According to LegalShield, bankruptcy inquiries jumped to their highest level since early 2020 in Q1, suggesting a possible summer filing boom. According to research from the legal services provider, additional tariffs and record-high U.S. consumer debt may further drive already-struggling American households over the edge.

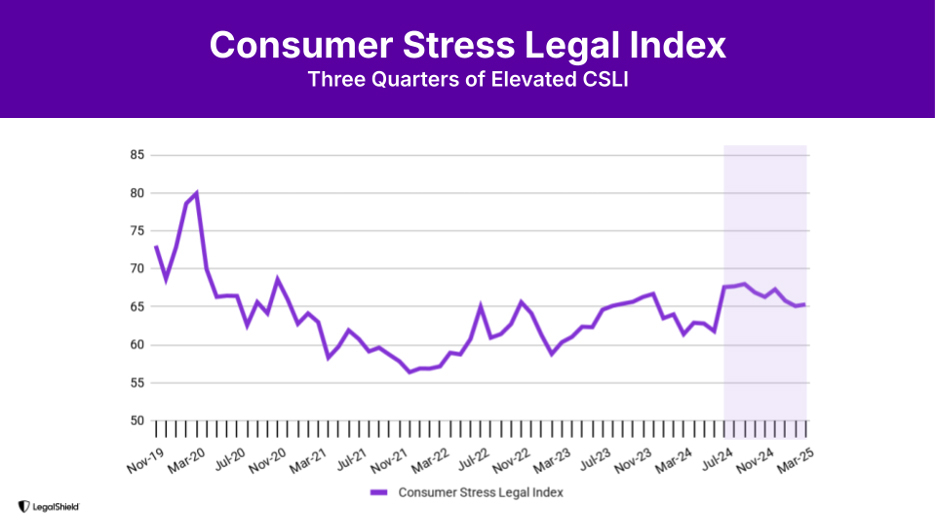

According to LegalShield’s Consumer Stress Legal Index (CSLI), the warning signs of bankruptcy coincide with a third consecutive quarter of high consumer stress, suggesting that increased financial pressure consumers across the country are feeling has become and will be the “new normal” for millions of Americans.

“Bankruptcy inquiries hit the highest we’ve seen since early 2020, just before Americans’ checkbooks were boosted by COVID checks from the government,” said Matt Layton, LegalShield SVP of Consumer Analytics. “When you combine record debt, rising delinquencies, and prolonged financial stress, topped by price pressures driven by tariff uncertainty, the risk of a summer surge in bankruptcy filings becomes very real.”

Since its July 2024 peak, the CSLI has stayed high, leveling off marginally to end Q1 2025 at 65.3, down from 67.3 at the end of 2024. Relatively solid employment figures and a sharp reduction in consumer finance inquiries during tax refund season may be hiding more serious issues, as bankruptcy and foreclosure inquiries rose prior to tariff announcements that rocked the markets.

Based on more than 35 million requests for legal services from LegalShield members, the CSLI provides a unique, up-to-date perspective on the financial health of American households.

What Does This Mean for Consumers?

1. Bankruptcy risk is rising rapidly.

- Index: 36.4 (up from 33.3 in Q4; 30.0 in Q1 2024)

- Insight: Record debt has buried many consumers. According to the Federal Reserve Bank of New York, at the end of 2024, the percentage of households that are 90+ days over due on their auto loans and credit cards reached a 14-year high, and delinquencies are still rising. At $1.21 trillion, credit card balances reached a record high.

2. Mortgage pressure is intensifying for all Americans.

- Foreclosure Index: 41.3 (up from 40.1 in Q4; 36.2 in Q1 2024)

- Insight: Elevated mortgage rates and affordability constraints are stressing homeowners and freezing inventory.

3. Consumer finance concerns are moderating temporarily.

- Consumer Finance Index: 97.9 (down from 108.5 in Q4; 99.7 in Q1 2024)

- Insight: Tax refunds and strong job growth gave consumers a temporary cushion—but risks remain as tariff-driven price increases are expected.

4. Housing market is signaling “softness.”

- Housing Construction Index: 114.1 (down from 118.4 in Q4; 115.3 YoY)

- Housing Sales Index: 94.1 (down from 97.9 in Q4; slightly up from 92.3 YoY)

- Insight: Both buyer demand and builder activity are being stifled by higher material costs brought on by tariffs and higher mortgage rates. One of the best indicators of overall economic activity is the number of new housing starts. In addition to reducing future housing supply and driving up home prices, a decline in residential construction also hurts related businesses like labor markets, durable products, and building materials.

Overall, the first half of 2025 may represent a turning point for many American households as they cope with new tariffs, growing costs, more debt, and persistently high interest rates. By the end of 2024, U.S. bankruptcy filings increased 14.2% year-over-year, and according to data from LegalShield, filings may continue to increase.

Note: LegalShield’s Bankruptcy Index has historically been two quarters ahead of actual bankruptcy filings.

To read more, click here.