According to the most recent U.S. Census data, over 45.6 million of the 127.4 million occupied dwelling units in the country are occupied by renters. And focusing on the rental market, single-family rentals are growing at the quickest rate, taking larger and larger shares of a developing market. From a mere 3,800 single-family rentals in 2015 to 39,000 new deliveries ten years later, the number of completed single-family rentals in build-to-rent communities nationwide has soared.

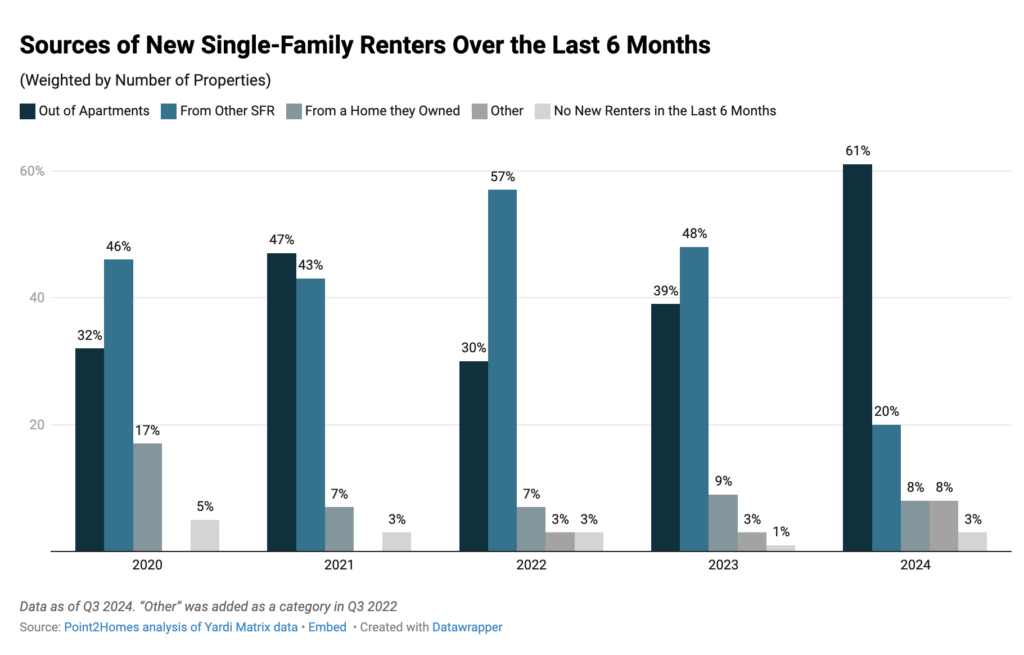

A Point2Homes examination of the most recent Yardi Matrix data shows that while low vacancy rates and robust construction activity are sufficient evidence that the single-family build-to-rent (SFR BTR) market is doing well, other factors are also supporting this conclusion: The percentage of renters who choose single-family living has hit a five-year high, with six out of ten new home renters previously residing in apartments. The increasing need for comfort and space is further highlighted by the fact that three-bedroom rental properties are gradually surpassing two-bedroom rental properties in renters’ choices.

Highlights from the Point2 March Build-to-Rent Report:

- SFR markets expand: Six out of ten new renters switched from apartments to single-family homes, indicating that space is becoming a more significant consideration for tenants.

- In contrast to 2022, when only three out of ten new renters moved from their apartment to a home, 2024 saw a faster transition away from compact living.

- Space is key: three-bedroom rental homes are becoming more and more popular, accounting for the majority (53%) of SFR BTR completions in 2025 thus far.

- The average monthly mortgage payment is $2,504 while the average rent is $1,776. Renting is more cost-effective than buying. In the majority of Yardi Matrix markets, the typical rent is hundreds or even thousands of dollars less than the mortgage payment.

Competition Softens as Renters Benefit

In 2024, deliveries, overall inventory, and single-family rental units under construction all hit record highs. The demand for renting single-family houses is expected to stay strong due to demographic and lifestyle factors, even if single-family rental occupancy rates decreased by 0.7% year-over-year.

Single-family rentals are gradually emerging as the answer to renters’ housing issues, helped along by strong millennial demand, positive economic conditions, and robust job growth in many cities. Professionals of all ages and young people starting families are becoming increasingly disillusioned with the noisy bustle of large urban centers and the cramped apartment living. As a result, the suburbs, which provide greater space, privacy, and lifestyle options, are drawing them in more and more.

Therefore, many renters are jumping from apartment living to join the expanding communities of house renters, drawn by the more indoor and outdoor space, the comfort provided by the modern home features, and the abundance of community services.

The persistent prevalence of distant work, which never recovered to pre-pandemic levels, is another factor contributing to the increased demand for homes in the suburbs and exurbs. According to the Flex Index, 68% of U.S. firms provided flexibility in work location in Q4 2024, which raised the amount of space required at home to support work-from-home arrangements.

Another issue is the cost of homeownership, which is also one of the reasons why renting a single-family house is increasingly being used as a springboard to purchase. Apartment tenants are preferring to rent a house as an intermediary rung on the ladder rather than going straight up to own their own property. Because they don’t have to give up room, people who can’t afford to buy a home—especially in the most desirable suburban areas—move to rental homes.

Single-family homes are popular among young renters looking for more space, although 8% of new renters were former homeowners. This may suggest that families and empty-nesters who are moving for job or to be nearer to loved ones also find that renting is the best option.

Renting Outweighs Buying in Affordability in Most Markets

One common classification of a human right is the right to property, or the right to own property. This explains why being a homeowner is seen as one of the major life milestones and why it plays such a significant role in people’s lives (and the American Dream). Additionally, because it provides security, stability, and an opportunity to accumulate money, home ownership is linked to a higher quality of life.

Nevertheless, the social and economic climate of today encourages renting: Renting is becoming the better option as rising housing prices and high mortgage rates restrict many people from buying. Additionally, rental homes provide more area at a lower cost.

The average rent for a single-family rental is $1,776, which is hundreds of dollars less than the typical mortgage payment of $2,500. Furthermore, the benefits of renting may not end there. In addition to the monthly housing payments, homeownership entails substantial additional expenses including property taxes, ongoing house upkeep, homeowner’s insurance premiums, and private mortgage insurance.

Top 10 Metros Where Renting is Cheaper Than Buying:

| Market | Mortgage Payment | Rent | Difference |

|---|---|---|---|

| Detroit | $1,601 | $1,324 | $276 |

| Kansas City | $1,981 | $1,328 | $653 |

| Indianapolis | $1,813 | $1,338 | $475 |

| Columbus | $1,916 | $1,360 | $556 |

| Houston | $2,041 | $1,385 | $656 |

| Las Vegas | $2,827 | $1,509 | $1,318 |

| Dallas | $2,244 | $1,575 | $669 |

| Twin Cities | $2,266 | $1,578 | $688 |

| Raleigh | $2,732 | $1,612 | $1,120 |

| Charlotte | $2,443 | $1,637 | $806 |

Some 94.7% of all SFR BTR apartments are now occupied, maintaining excellent occupancy rates throughout the country. Once more, these rates are highest in places with a large number of young professionals and new job prospects, as well as metro areas where BTR building is accelerating. They also tend to reflect population and employment growth.

Where, then, might renters more easily locate a spacious single-family home? Renters may find a rental home more easily in metro areas with lower occupancy rates, such as Jacksonville, FL; Charleston, NC; Austin, Texas; Dallas; San Antonio; and even Phoenix, than in California’s Central Valley, where occupancy rates are higher than 98%. Good luck in your search, homebuyers!

To read more, click here.