According to the latest Mortgage Bankers Association’s (MBA) National Delinquency Survey, the delinquency rate for mortgage loans on one- to four-unit residential properties increased to a seasonally adjusted rate of 3.98% of all loans outstanding at the end of Q4 2024.

The delinquency rate was up six basis points from Q3 of 2024, and up 10 basis points from one year ago. The percentage of loans on which foreclosure actions were started in Q4 rose by one basis point to 0.15%.

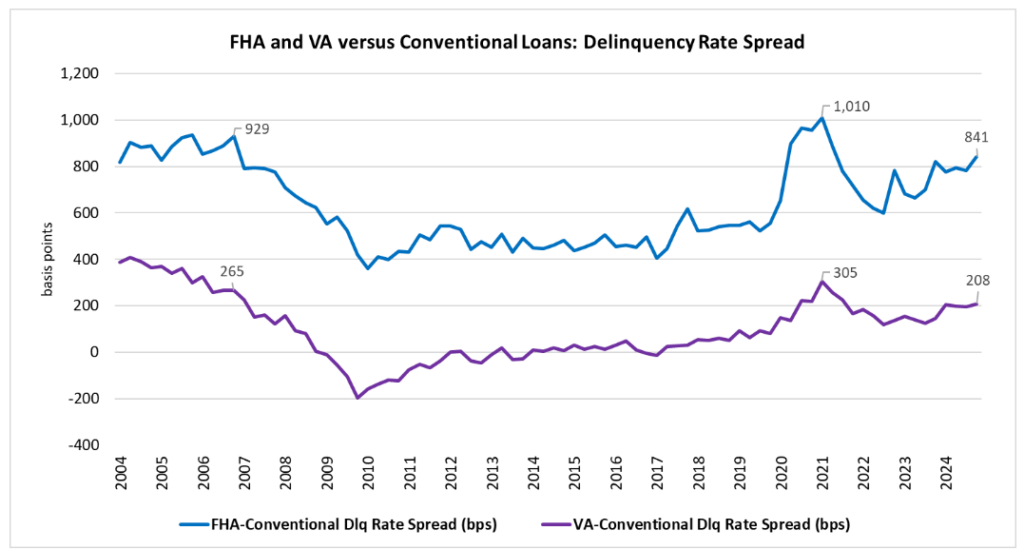

“Although mortgage delinquencies rose only 10 basis points in the fourth quarter of 2024 compared to one year ago, the composition of the delinquencies changed,” said Marina Walsh, CMB, MBA’s VP of Industry Analysis. “Conventional delinquencies remain near historical lows, but FHA and VA delinquencies are increasing at a faster pace. By the end of the fourth quarter, the spread between the FHA and conventional delinquency rates reached 841 basis points, while the VA and conventional spread was 208 basis points.”

According to Walsh, while the labor market remains relatively strong and often tracks with mortgage performance, some of today’s headwinds include inflationary pressures, lower personal savings rates, natural disasters, increasing consumer debt, higher tax and insurance payments, and higher debt-to-income ratios. All of these factors may be impacting government borrowers to a greater extent than conventional borrowers.

“Government loans are also rolling to later stages of delinquency,” added Walsh. “Compared to one year ago, the seriously delinquent rate rose 70 basis points for FHA loans and fifty-seven basis points for VA loans, but only two basis points for conventional loans.”

Key Findings

- Compared to last quarter, the seasonally adjusted mortgage delinquency rate increased for all loans outstanding. By stage, the 30-day delinquency rate decreased nine basis points to 2.03%, the 60-day delinquency rate increased three basis points to 0.76%, and the 90-day delinquency bucket increased 11 basis points to 1.19%.

- By loan type, the total delinquency rate for conventional loans decreased by one basis point to 2.62% over the previous quarter. The FHA delinquency rate increased 57 basis points to 11.03%, and the VA delinquency rate increased 12 basis points to 4.70%.

- On a year-over-year basis, total mortgage delinquencies increased for all loans outstanding. The delinquency rate increased one basis point for conventional loans, increased 22 basis points for FHA loans, and increased 63 basis points for VA loans from the previous year.

- The delinquency rate includes loans that are at least one payment past due, but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of Q4 was 0.45%, remaining unchanged from Q3 of 2024 and two basis points lower than one year ago.

- The non-seasonally adjusted seriously delinquent rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 1.68%. It increased 13 basis points from last quarter, and increased 16 basis points from last year. The seriously delinquent rate increased five basis points for conventional loans, increased 49 basis points for FHA loans, and increased 32 basis points for VA loans from the previous quarter. Compared to a year ago, the seriously delinquent rate increased two basis points for conventional loans, increased 70 basis points for FHA loans, and increased 57 basis points for VA loans.

- The five states with the largest quarterly increases in their overall delinquency rate were: Florida (99 basis points), South Carolina (59 basis points), North Carolina (40 basis points), Georgia (39 basis points), and Louisiana (32 basis points).

What Lies Ahead

The year 2025 began with a major climate related issue destroying billions of real estate in the California marketplace as wildfires tore through the region and may drive Q1 delinquencies upward. A recent study by Realtor.com took a closer look at the immediate and long-term impact that the wildfires in the Palisades and Eaton regions of Los Angeles County will have on the area’s housing market.

Fueled by lingering drought-like conditions and ongoing windy conditions, communities in the Los Angeles County region are faced with the decision to either stay and rebuild or pick up the pieces and relocate elsewhere. Though the full damage of the fires has yet to be fully assessed, more than $40 billion worth of residential real estate is located within the boundaries of the impacted area. In measuring the impact on the housing space in the long- and near-term, Realtor.com matched up fire perimeters as reported by the National Interagency Fire Center on January 21, 2025 with its own database of residential properties and found the following:

- The estimated 15,800-plus residential properties within the designated fire boundaries had a total value of $40.3 billion. This estimate includes single-family homes, town homes, condominiums, and cooperatives.

- The sizable total value of residences impacted by the fires stems from both the high number and the relatively high median value. The median home within the boundaries of the Eaton fire has an estimated $1.3 million value while the typical home in the Palisades fire boundary has an estimated value of $3 million.

- For comparison, the total value of residential real estate in Los Angeles County is $2 trillion, and the median value of the 1.7 million properties in Los Angeles County is somewhat lower ($870,500).

As if the market for homes in the Los Angeles regions were not enough, with Mother Nature unleashing her fury one outcome is a “shock” to the housing supply, or a sharp decline in housing production. It is challenging to estimate the magnitude of the housing supply stock at this time.

The majority of reports that are now accessible only include “structures” that have been demolished, which makes it difficult to convert them into “housing units,” which are the standard indicator of supply in the residential market. An initial estimate of the home stock lost by the recent fires was generated by First American for the study. According to the analysis, during the first week of the flames, between 1.1% and 1.6% of Los Angeles’ entire housing stock might have been destroyed.

Click here for more on the MBA’s Q4 study on delinquencies nationwide.