With the Federal Reserve slashing the target range for the federal funds rate by 0.25 percentage points to 4% to 4.25% just last week and the market adjusts with mortgage rates inching closer to the 6% mark, a new Realtor.com report found that metros with younger, more mobile populations stand to benefit the most from consistently lower mortgage rates.

Realtor.com found that in these metros, 81% of existing mortgages have a mortgage rate of 6% or lower. In other words, as mortgage rates approach the 6% level, we can expect to see more homeowners “unlocked,” especially in areas with high mortgage usage.

The report finds that Washington, D.C. (73.6%); Denver, Colorado (72.9%); Virginia Beach, Virginia (70.7%); and Raleigh, North Carolina (70.7%) lead the nation with the largest share of mortgaged households, making them the most likely to see buyer demand accelerate as financing conditions improve. By contrast, Miami, Florida (44.8%); Buffalo, New York (44.2%); and Pittsburgh, Pennsylvania (44.2%) rank among the least mortgage-reliant metros, suggesting their housing markets may be slower to respond to falling rates.

“Falling mortgage rates open doors for many would-be buyers and sellers, but where you live determines how much the market shifts in response to the opportunity,” said Danielle Hale, Chief Economist at Realtor.com. “In markets like Denver or Washington, D.C., where most owners are still paying off their mortgages, lower rates are more likely to spark renewed activity. Meanwhile, metros with older populations and more outright owners, like Buffalo or Miami, may see a lower market-level response, even though lower rates are a difference-maker for some individuals in these markets.”

Across the 50 largest U.S. metros, Realtor.com’s breakdown shows a variation in the role mortgages play. In Washington, D.C., nearly three-quarters of owned homes carry a mortgage, followed closely by Denver, Colorado and Virginia Beach, Virginia. These younger, more mobile housing markets are likely to see the fastest reacceleration in demand as borrowing costs decline. On the other end of the spectrum, metros such as Buffalo, New York; Pittsburgh, Pennsylvania; and Miami, Florida have the highest share of outright owners, driven by high concentration of older homeowners.

Top 10 Metros with the Highest Share of Mortgaged Households

Realtor.com found the 10 metros with the biggest share of mortgaged households include:

- Washington, D.C. (73.6%)

- Denver, Colorado (72.9%)

- Virginia Beach, Virginia (70.7%)

- Raleigh, North Carolina (70.7%)

- San Diego California (70.0%)

- Baltimore, Maryland (69.4%)

- Atlanta, Georgia (69.2%)

- Seattle, Washington (69.1%)

- Portland, Oregon (68.5%)

- Richmond, Virginia (68.3%)

Top 10 Metros with the Highest Share of Outright Owners

Realtor.com also found the 10 metros with the largest share of homes with outright owners include:

- Miami, Florida (44.8%)

- Buffalo, New York (44.2%)

- Pittsburgh, Pennsylvania (44.2%)

- Detroit, Michigan (42.3%)

- Tampa, Florida (42.3%)

- Houston, Texas (42.2%)

- Tucson, Arizona (41.9%)

- San Antonio, Texas (41.5%)

- Birmingham, Alabama (41.0%)

- New York, New York (40.1%)

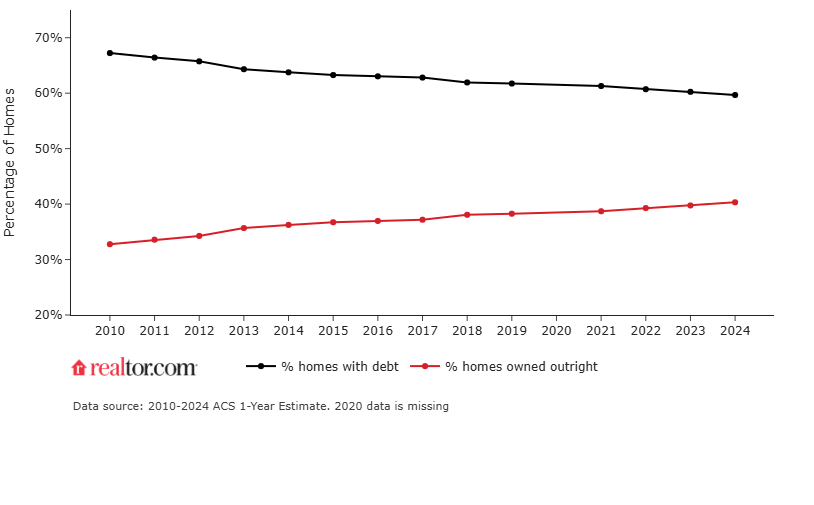

Nationwide, Realtor.com reports that 64% of occupied U.S. housing units are owned, and nearly two-thirds of those homeowners have a mortgage. The age profile of homeowners is driving mortgage reliance nationwide, as older households account for a majority of outright owners, with 53.9% were aged 65 and above in 2024, on par with levels seen in the previous years. Because most people purchase homes earlier in life, rising property values allow them to build equity over time. That equity can be used to refinance, or to sell and downsize, reducing or eliminating the need for new mortgage debt.

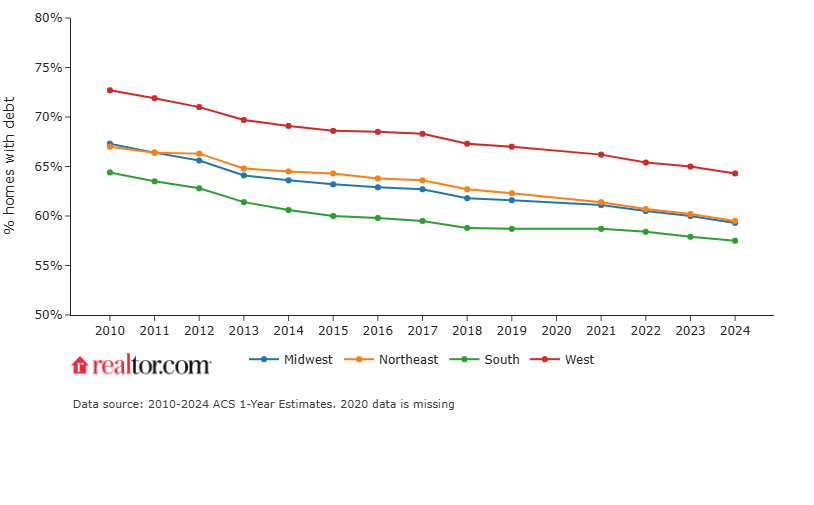

At the state level, the divide is just as stark as by metro. D.C. (74.3%), Maryland (70.0%), and Colorado (69.0%), stand out for their high shares of mortgaged households, while West Virginia (55.1%), Mississippi (51.6%), and New Mexico (50.6%) are home to more outright owners. These differences suggest that rate-sensitive demand will surge more strongly in the Northeast and West regions, while parts of the South may remain less reactive.

Click here for more on Realtor.com’s report on U.S. metros that will benefit the most from a drop in mortgage rates.