Although it is still far below pre-pandemic levels, nearly 6% of home sellers in the U.S. currently run the risk of selling for less than their purchase price, up from an estimated 4.4% a year ago. However, depending on where you are in the country, the story is different. In Providence, RI, for example, almost no vendor faces the possibility of losing money on their sale, according to a new Redfin study.

Further, over 20% of vendors in the San Francisco metro are in danger. Additionally, the situation varies depending on the type of home: condos are far more likely than single-family homes or townhouses to be at risk of losing money when they sell.

Based on the sale-to-list price ratio of the metro region where a home is located, Redfin analyzes active listings on the MLS in May to determine how much a home is expected to sell for. For instance, Redfin forecasts that a $500,000 home in a metro area with a 95% sale-to-list price ratio—where homes typically sell for 5% less than the initial list price—will fetch $475,000. We contrast the seller’s initial purchase price for the house with the anticipated sale price.

| Share of active listings based on when they were last purchased | |||

| Purchased post-pandemic (after July 2022) | Purchased during pandemic (July 2020-July 2022) | Purchased pre-pandemic (before July 2020) | |

| May 2025 | 16.3% | 20.6% | 63.1% |

Note: Closing fees are not included in a projected loss. For further information, refer to the methodology section located at the conclusion of the study.

Selling at a Loss vs. Buyers Getting a Bargain

Notably, Redfin’s methodology determines the percentage of sellers who, should they proceed with a sale in the current market, run the danger of doing so at a loss. The percentage of sellers who will really sell their house at a loss is not predicted by it. Many prospective sellers who are losing money may only wait for a buyer who is prepared to pay the asking price. Others may decide to rent out their house or remove it from the market and stay in it.

About half of properties for sale were in danger of selling at a loss in the early 2010s, after the global financial crisis. Approximately 10% of properties for sale in early 2020 were at risk of selling for less than their purchase price, even before the pandemic.

The very low percentage of sellers who are losing money today is good news for homebuyers, according to Asad Khan, Senior Economist at Redfin.

“We are seeing more opportunities for buyers to pay a little less than they would have just a year or two ago. That’s because sellers with significant equity in their homes—and therefore at no risk of selling at a loss—are more willing to be flexible on price,” he said. “That’s a meaningful shift for anyone who’s been watching and waiting for prices to come down, especially first-time homebuyers.”

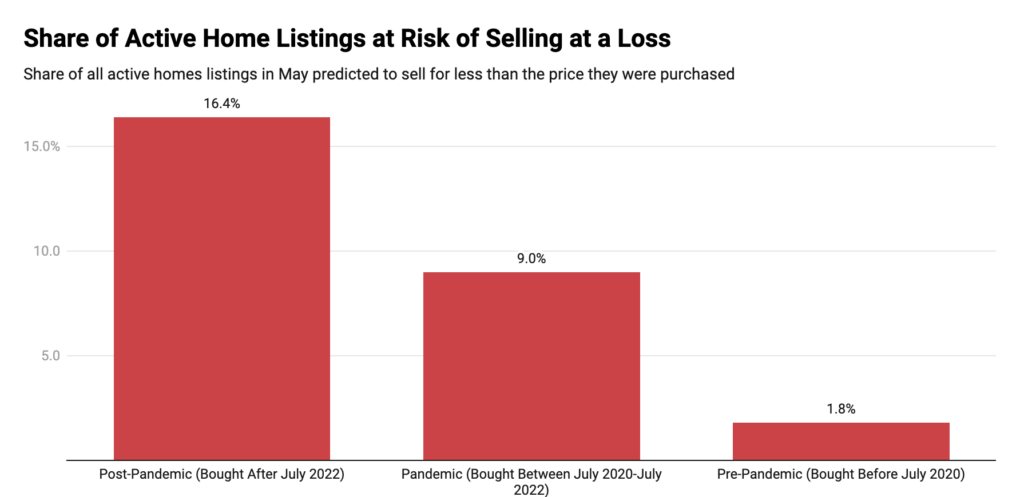

Specifically speaking to recent homeowners, almost one in six (16.4%) of today’s sellers who purchased their property after the pandemic run the risk of selling it for less than what they paid for it. In contrast, only 1.8% of home sellers who purchased their homes prior to the pandemic are at risk of losing money on their sale, compared to an estimated 9% of sellers who purchased their homes during the pandemic.

“The longer someone has owned their home, the more likely they are to come out ahead, but that’s little comfort for those who bought more recently and may be facing a loss,” Khan said. “Not every homeowner is listing because they want to—some are listing because they have to. In those cases, it’s important to list at a realistic price for the market and be prepared to adjust depending on buyer interest.”

A significant portion of sellers today are those who purchased their homes following the pandemic: 16.3% of all homes listed for sale in the U.S. were bought after July 2022.

Note: Redfin excluded homes bought in the past nine months from the analysis, as they are more likely to have been flipped by developers.

U.S. Homeowners Respond to Housing Market Changes

If they were to sell now, homes bought after the pandemic are more likely to do so at a loss for two key reasons:

- High prices were paid by sellers who purchased after the pandemic: Shortly after the pandemic started, a buying frenzy was sparked by fierce competition and historically low mortgage rates. Many homes sold for significantly more than their original price due to frequent bidding wars, which caused demand to soar to previously unheard-of heights by the middle of 2022.

- Prices are currently cooling: As mortgage rates increased and demand slowed, prices in most of the country have leveled off after reaching a peak in the middle of 2022. Some markets have held up well, but others have seen their prices fall from their peak, especially in the Sun Belt, where demand peaked during the pandemic.

