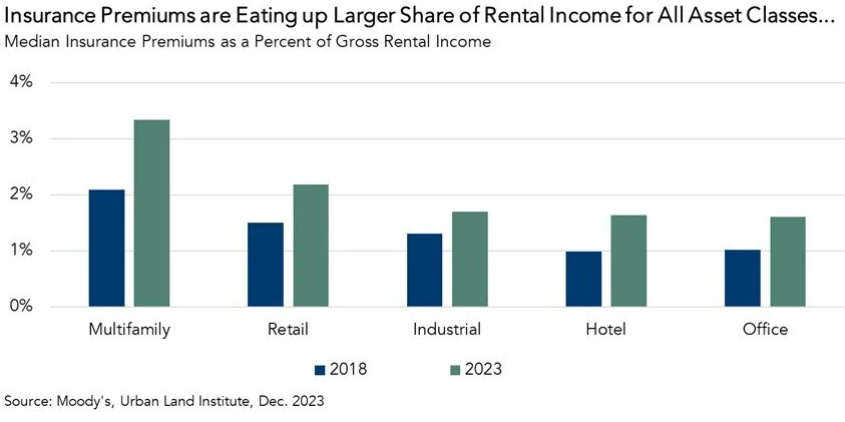

Commercial real estate (CRE) property insurance premiums are on the rise, and property owners are feeling the strain. A combination of factors is driving these increases, and understanding them can help property owners better manage the impact.

- Weather-related property damage: Extreme weather events like hurricanes and wildfires are becoming more frequent, leading to higher property damage claims. Insurers adjust premiums to account for the growing risk, which results in higher costs for property owners.

- Surge in replacement costs: Since the pandemic, material costs for construction and repairs have surged by around 35%, outpacing inflation. As rebuilding costs increase, insurers raise premiums to cover the higher expenses associated with repairs and replacements.

- Reinsurance availability: Reinsurance helps insurers manage large losses by purchasing coverage from other insurers. When reinsurance capacity is limited, insurers raise premiums to offset the increased risk. In 2022 and 2023, reinsurance availability was constrained, but recent improvements are offering some relief.

How Property Owners Can Adapt

Though rising premiums are challenging, property owners can take steps to manage costs:

- Higher deductibles: Opting for higher deductibles can lower premiums in the short term. However, this increases out-of-pocket expenses if a claim occurs.

- Complex coverage options: Consider layered or parametric coverage, which can provide more flexibility and help manage risk while controlling costs.

- Reducing debt: Lowering debt can improve cash flow and offset higher insurance premiums, though it doesn’t directly reduce the premiums themselves.

- Negotiating with insurers: Larger property owners may have the leverage to negotiate better rates. However, smaller owners, especially in disaster-prone areas, may face higher premiums without this option.

Focus on the Bigger Picture

As premiums rise, smaller property owners in high-risk areas may be forced to sell, potentially leading to market consolidation as larger investors acquire their properties. By understanding these factors and adopting effective strategies, property owners can better navigate the challenges of rising insurance costs.

Click here for more on First American’s examination of commercial real estate insurance premiums.