During the “Residential Economic Issues & Trends Forum” during the NAR 2025 REALTORS Legislative Meetings, Lawrence Yun, Chief Economist for the National Association of Realtors, predicted that existing home sales would rise by 6% in 2025 and by 11% in 2026.

Yun predicted that mortgage rates would average 6.4% in the second half of 2025 and 6.1% in 2026, that new house sales would increase by 10% in 2025 and 5% in 2026, and that the median home price would increase by 3% in 2025 and 4% in 2026.

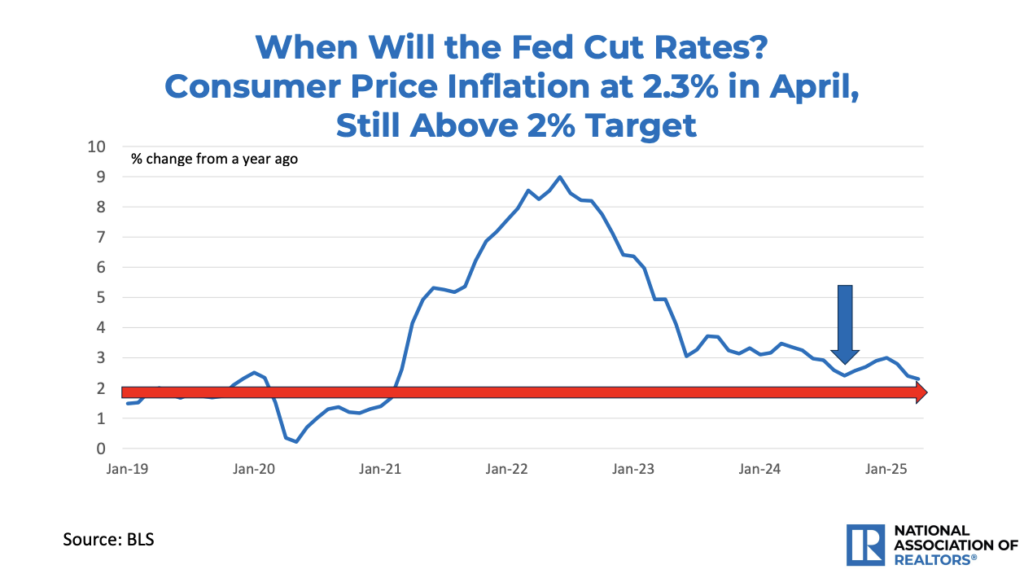

The Federal Reserve had earlier predicted that the GDP would grow by 2.1% and inflation would climb by 2.4% in 2024. However, in March 2025, it revised that prognosis, reducing its estimate of GDP growth to just 1.7% and increasing its inflation estimate to 2.7%.

“The housing market remains very difficult at the moment, as you know,” Yun told an auditorium of real estate professionals. “Part of the delay in recovery is because the Federal Reserve has changed its outlook and appears to be on pause for a longer period. The fast ascent of mortgage rates has really hurt the real estate market.”

Housing Market Affected by Rapid Increase in Mortgage Rates

Regarding the real estate industry, Yun told the crowd, “Your past clients are all happy. But for new home buyers, their monthly payment obligation has increased, and this is what’s killing the housing market. Mortgage rates are the magic bullet, and we’re waiting and waiting until those come down.”

Inflation in April was 2.3%, which was just above the Fed’s implicit objective of 2.0%, according to Yun, who said, “We’re not there yet, but we’re very close. The Fed will cut interest rates once inflation is fully under control.”

Yun also noted that the biggest contributor to inflation is the cost of housing.

“Only the tariffs’ impact is being discussed,” he said. “What about other forces that are less discussed? There are other forces out there; for example, the shelter component is the biggest weight to the price component. The shelter cost is already coming down from its recent cyclical peak, and it’s trending downward.”