“Current sellers who bought their home after mid-2022 may have overextended themselves, thinking that prices were going to keep rising at similar rates,” Khan said. “Prices have kept ticking up since then, but at a slower pace—and now prices have started to fall in some parts of the country, especially in the Sun Belt. That means sellers are in a position where they may need to choose between accepting a lower price, or taking the home off the market.”

Several sellers who don’t need to move right away have already chosen to “de-list” their house, according to Redfin brokers in different U.S. regions.

“A lot of sellers are taking their home off the market rather than reducing their price, with the idea of listing it again next year,” said Aditi Jain, a Redfin Premier agent in Boston. “They’re not motivated by making money the way they would have been two or three years ago because there’s not as much money to make. Another trend with sellers: They’re accepting offers instantly. If they get one solid offer, they’re signing the contract, canceling other tours and open houses, and trying to close the deal as soon as possible.”

The largest percentage of all housing types, more than one in four (28.7%) condos for sale that were purchased after the pandemic boom are at risk of losing money when they sell. In total, some 9.9% of condos for sale run the danger of losing money when they sell.

| Share of active listings at risk of selling at a loss | ||||

| Overall | Bought post-pandemic | Bought during pandemic | Bought pre-pandemic | |

| Single-family | 4.4% | 12.9% | 7.9% | 0.9% |

| Condos | 9.9% | 28.7% | 12.7% | 4.5% |

| Townhouse | 6% | 19.2% | 8.3% | 1.3% |

| All home types | 5.7% | 16.4% | 10.1% | 1.9% |

“We are seeing the biggest price drops in the condo market,” said Denver Redfin Premier agent Andy Potarf. “I had a seller who bought a condo for $570,000 in 2021 and it just sold for $525,000 last week. Sellers who have to sell are willing to take a bigger hit to get the deal done.”

Potarf went on to say that condo sellers are in a particularly difficult situation because many of them are subject to limitations on how they can lease their homes, either from local authorities or homeowners associations.

“A lot of condo sellers have a choice to make: stay put, or take a loss,” he said.

Comparatively, some 12.9% of homes purchased after the pandemic and 7.9% of homes purchased during the epidemic are among the 4.4% of active single-family listings that might be sold at a loss.

The possibility of homes selling at a loss in the current market is examined in the section above. Because there are far more sellers than buyers in the market, Redfin predicts that by the end of 2025, home prices in the U.S. will have dropped 1% annually.

| Share of homes at risk of selling at a loss if home prices drop | ||||

| Current | 1% Price Drop | 3% Price Drop | 5% Price Drop | |

| Overall | 5.7% | 6.4% | 8.1% | 10.1% |

| Bought post-pandemic | 16.4% | 19.1% | 25.3% | 32.5% |

| Bought during pandemic | 9% | 10.1% | 12.6% | 15.8% |

| Bought pre-pandemic | 1.8% | 1.9% | 2.2% | 2.5% |

The total percentage of homes at risk of selling at a loss will rise to 6.4% if prices actually drop by 1% as anticipated. The share will rise to 8.1% if prices drop by 3%. The percentage of homes at danger of selling at a loss will rise to 10.1% in the improbable event that prices drop by an estimated 5%.

Even if prices drop by 5%, those who purchased before the epidemic have little chance of selling at a loss. It’s crucial to keep in mind that our analysis looks at homes that were listed in May and that sellers may withdraw if prices drop sharply.

- Overall: San Francisco has the greatest percentage of major metro areas where nearly one in five (19.6%) homes up for sale are likely to sell for less than what was paid for when they were bought. Condos for sale in San Francisco are especially vulnerable to losing money when they sell (see section below). After a decade of tremendous expansion propelled by the tech boom, the Bay Area of California had a noticeable downturn during the pandemic as residents were able to relocate elsewhere due to remote work. San Francisco still has a greater percentage of homes that were purchased for more than they are expected to sell for, even though the market has finally leveled out. Austin, Texas (13.8%) and Oakland, CA (11%), another Bay Area metro, follow. The three largest metro areas with the lowest percentage of properties at risk of selling for a loss are Providence, RI (0.5%), New Brunswick, NJ (0.5%), and Anaheim, CA (1%).

- Single-family homes: Among large metro areas, Austin, Texas, has the highest percentage of single-family homes at risk of selling at a loss (13.2%), followed by San Antonio (10.2%) and St. Louis (10%). The East Coast metro areas with the lowest shares were Boston (0.6%), New Brunswick, NJ (0.5%), and Providence, RI (0.5%).

- Condos: Over one-third (35.6%) of all for-sale properties are condos. Condos in San Francisco could end up losing money when they sell. Portland, OR (24.8%), and Oakland, CA (23.2%)—the next two big metro areas on the list—are both less than ten percentage points behind that. Providence, RI (1.3%), Milwaukee (1.1%), and New Brunswick, NJ (0.4%) have the lowest rates of condo sales at a loss.

- Homes purchased after the pandemic: In Austin, Texas, nearly half (47.5%) of all for-sale properties purchased after July 2022 run the danger of losing money when they sell. Among major metro areas, that is the largest share. Two additional Sun Belt metro areas are Tampa (35.8%) and Orlando, FL (31.5%). Providence, RI (1.3%), New Brunswick, NJ (1.5%), and Milwaukee (1.7%) had the lowest proportions at the other end of the range, indicating that price increase has held up better in East Coast and Midwest markets.

- Homes purchased before the pandemic: In San Francisco, 16.6% of all for-sale properties purchased before July 2020 are at risk of losing money. This is more than twice as many as the next-highest metro areas, St. Louis (7.2%) and Detroit (5.6%). Nashville, TN, had the lowest percentage (0.2%), followed by Providence, RI (0.2%), and San Diego (0.2%).

To read more, click here.