Less than half of new apartments completed in Q3 2024 were rented within three months, a rate tied with Q4 2023 for the lowest share on record (aside from the start of the pandemic). That’s because, with 142,900 new apartments completed in the third quarter—the highest number on record—renters have a lot of options to choose from.

A new Redfin report analyzed the U.S. Census Bureau’s seasonally adjusted absorption rate data for unfurnished, unsubsidized, privately financed rental apartments in buildings with five or more units, dating back to 2012. The most recent data available covers apartments completed in the third quarter of 2024, and either rented or not rented within three months of then.

“Some landlords are slashing prices and offering concessions like free parking to woo tenants, but renters should know that these perks could start to dry up,” said Redfin Senior Economist Sheharyar Bokhari. “Builders are slowing their roll, with permits to construct apartments down almost 10% year-over-year. This means renters will eventually have fewer apartments to choose from, which could embolden landlords to boost rents—though that may not happen until well into next year, because a lot of apartments built during the pandemic are still coming on the market.”

Apartments were filling up at record speed during the pandemic moving frenzy, and the soaring demand drove up rents. That caused builders to ramp up construction to meet that demand, which led to more vacancies and lower rents. The rental vacancy rate for buildings with five or more units was 8.2% at the end of 2024, the highest level since the start of 2021. The median U.S. asking rent is now $1,607, up 0.4% year-over-year, but roughly $100 below its record high. While rents are no longer falling like they were in 2023, the small increases being posted are a far cry from the double-digit growth seen during the pandemic.

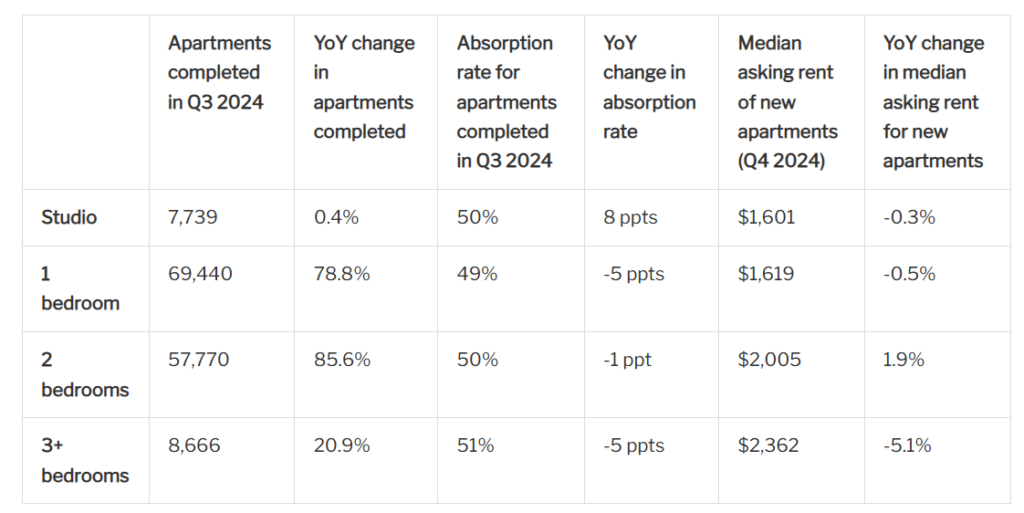

The absorption rate for apartments completed in the third quarter was around 50% for all bedroom types. And all bedroom types, except studio apartments, were absorbed at a slower pace than a year earlier.

Half (50%) of studio apartments completed during the third quarter were rented within three months, up from 42% a year earlier. Meanwhile, the absorption fell from 54% to 49% for one-bedroom apartments, from 51% to 50% for two-bedroom apartments, and from 56% to 51% for three+-bedroom apartments. The market for studio apartments may be holding up relatively well because there aren’t as many available; completions of all other bedroom types posted double-digit increases in the third quarter, while completions of studios only rose 0.4%.

Click here for more on Redfin’s report on U.S. apartment trends.