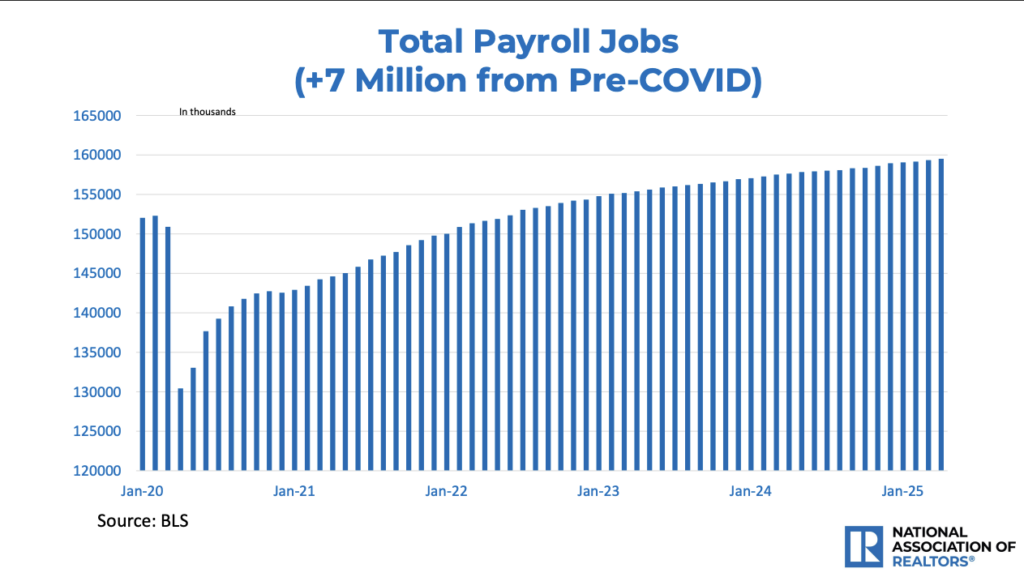

According to Yun, job growth in the U.S. has improved since 2020, when it was at its pre-pandemic peak. He also clarified that the consumer price index’s 2.3% growth is being outpaced by pay growth of 3.8%.

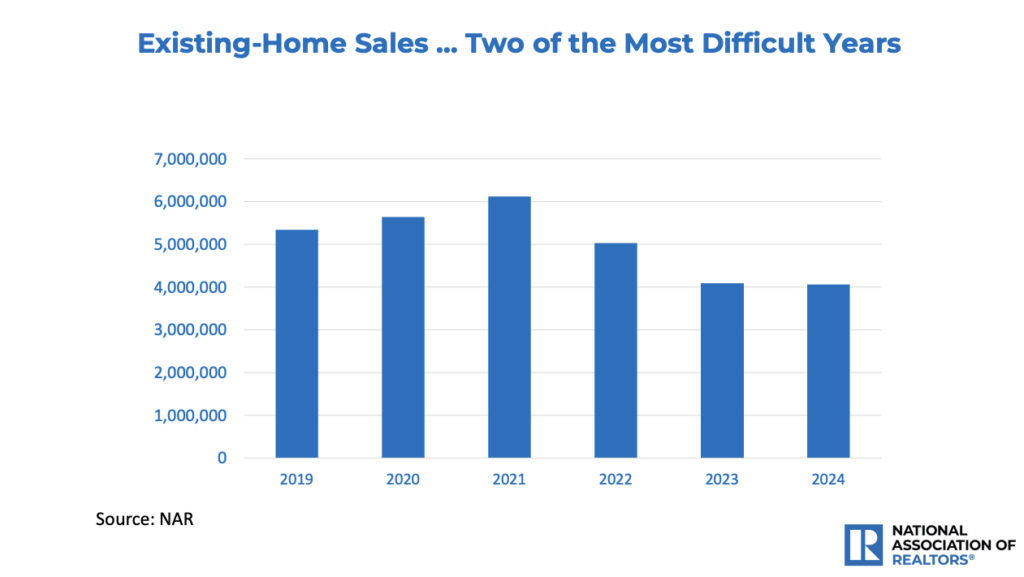

“Home sales have been very difficult over the past two years,” Yun said in reference to the housing market. “We’ve had the lowest home sales in 30 years for two consecutive years.”

While economic and residential forecasts are beneficial for consumers, they may not always be accurate. Only time will tell where the housing market will go.

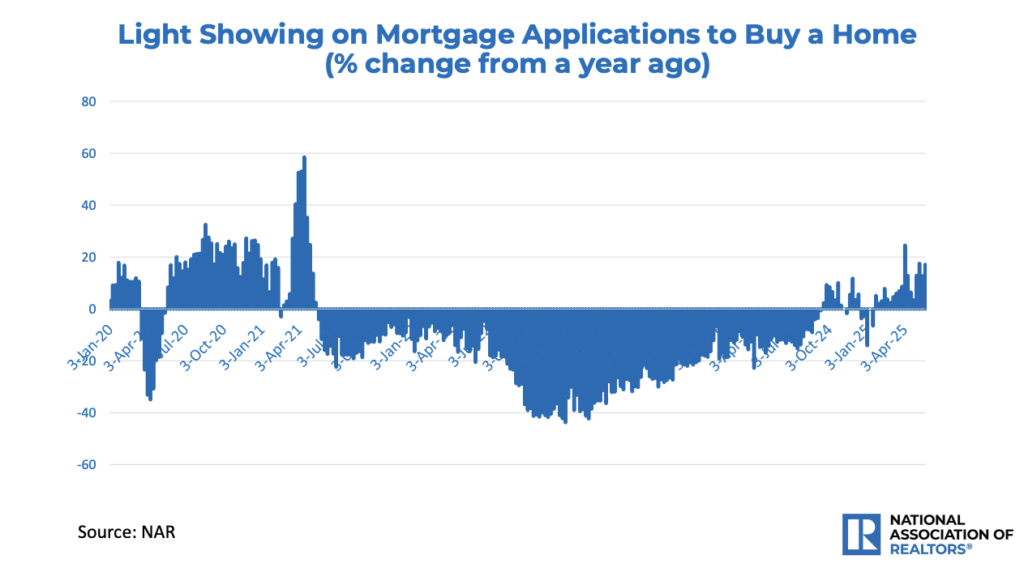

Yun added optimistically, “There’s a light at the end of the tunnel based on recent rises in mortgage applications to buy a home. Moreover, a solid majority of renters expressed desire to own a home.”

To read more, click here.