In the U.S., non-homeowners seem to have a harder time achieving homeownership. The smallest percentage in recent years indicates that they anticipate purchasing a home in the next five or 10 years, and two-thirds of these Americans think they are priced out of the market. In overall, Americans are still largely pessimistic about the housing market, as they have been since 2022, with most believing that now is not a good time to purchase a home— according to a new survey from Gallup.

According to the study, some 62% of Americans say they own a home, while 34% say they rent, which is comparable to recent statistics. Prior to the housing crisis in the late 2000s, homeownership rates were higher; from 2005 to 2009, they continuously registered at 70% or above.

Homeownership rates don’t seem to be expected to rise significantly anytime soon. Of those without a home, 30% believe they will purchase one in the next five years, 23% in the next ten, and 45% not for some time to come.

The number of consumers who expect to buy in the near future is significantly lower than that of prior Gallup surveys, all of which were conducted between 2013 and 2018, when at least 41% of non-homeowners expected to buy within the next five years. Similarly, the lowest percentage Gallup has ever seen, 53% of respondents, stated they intended to buy within the next five or 10 years.

Housing Uncertainty Impacting Market Activity

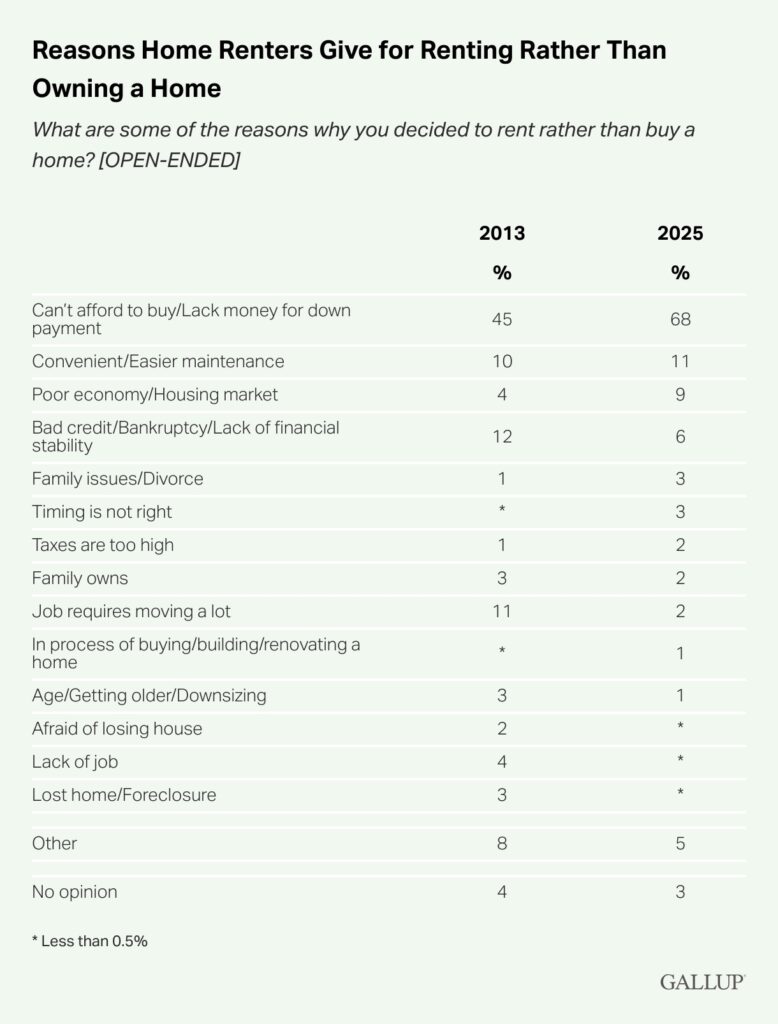

The cost of homeownership, including a down payment, is the biggest obstacle to buying a home, according to renters, and it has gotten worse over time. Sixty-eight percent of American adults who now rent their homes say they do so because they lack the funds for a down payment or because they cannot afford to buy a home. This was the reason given by 45% of respondents when Gallup last asked this topic in 2013.

Renting seems to be less of a deliberate lifestyle decision and more a product of economic conditions. Just 11% of renters claim that renting is more convenient, and 1% claim that they rent because they are downsizing and getting older. There is an economic component to almost all other justifications for renting. Other renters list the housing market, poor credit, high property taxes, or employment considerations as reasons for renting their house in addition to the high cost of ownership.

Americans’ perceptions about the situation of the real estate market are one factor contributing to their low intentions to purchase a property. 72% of Americans believe that now is a bad time to buy a home, while 26% believe that now is a good time. This indicates that Americans still have a negative opinion of the housing market. Compared to 2023 and 2024, when record lows of 21% thought it was a good time to buy a home, those assessments are a little less pessimistic.

However, compared to the entire trend, which spanned 1978 to 2021, during which time Americans were constantly more positive than negative about purchasing a home, they are significantly worse.

The tendency peaked in 2003, when 81% of respondents said it was a good time to buy. Although it dropped to 52% in 2006, it stayed at or above 50% until 2022, when record-high median U.S. home values and skyrocketing inflation caused the percentage of respondents who said it was a good time to buy to drop to 30%.

Homebuyers Reveal Expectations for 2025

Over the next year, some 57% of American people anticipate that local house prices will rise, 28% think they will remain the same, and 13% think they will fall. 68% of respondents anticipated price increases last year, falling just short of the record 71% recorded in 2021.

Since Gallup originally posed the question in 2005, most people have thought local home prices would increase, with the exception of 2008–2012, when the housing bubble burst, and 2020, when the COVID-19 epidemic was just getting started.

At 17 and 16 points, respectively, Americans in the South and West exhibit comparable drops in expectations for growing home prices, while those in the Midwest experience a lesser nine-point reduction and those in the East see no change. As a result, 69% of Eastern residents are the regional grouping most likely to anticipate an increase in local property values, compared to 51% to 57% of people in other regions.

Home values are still far higher than they were ten years ago, despite a modest decline from their 2022 top. Many potential homeowners are priced out of the market due to high interest rates that increase the cost of home mortgages. Nearly half of non-owners believe they are unlikely to purchase a home in the near future, and fewer than 10 years ago anticipate doing so in the next five years.

The majority of Americans still believe that the market is not favorable for homebuyers and that prices will rise over the course of the next year, which is why they are less inclined to purchase a home. However, Americans continue to view real estate as the finest long-term investment, probably due to the increase in home values in comparison to other financial assets. Making that investment option more accessible to a larger portion of the adult population in the U.S. is the problem.

Gallup’s Economy and Personal Finance survey, which was conducted from April 1–14, served as the basis for these findings.

To read more, click here.