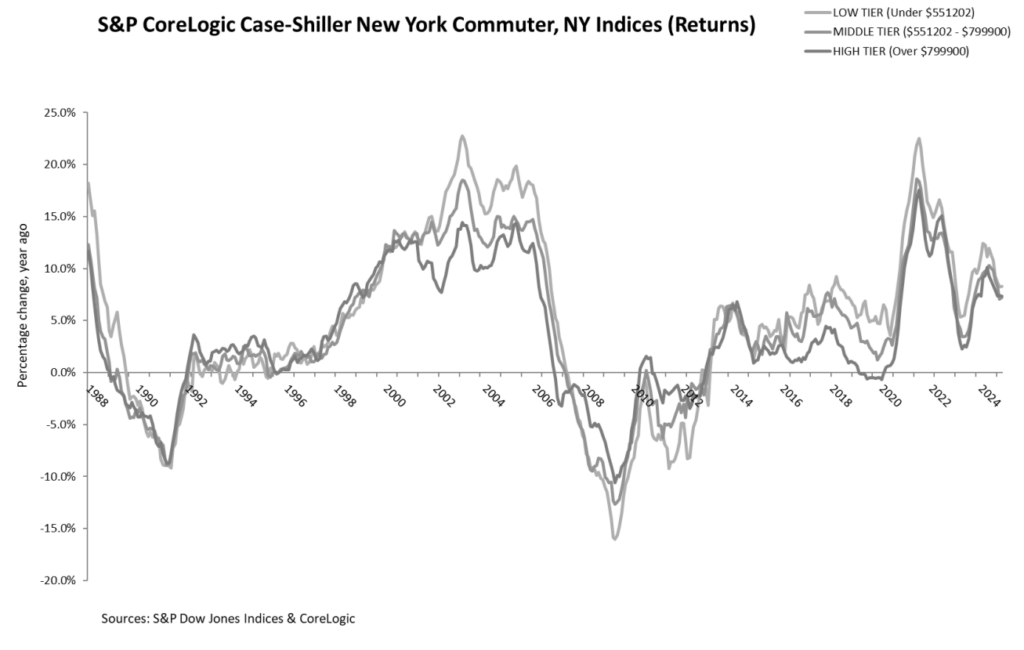

The chart below compares year-over-year returns for different housing price ranges (tiers) in New York.

“Despite below-trend growth, our National Index hit its 18th consecutive all-time high on a seasonally adjusted basis,” Luke said. “Again, with the exception of Tampa, all markets rose monthly with seasonal adjustment. With New York leading the nation for the seventh consecutive month and U.S. banks reporting strong Q4 earnings, this could set the Big Apple up as we close out the year.”

The increasing trends of the pre-seasonally adjusted U.S. National, 20-City, and 10-City Composite Indices continued to revert in November; the national index fell -0.1%, the 20-City Composite fell -0.1%, and the 10-City Composite remained constant. The U.S. National, 20-City, and 10-City Composite Indices all showed a 0.4% month-over-month increase after accounting for seasonal adjustment.

“Most Americans still consider homeownership to be part of the American dream, even as today’s market proves challenging,” Jones said. “For would-be buyers who are discouraged by sustained home price growth, the rental market offers a strong alternative as rents continue to ease in much of the country. For home shoppers ready to take the plunge, the Top Markets for First-Time Homebuyers are solid options for getting into the housing market without breaking the bank.”

Per the Realtor.com report cited above, the Top 10 Markets for First-Time Homebuyers in 2025 are:

- Harrisburg, PA

- Rochester, NY

- Villas, FL

- Lauderdale Lakes, FL

- Altamonte Springs, FL

- Lansing, MI

- North Little Rock, AR

- Baltimore

- Tonawanda, NY

- Wilmington, DE

Even though these 10 markets rank highest overall, each has its pros and cons. North Little Rock, AR, has mediocre access to the kinds of amenities that first-time homebuyers want, Lauderdale Lakes, FL, and Baltimore have comparatively lengthy commutes, and Harrisburg, PA, Rochester, NY, and Tonawanda, NY, rank in the lowest half of cities in terms of the number of listings available per capita.

When adjusting for cost of living, these 10 areas not only have inexpensive property listings, but they also have reasonably high salaries for those in the prime 25–34 age bracket for first-time homebuying. For the median price of a for-sale listing and the typical income of those aged 25 to 34 in those cities, which ranges from 15.2% of income in Rochester, NY, to 24.8% in Wilmington, DE, all 10 of the featured markets align with the criteria.

Note: Realtor.com defines “affordable” as a residence that costs 30% or less of the renter’s or buyer’s monthly salary.

Overall, home values experienced an uptick in growth year-over-year, but as 2025 has just begun, potential homebuyers and sellers may find more opportunity to get the best bang for their buck in the coming months.

To read the full report, including more data, charts, and methodology, click here.