As housing costs continue to rise, a new report from LendingTree reveals a striking reality for aspiring homeowners: in all of the nation’s 100 largest metro areas, renting remains more affordable than owning a home with a mortgage. The findings highlight the growing cost burden of homeownership in both high-cost urban markets and smaller cities alike.

According to the study, the median monthly rent across the country in 2023 was $1,406, compared to $1,904 for homeowners with a mortgage. That’s a monthly difference of nearly $500, or roughly $6,000 annually—money that could otherwise be used for saving, investing, or managing everyday expenses. This gap has notably widened from 2022, when the difference stood at $475.

And this isn’t just happening in the giant coastal cities, with places in Omaha, Wichita, Toledo, Oklahoma City and dozens of other areas from coast to coast representing the trend as well. In nearly half of the largest U.S. metros, it is at least $500 cheaper per month to rent rather than own. In some cities, the gap is even more dramatic, topping $1,000 per month.

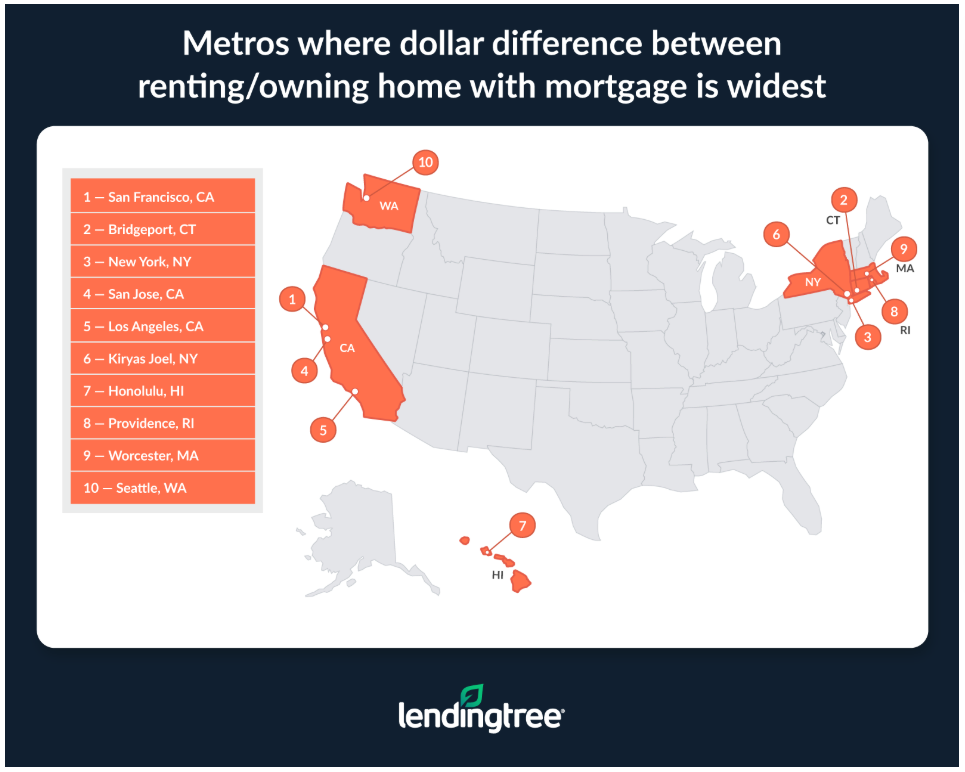

San Francisco tops the list with the most significant difference between renting and owning, with renters there paying a median of $2,397 per month, while homeowners with a mortgage faced monthly costs of $3,811 (a striking $1,414 gap). Similar trends were found in Bridgeport, Connecticut, and New York City, where the cost difference between renting and owning exceeded $1,300 per month.

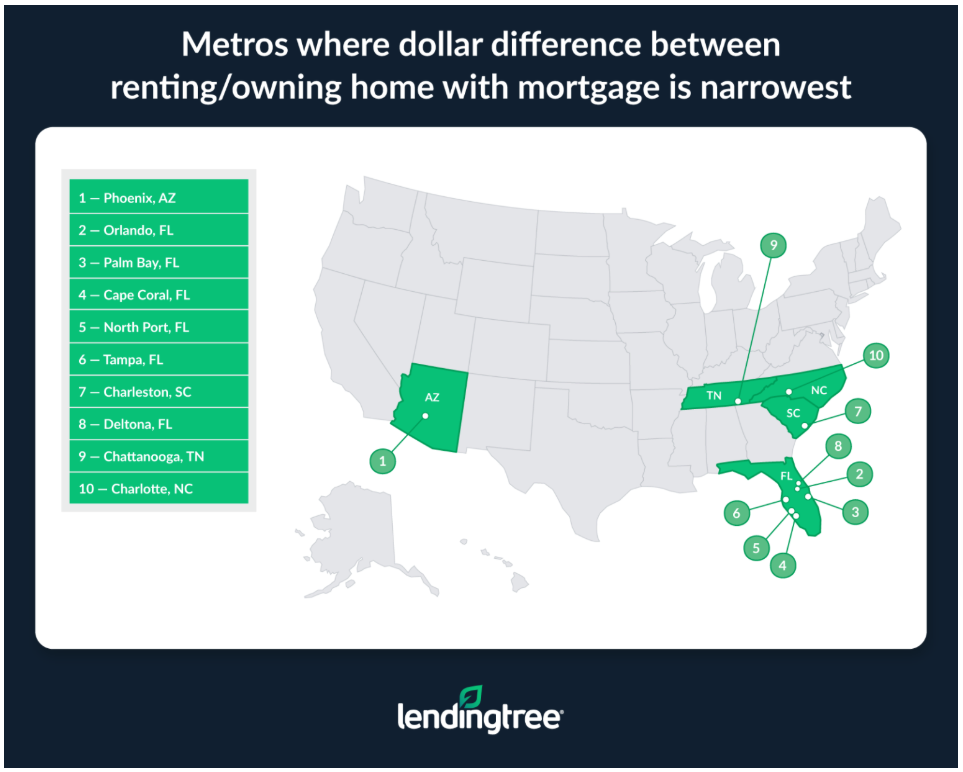

In a handful of metro areas, such as Phoenix, Orlando, and Palm Bay, Florida, the difference was much more narrow, hovering around $90 to $130 per month. However, even in these markets, renting remained the cheaper option.

When measured as a percentage, the affordability advantage for renters was most pronounced in cities like New York, Bridgeport, and Providence, Rhode Island, where rents were between 66% and 76% lower than the typical cost of owning a home.

It is important to note that the report emphasizes that affordability is just one piece of the puzzle. While renting may offer short-term financial relief, buying a home can offer long-term benefits such as building equity, gaining tax advantages, and having more freedom to customize or renovate. For individuals with financial stability and plans to stay put, buying may still be a worthwhile investment.

On the other hand, renting can be the better option for those facing high mortgage rates, lacking sufficient down payment savings, or needing flexibility to move in the near future. The low-maintenance nature of renting also appeals to many who are unwilling or unable to take on the responsibilities of homeownership.

Ultimately, the LendingTree insights show that there is no one-size-fits-all answer. The decision to rent or buy depends on a household’s financial readiness, life stage, and long-term goals. But in the current housing climate, it is clear that for most Americans, renting continues to provide more financial breathing room than owning a home.

Click here for more on Lending Tree’s analysis of renting versus homeownership.