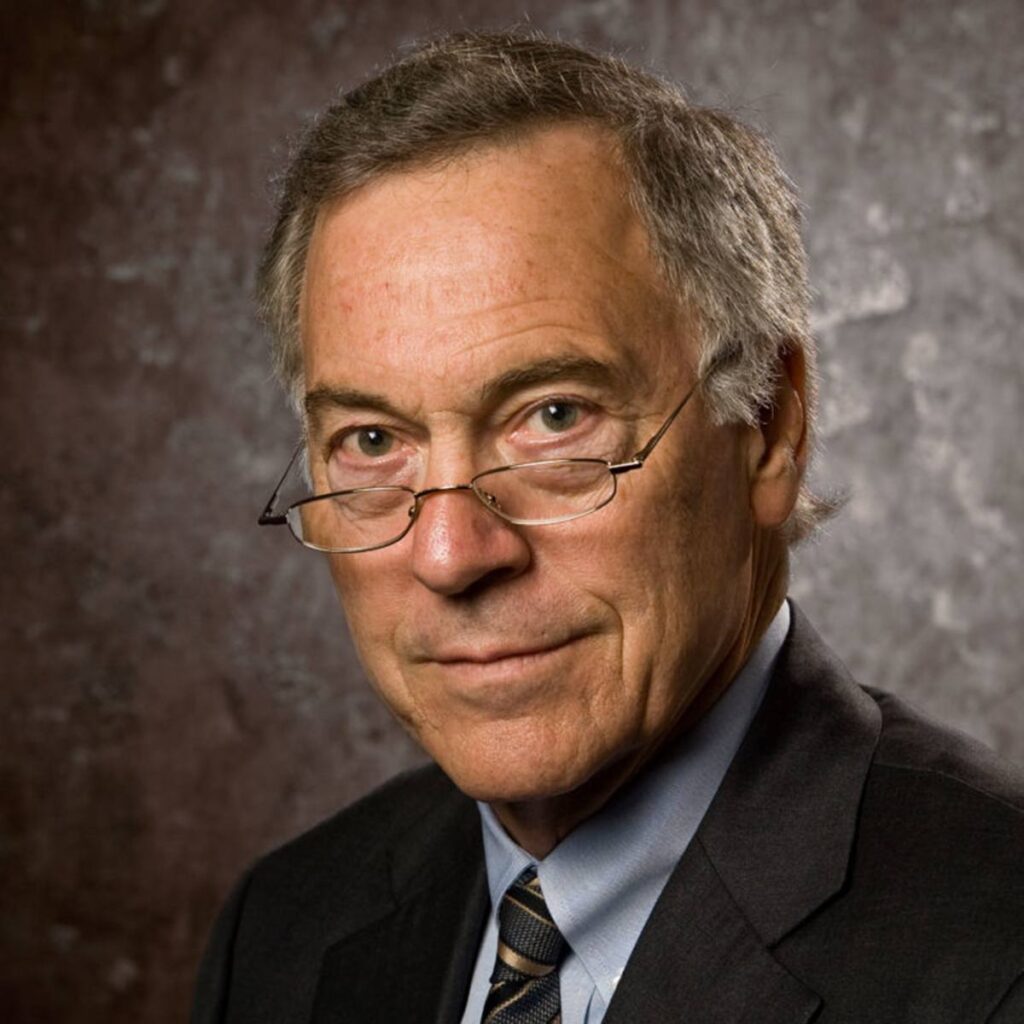

In a new Finbold report, American economist Steve Hanke has doubled down on his recession warning, declaring that “the downturn is already on an irreversible path.”

In an interview with David Lin that was on June 21, Hanke predicted that the recession will most likely strike in the second half of the year. He attributed this impending contraction to a declining money supply and rising policy uncertainty.

According to Hanke, Professor of Applied Economics at Johns Hopkins University, persistent drops in the money supply—which has historically been a good indicator of economic weakness—are a serious warning sign. He clarified that while the consequences of monetary contraction manifest themselves with “long and variable lags,” the end result is typically the same: a decline in economic activity.

“This is a slow-moving train,” Hanke said. “Once you get these contractions in the money supply, we will have long and variable lags that ultimately affect economic activity, and that’s what’s happening. I think the train will arrive in the second half of the year, and things will continue to slow down.”

As reported by Finbold, Hanke has pointed out that while predicting a possible economic slowdown, many economists have neglected to take money supply trends into consideration.

Additionally, the researcher identified danger indications flashing on soft data indicators. The growing difficulty of finding work for fresh college graduates is one prominent example. He clarified that in light of growing political and economic unrest, employers are becoming more reluctant to onboard inexperienced employees because they see them as investments in human capital.

Trump Admin Impacts & Recession Forecasts

Hanke argued that the increase in “regime uncertainty” brought on by the Trump administration is a major contributing cause to this hesitancy. In this instance, companies are postponing long-term investments in anticipation of more defined policy direction because they are concerned about the unpredictability of changes in tariffs and regulations. He claimed that because of this uncertainty, investors and employers are being left out.

Hanke had previously set the probability of a 2025 recession at 90% in an earlier Finbold analysis, with trade-related uncertainty being a major contributing factor.

He also made historical comparisons to the New Deal era of the 1930s, when uneven policy changes resulted in protracted economic stagnation. Hanke cautioned that until today’s uncertainty is addressed, the economy might be on a similar trajectory.

Hanke further explained that actual economic activity and inflation are the two main factors that are impacted by a declining money supply. These factors combine to form nominal GDP, which is already declining, he cautioned.

“You have got Trump’s regime uncertainty, which, as I said, just like in the Great Depression, just pushes things down even more,” Hanke said. So that’s why I think the probability of a recession later this year is much higher than the consensus beliefs.”

He made a direct comparison to the Smoot-Hawley Tariff Act of 1930, which led to an 83% market meltdown between 1930 and 1932 and a worldwide trade war. Hanke thinks that today’s financial markets are starting to reflect that traumatic past.

In addition to Hanke’s caution, the economy is now facing new uncertainty due to the Middle East’s rising geopolitical tensions, particularly since the U.S. entered the conflict between Israel and Iran, adding even more uncertainty to an already volatile outlook.