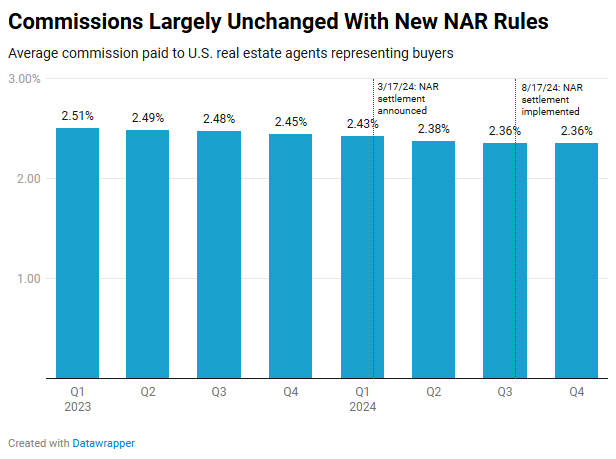

According to a recent Redfin analysis, the average buyer’s agent commission for properties sold in Q4 was 2.37%. That is down marginally from 2.45% a year ago, prior to the announcement of the new National Association of Realtors (NAR) commission standards, but it is practically unchanged from 2.36% in Q3, when the new rules went into effect.

More specifically, overall commissions decreased little in the month when the new regulations took effect. When the regulations come into effect on August 17, the average buyer’s agent commission dropped from 2.38% in July to 2.35% in August. However, the average monthly commission was precisely where it was prior to the regulations taking effect, ending the year at 2.38% in December.

A court settlement led to the creation of the new commission regulations: NAR agreed to create new guidelines regarding the communication of commissions offered to buyer’s agents as part of a settlement in March of a number of class-action lawsuits. Listing agents are no longer permitted to unilaterally offer sellers payment of the buyer’s agent commission in NAR-affiliated MLS’s, according to the new regulations. Although there are few exceptions, Redfin agents report that the majority of sellers continue to opt to pay the buyer’s agent commission.

“Buyers and sellers are still asking about commissions, and sellers are still navigating what the new rules mean for how much they should offer or agree to pay the buyer’s agent,” said Desiree Bourgeois, a Redfin Premier agent in the Detroit area. “When news of the settlement first came out, some sellers thought they were going to pay nothing to the buyer’s agent. That’s not happening; sellers are realizing most buyers are requesting the seller pay for their agent as part of the offer. It’s an ongoing conversation, but people are starting to understand and asking more pointed questions.”

Commissions Slip Slightly for Expensive Homes, Tick Up for Affordable Homes

In general, agents prefer to agree with the data that shows commissions have only slightly decreased. A Redfin-commissioned survey of 500 U.S. real estate agents from various brokerages conducted by Ipsos between December 13, 2024, and January 8, 2025, found that approximately half (48%) of these agents believe that the average agent commission in their region has stayed relatively constant since the NAR settlement went into effect. Four percent say commissions have gone up, while more than two out of five (43%) believe they have gone down.

More than half (54%) of agents stated that their clients are making more of an effort in discussions after the NAR settlement, and they also report that purchasers and sellers are bargaining over commissions more. An estimated 6% report less negotiating, and one-third (34%) stated efforts at negotiation have been roughly the same.

In the 10 years before the NAR settlement, commission rates had begun to gradually decline. However, due to the substantial increase in housing values, buyer’s agents now make more money in monetary terms.

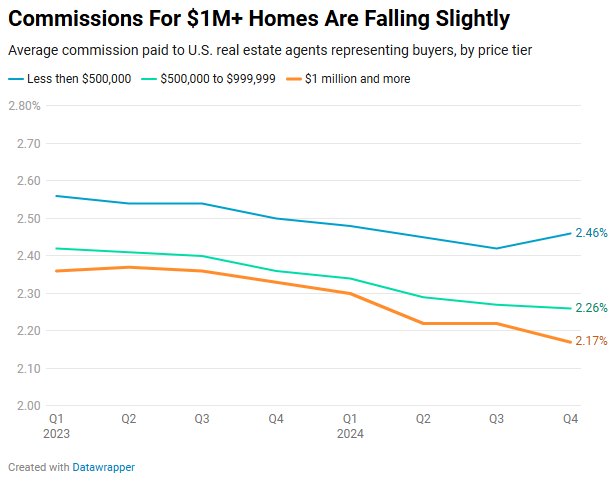

Commissions for Million-Dollar Homes Drop, Increasing for Homes Under $500K

A distinct tendency shows up when the commission data is categorized by price tier. Prior to the NAR settlement, buyer’s agents received a slightly higher commission percentage for more affordable properties and a slightly lower percentage for luxury homes.

The average buyer’s agent commission for properties that sold for $1 million or more during Q4 was 2.17%. This is lower than the third quarter’s 2.22% and the previous year’s 2.33%. The average buyer’s agent commission for properties selling for between $500,000 and $999,999 was 2.26%, which was nearly unchanged from 2.27% in the previous quarter and lower than 2.36% in the previous year.

The average buyer’s agent commission for properties under $500,000 sold for 2.46%, which was lower than the 2.5% commission from a year ago but higher than the 2.42% commission from the previous quarter. Because agents may lower their fees and still make a good living, commissions for expensive homes are somewhat declining.

“Luxury sellers typically expect buyers will want them to cover 2% in buyer’s agent commission,” said Stayce Mayfield, a Redfin Premier agent in St. Louis. “That’s different from what we’re seeing for more affordable homes; buyers of those homes are often asking sellers to cover a 2.5% or 2.7% commission. Buyer’s agents expect a lower commission for luxury homes, and they’re mostly okay with it. They’re still earning more money; 2% of a million-dollar home sale is a lot more than 2.7% of a $300,000 sale.”

Additionally, in competitive property markets and/or for a particularly desirable home, Redfin agents are reporting increased haggling over buyer’s agent commission. A seller may be more inclined to haggle about who will and how much will pay the buyer’s agent if they receive several offers.

According to a Redfin-commissioned agent poll, three quarters (75%) of real estate agents expressed concern about decreased commissions over the next five years of their careers. Less than 25% of respondents stated that they are unconcerned about commission declines. In the upcoming year, 51% of agents think commissions will decrease, 38% think they will remain the same, and 5% think they will rise.

Redfin’s data on buyer’s agent commissions for closed home sales served as the basis for the study in this report. Redfin-owned Bay Equity Home Loans, deals referred by Redfin and closed by Redfin partner agents, and sales of Redfin agents’ listings were the sources of the commission data, which was compiled from national data.

To read the full study, including more data, charts, and methodology, click here.