According to a recent Redfin research, some 8% of U.S. homes have increased in value by more than $500,000, and more than one in four (25.7%) have increased by at least $250,000. These are the maximum and minimum numbers of homeowners who may profit from the removal of the capital gains tax on home sales, a proposal that President Trump and US lawmakers are now putting forth.

The typical gain for properties whose value has increased by at least $250,000 is $384,606, which translates to a potential tax burden of $20,104 (assuming a 15% tax rate). The median gain for residences with a value increase of at least $500,000 is $712,986, which translates into a possible tax liability of $31,948.

This is based on a comparison between the most recent sale price and the current Redfin Estimate for properties in the U.S. A high-level estimate of who could profit from a modification to the capital gains tax regulations governing property sales is given by the analysis. However, please be aware that each homeowner’s situation is different and that tax laws are complicated.

“A lot of baby boomers say they never plan to sell their homes—but that mindset could shift if capital gains are taken off the table,” said Daryl Fairweather, Chief Economist at Redfin. “With the financial barrier removed, more may decide to sell and either downsize or relocate, potentially freeing up housing inventory and putting downwards pressure on home prices.”

| U.S. Homes Potentially Impacted by Capital Gains Tax on Home Sales | ||||

| Metrics | Share of U.S. homes | Median capital gain | Tax liability on median capital gain (using 15% tax rate) | Median home value(Redfin Estimate) |

| Homes that have gained $500,000+ | 8% | $712,986 | $31,948 | $1,229,076 |

| Homes that have gained $250,000+ | 25.9% | $384,026 | $20,104 | $720,111 |

| Overall | N/A | $144,543 | $0 | $385,700 |

U.S. Homes Potentially Impacted by Capital Gains Tax on Home Sales

Since the average American home has increased in value by $144,543 since it was last bought, its owners would not be subject to capital gains tax if they sold it today.

This is due to the fact that, as of right now, property sellers who have been in their residence for at least two of the previous five years are eligible to deduct up to $250,000 in capital gains from their taxable income if they are filing alone, or up to $500,000 if they are filing jointly with a spouse. According to the IRS, most persons pay no more than 15% in capital gains tax, which can range from 0% to 20% based on income.

For instance, a couple may be required to pay capital gains tax on $200,000, the amount above the $500,000 exception for couples filing jointly, if they sell their primary house for $700,000 more than they purchased for it ten years ago. A 15% capital gains tax rate would result in a possible tax bill of $30,000.

Note: Redfin’s analysis does not take into account how home improvement costs and other offsets can also potentially reduce homeowners’ capital gains tax burden.

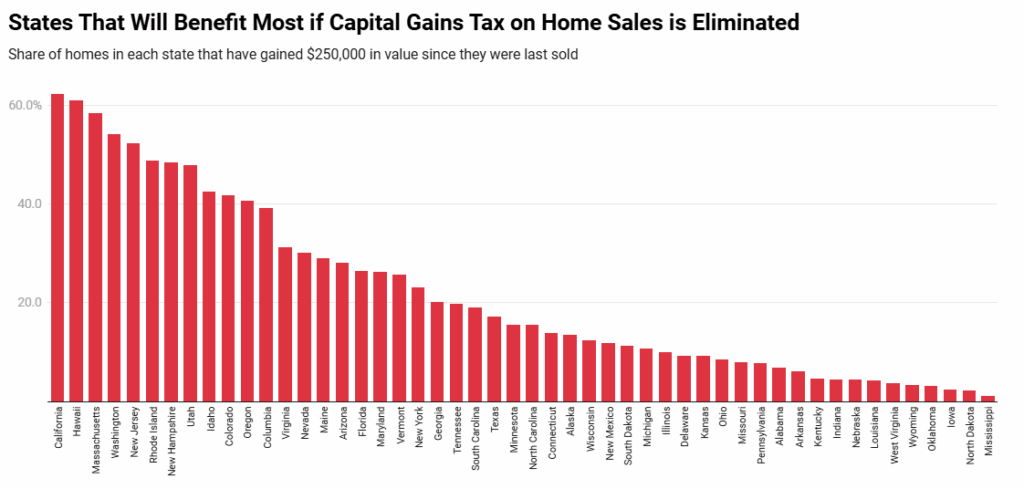

California, Hawaii & Massachusetts Boast the Highest Share of Homeowners Who Would Benefit

Homeowners who have already amassed a sizable fortune through their property stand to earn the most from the elimination of the capital gains tax, and they are primarily from states where home values are high and have grown rapidly.

First up is California, where the average capital gain for all homes is $332,659 and the median home value is $766,896. Looking more closely, California has the largest percentage of homes that have gained at least $250,000 since their last sale, at 62.3%. Some 33% have made more than $500,000.

| States With Highest Share of Homes Above Capital Gains Thresholds | ||||

| Metrics | Median home value(Redfin Estimate) | Share of homes that have gained $250,000 in value since they were purchased | Share of homes that have gained $500,000 in value since they were purchased | Median capital gain(all homes) |

| California | $766,896 | 62.3% | 33% | $332,659 |

| Hawaii | $834,015 | 61% | 34.6% | $338,346 |

| Massachusetts | $648,604 | 58.4% | 20.8% | $291,011 |

| Washington | $621,091 | 54.1% | 19.4% | $270,412 |

| New Jersey | $610,210 | 52.2% | 15.4% | $260,587 |

Additional Key Findings — National

- Due in part to higher initial property prices, California properties are more likely to surpass capital gains requirements.

- In many parts of the state, strong employment markets and pleasant weather have long maintained high demand, driving up the median price of homes in major cities like Los Angeles and San Francisco to over $1 million.

- Proposition 13 in California has made it difficult for homeowners to sell their houses by locking them into low property-tax rates. This indicates that Californian homeowners have more time to grow the size of their capital gain because they tend to stay in their homes longer than homeowners in other parts of the nation.

- Hawaii has a slightly greater percentage of properties that have gained $500,000 (34.6%) and a higher overall median capital gain ($338,346) than California, but a little lower percentage of homes that have earned more than $250,000.

- New Jersey (52.2%), Washington (54.1%), and Massachusetts (58.4%) complete the top 5 states with the largest percentage of properties that have increased in value by at least $250,000 since they were last sold.

- California has the most percentage of any state with more than one in five (20.8%) of all homes in the country that have increased in value by more than $250,000. New Jersey (4.8%), Massachusetts (7%), Florida (12.1%), and Washington (6.9%) followed.

- Almost one-third (35.6%) of all residences in the country have increased in value by more than $500,000.

“But it’s important to note that these homes are not starter homes, they are more likely to be million-dollar homes that are out of reach for most homebuyers,” Fairweather said. “The impact of the tax break would also not be felt nationwide—it would disproportionately benefit wealthier homeowners from coastal states like California. Some states, especially in the South and Midwest, would see far less impact.”

To read the full report, click here.